When it comes to dividend stocks, investors usually have to choose between low-yield stocks with high dividend growth, and stocks with high yields but low dividend growth. Only in rare instances does a company offer both a high dividend yield, and a high level of dividend growth each year.

Consumer products giant Altria Group (NYSE:MO) is a rare high-yield, dividend growth stock. Not only does Altria have a nearly 5% dividend yield, but the company has also raised its dividend 52 times in the past 49 years. Its high rate of dividend growth is due to its strong brands, competitive advantages, and excellent free cash flow.

Altria has the potential to deliver total returns in excess of 10% per year, with a high dividend yield and dividend increases each year. This is why Altria is a buy for income investors.

Tobacco: A Cash Cow

Altria is a diversified consumer products manufacturer. Its primary business segment is tobacco, where it operates the flagship Marlboro brand, as well as a number of smokeless tobacco brands like Skoal and Copenhagen. Altria also has a wine business and a 10% investment stake in beer giant Anheuser Busch Inbev (BR:ABI) (BUD). In all, Altria generates annual revenue of more than $25 billion.

Put simply, Altria is a free cash flow machine. Last year, Altria generated $4.9 billion of operating cash flow, and needed just $199 million for capital expenditures. Altria’s high free cash flow is the result of tremendous competitive advantages and operational efficiencies. As a tobacco manufacturer, Altria operates in a highly regulated industry. Consider that tobacco companies are banned from advertising on television in the U.S., which makes it incredibly hard for competitors to build brand power. In addition, Altria has a very lean manufacturing and distribution operation, and enjoys pricing power.

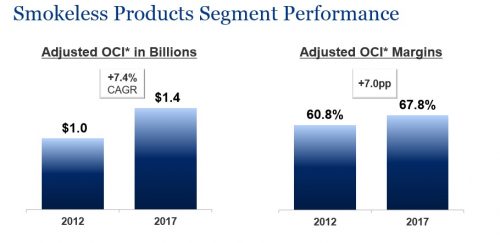

This has led to strong margin expansion and profit growth for Altria over the past five years.

Source: Annual Shareholder Meeting, page 6

Such strong economies of scale are why legendary investor Warren Buffett once professed his fondness for the tobacco business. The following Buffett quote summarizes the incredible economics of the tobacco industry:

“I’ll tell you why I like the cigarette business. It cost a penny to make. Sell it for a dollar. It’s addictive. And there’s a fantastic brand loyalty.”

The brand loyalty Buffett is referring to, is due entirely to Marlboro, the most valuable cigarette brand in the United States. Marlboro commands more than 40% of U.S. retail market share, which gives Altria the ability to raise prices each year. For example, the average pack of Marlboros cost $6.79 last quarter, an increase of 2.3% from the same quarter the previous year.

Another benefit of Altria’s business model is that it is highly consistent. Sales of tobacco and alcohol tend to hold up very well during recessions. This allows Altria to sail through economic downturns relatively unscathed, and continue to raise its dividend each year like clockwork.

Rolling Out New Products

Altria has increased its dividend 53 times in the past 49 years. It has increased its dividend twice in 2018. The most recent quarterly dividend was increased 21% from the same quarterly payout last year. This is a very high dividend growth rate for Altria, especially considering the stock has a high dividend yield of nearly 5%.

Of course, future dividend increases will be reliant on the company’s ability to grow earnings and cash flow. One potential risk for Altria is the declining rate of smoking in the United States. Altria’s cigarette shipment volume declined by 5% last quarter, worse than the estimated industry decline of 4.5%. While the company has diversified its product portfolio in recent years, tobacco still represents more than 80% of revenue and profits.

However, Altria continues to grow revenue and earnings, even in a difficult environment. In the most recent quarter, Altria’s revenue net of excise taxes increased 3%, while adjusted earnings-per-share increased 20% from the same quarter a year ago. Revenue growth came from price increases and higher sales. Earnings growth was attributable to revenue growth, as well as share repurchases and tax reform.

Altria has bet its future growth on new products, such as e-vapor and heated tobacco.

The most important new innovation for Altria is the heated tobacco line IQOS, which heats tobacco rather than burns it. According to Altria, this offers consumers a “reduced-risk” experience, as heating tobacco is expected to produce fewer adverse health effects than traditional cigarettes. Altria is awaiting regulatory approval from the Food & Drug Administration for IQOS, and is prepared for nationwide rollout upon approval.

Altria’s brand power and product innovation should result in continued growth for the foreseeable future. Through earnings growth and dividends, Altria could generate strong shareholder returns over the next several years.

Lighting Up High Returns To Shareholders

At the midpoint of Altria’s 2018 guidance, the company expects earnings-per-share of approximately $3.99. As a result, Altria stock trades for a price-to-earnings ratio of 16.5. In the past 10 years, Altria stock traded for an average price-to-earnings ratio of 16.2. This is a reasonable estimate of fair value for Altria, and therefore the stock is fairly valued.

As a result, Altria’s future returns will be comprised of earnings growth and dividends. Altria is expected to grow earnings by 7% annually through 2023, which will add to its total returns. Lastly, dividends will contribute to shareholder returns. Altria has a high dividend yield of approximately 5%. With a target dividend payout ratio of 80% of annual adjusted earnings, the company should have little trouble continuing to raise its dividend in the years ahead.

The combination of valuation changes, earnings growth, and dividends is expected to result in annual returns of 12% per year over the next five years. This is an attractive rate of return, especially for a relatively low-risk dividend stock, particularly when compared with other high-yielding dividend stocks. Altria has competitive advantages, strong brands, and the company should be expected to hold up well during a recession. It continues to increase its dividend each year. These qualities make Altria an attractive stock for income investors, such as retirees, looking to generate higher dividend income from their portfolios.