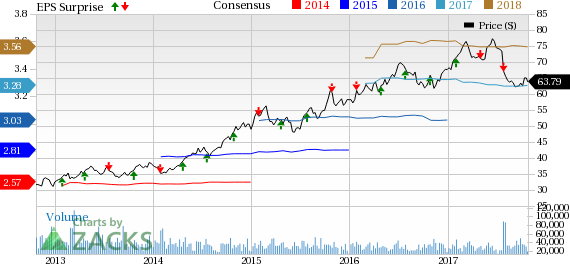

Altria Group, Inc. (NYSE:MO) , the leading manufacturer of cigarettes and smokeless tobacco products in the United States reported third-quarter 2017 results, wherein earnings of 90 cents per share topped the Zacks Consensus Estimate of 87 cents. Also, the bottom line rose 9.8% year over year.

Earnings Estimate Revision: The Zacks Consensus Estimate for 2017 has increased by a penny in the past 30 days. Further, in the trailing four quarters, excluding quarter under review, the company has outpaced the Zacks Consensus Estimate by an average of 0.1%.

Revenues: Altria’s revenues, net of excise taxes, dipped 1.3% to $5,123 million, and marginally missed the Zacks Consensus Estimate of $5,196 million.

Key Events: In August 2017, management announced 8.2% hike in its quarterly dividend to 66 cents per share. Altria paid roughly $1.2 billion as dividends in the third quarter and bought back 11.1 million shares worth nearly $759 million.

Guidance: Altria reiterated its 2017 adjusted earnings forecast in a range of $3.26-$3.32, up 7.5-9.5% from $3.03 reported in 2016.

Zacks Rank: Currently, Altria carries a Zacks Rank #3 (Hold), which is subject to change following the earnings announcement. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Movement: Altria shares jumped nearly 1% in the pre-market trading hours following the earnings release.

Check back later for our full write up on Altria’s earnings report!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Altria Group (MO): Free Stock Analysis Report

Original post