- Altria shares are down close to 11% since the start of 2022

- Stock currently generates a lucrative dividend yield of 8.5%

- Buy-and-hold investors could consider buying Altria stock now

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

Shareholders in Altria (NYSE:MO) have seen the value of their investment decline by 11.6% over the past 12 months. By comparison, the S&P 500 Tobacco Industry Index is up 1.7% in 2022.

Meanwhile, peers British American Tobacco (NYSE:BTI) and Imperial Brands (OTC:IMBBY) have gained 18.1% and 3.7% in 2022, respectively.

Source: Investing.com

On Apr. 21, MO shares went over $57 to hit a multi-year high but slide to a multi-year low of $41.

Through wholly-owned subsidiaries, Altria is the leading manufacturer of combustible and smoke-free products. It has an equity investment in other sin industries, including a 10% stake in Anheuser-Busch (NYSE:BUD), a 45% stake in cannabis company Cronos (NASDAQ:CRON), and 35% share in the electronic cigarette company JUUL Labs.

Recent Metrics

Q1 metrics released on Apr. 28 show revenue declined 2.4% YoY to $5.9 billion, primarily driven by the sale of its wine business in October 2021. Yet, adjusted diluted earnings per share (EPS) increased 4.7% YoY to $1.12. The stock was trading around $55 ahead of the results but has since fallen 23%.

As tobacco is addictive, it's recession-resistant, and Altria can pass on tax hikes and suffer a little material impact on its business.

In the first quarter, operating income in the smokeable products segment soared 8% YoY to $2.56 billion and for 2022 management reaffirmed previous guidance of adjusted diluted EPS in the range of $4.79-$4.93.

However, on June 23, the US Food and Drug Administration ordered the halt of sales of products offered by JUUL Labs and it is unclear how this may affect Altria’s bottom line.

It is worth noting that Altria has raised its dividend annually for more than five decades and it currently offers a lucrative dividend yield of 8.5%.

What To Expect From MO Stock

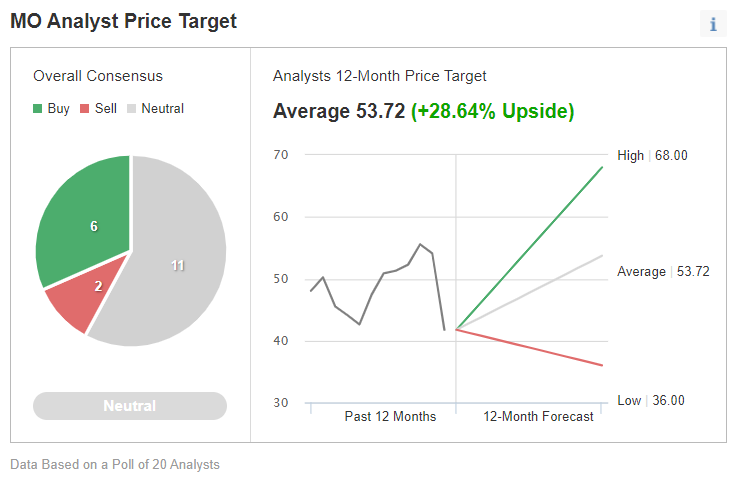

The stock has an overall "neutral" rating among the 20 analysts polled via Investing.com with a price target of $53.72, a 28.64% upside.

Source: Investing.com

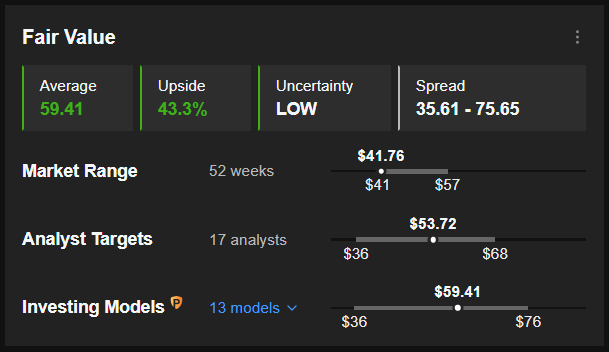

Similarly, the average fair value for MO stock on InvestingPro is $59.41, a 43.3% upside.

Source: InvestingPro

Looking at MO’s financial health, as determined by ranking more than 100 factors against peers in the consumer staples sector, in terms of growth and cash flow, MO scores 3 out of 5 which is a good performance ranking.

To understand short-term sentiment analysis, we can look at implied volatility levels for MO options. Implied volatility typically shows the market's opinion of potential moves in a security, but it does not forecast the direction of the move. MO’s current implied volatility is about 6.5% higher than the 20-day moving average. In other words, implied volatility is trending higher, while options markets suggest increased choppiness ahead.

Our expectation is for MO stock to build a base between $39 and $43 in the coming weeks and then potentially start a new leg up.

Adding MO Stock To Portfolios

Altria bulls who are not concerned about short-term volatility could consider investing now with a target price of $55.36.

Alternatively, investors could consider buying an exchange-traded fund (ETF) which holds MO stock including:

- Cambria Cannabis ETF (NYSE:TOKE)

- Formidable ETF (NYSE:FORH)

- WisdomTree US High Dividend Fund (NYSE:DHS)

- iShares Evolved US Consumer Staples ETF (NYSE:IECS)

Finally, investors who expect MO stock to bounce back in the weeks ahead could consider setting up a covered call.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on MO stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Covered Call On MO Stock

Price At Time Of Writing: $42.10

For every 100 shares held, the covered call strategy requires the trader to sell one call option with an expiration date at some time in the future.

Investors who believe there could be short-term profit-taking might use a slightly in-the-money (ITM) covered call. A call option is ITM if the market price (here, $42.10) is above the strike price ($40).

So, the investor would buy (or already own) 100 shares of MO stock at $42.10 and, at the same time, sell a MO Sept. 16 $40-strike call option. This option is currently offered at a price (or premium) of $3.70.

An option buyer would have to pay $3.70 X 100 (or $370) in premium to the option seller. This call option will stop trading on Friday, Sept. 16.

This premium amount belongs to the option writer (seller) no matter what happens in the future; for example, on the day of expiry.

The $40-strike offers more downside protection than an at-the-money (ATM) or out-of-the-money (OTM) call.

Assuming a trader would now enter this covered call trade at $40.00, at expiration, the maximum return would be $160, i.e., ($370 - ($42.10 - $40.00) X 100), excluding trading commissions and costs.

The trader realizes this gain of $160 as long as the price of MO stock at expiry remains above the strike price of the call option (i.e., $40 here).

At expiration, this trade would break even at the MO stock price of $38.40 (i.e., $42.10-$3.70), excluding trading commissions and costs.

On Sept. 16, if MO stock closes below $38.40, the trade would start losing money within this covered call set-up. Therefore, by selling this covered call, the investor has some protection against a potential loss. In theory, a stock's price could drop to $0.

A covered call limits upside profit potential and this may not appeal to everyone. However, others might find that acceptable in exchange for the premium received.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »