For years — decades, even — the price of alumina was taken to be one-third of the primary Aluminum price. For many years, such a relationship was enshrined in long-term supply agreements with alumina producers sharing in the ups and downs of the primary aluminum price experienced by the smelters.

Incidentally, primary smelters’ power cost was often likewise tied to the primary aluminum price, sheltering smelters from a divergence in their input costs pushing them into losses and making aluminum smelting a much more attractive long-term investment for the financial community.

Well, that happy state of affairs began to unravel around the start of the decade as Alcoa (NYSE:AA), Rio Tinto (LON:RIO) and some other leading alumina producers decided to break away and sell more, if not all, of their output at spot prices or floating prices linked to an index — or, more commonly, an element of both.

According to Aluminium Insider, Alcoa is now pricing around 95% of its third-party alumina sales basis either on an index or the spot market. Bauxite and alumina suppliers are not driven by identical dynamics to the aluminum smelters. If nothing else, the producers can be different and the sites of production are often different, opening up the possibility for pressure points erupting for one part of the supply chain without it hitting the whole market. Think China, which is a major importer of bauxite, a partial importer of alumina and has the potential to be a major exporter of primary aluminum if primary metal exports were not deliberately restrained by the authorities with a hefty export tax.

So, when U.S. sanctions against Oleg Deripaska hit Rusal, the world’s largest aluminum producer outside China and a major supplier of alumina to smelters around the world – Rusal produces 2.3 million tons of alumina that it sells to third parties — effectively halted supply, it is hardly surprising the alumina market spiked.

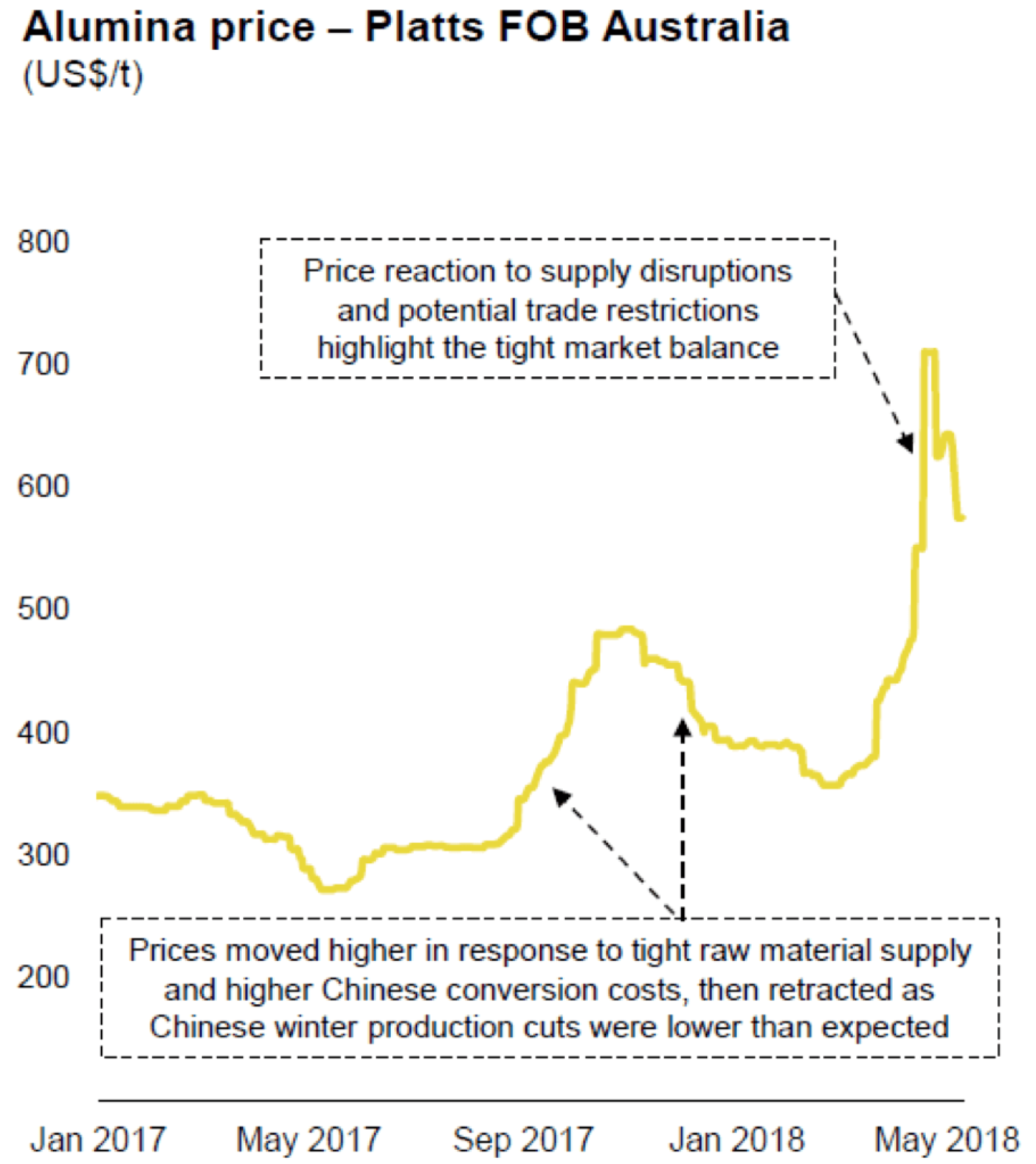

Source: Platts

The impact on the alumina market of Rusal being shut out of the supply market was exacerbated by the temporarily enforced closure of Hydro’s Alunorte refinery in Brazil on environmental grounds.

Alunorte is the largest alumina refinery in the world, producing nearly 6 million tons per annum. Restrictions removed nearly a quarter of a million tons per month, according to Aluminium Insider.

Prices reached $800 per ton, which put extreme pressure on those mills that are not vertically integrated and were forced to pay spot prices – if they could locate supply.

The one-third pricing model was blown out the water, at $800/ton and two tons of alumina required to yield one ton of aluminum, alumina costs were close on two-thirds of finished aluminum prices. Both LME primary aluminum prices and alumina spot prices have since eased, but are still out of line with historical trends.

As a result, consumers are seeing billet premiums and conversion premiums rising even though the LME ingot price has stabilized in a band around $2200-2250/ton.

Although Alunorte is expected to resume full production in July, easing supply, and the sanctions against Deripaska have been postponed to give him the opportunity to exit control and, hence, avoid Rusal’s shutout from the market, prices remain sensitive to news and supplies are not exactly plentiful.

In the face of solid demand for downstream products, elevated conversion premiums are likely to remain a feature for the rest of this year, even if the LME price stays in the current range. Consumers will need to shop around for supplies, as some producers will be more exposed to upward pressure on billet premiums than others.

The market is likely to settle down in a month or two and is already showing less distress than at the beginning of May. However, having raised conversion premiums, the supply chain is unlikely to willingly give them up again, with demand remaining robust.

by Stuart Burns