January 08, 2014 14:25

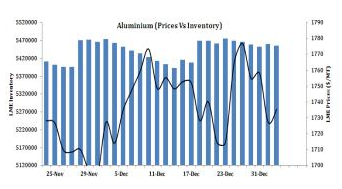

- Aluminum ended yesterday’s trading session marginally higher by 0.1% at the LME platform marginally recovering from the intraday lows to close

at $1785/MT mark.

- The aluminum inventories have declined by 23150 MT in the last seven trading session. Cancelled warrants ratio for the commodity has also marginally increased

by 0.3% which protected the commodity from a sharp fall in the Yesterday`s trading session.

- During the day, we hold a ranged view on aluminum as the commodity might take positive cues from the factory orders data and the increase in the premium of the metal from $16/lb to $14.75/lb. However, the metal might face negative pressure from a strong dollar on the back of strong US economic data which have been positive lately

Even though aluminum inventories declined broadly the inventories have been rising since last two months:

- Aluminum ended yesterday’s trading session marginally higher by 0.1% at the LME platform marginally recovering from the intraday lows to close

at $1785/MT mark.

- The aluminum inventories have declined by 23150 MT in the last seven trading session. Cancelled warrants ratio for the commodity has also marginally increased

by 0.3% which protected the commodity from a sharp fall in the Yesterday`s trading session.

- During the day, we hold a ranged view on aluminum as the commodity might take positive cues from the factory orders data and the increase in the premium of the metal from $16/lb to $14.75/lb. However, the metal might face negative pressure from a strong dollar on the back of strong US economic data which have been positive lately

Even though aluminum inventories declined broadly the inventories have been rising since last two months: