Altria Group Inc. (NYSE:MO) reported mixed results in the second quarter of 2017, wherein while earnings lagged the Zacks Consensus Estimate, revenues beat the same. The company however kept earnings guidance intact for 2017.

Quarter in detail

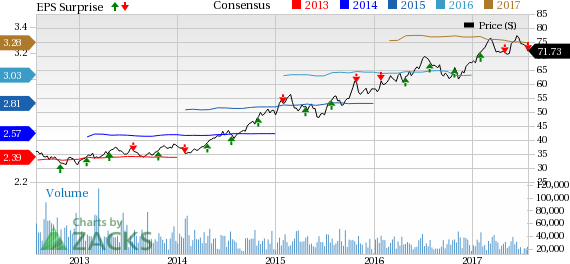

Adjusted earnings of 85 cents per share lagged the Zacks Consensus Estimate by a penny. However, earnings increased 4.9% year over year driven by higher operating income in the smokeable and smokeless segments and lower outstanding shares. This was offset by lower equity earnings from Altria’s beer investment.

Net revenue increased 2.2% to $6.7 billion in the second quarter primarily driven by higher net revenues in the smokeable and smokeless products segments, offsetting the decline in Wine segment. Revenues net of excise taxes increased 3.8% year over year to $5.1 billion and also exceeded the Zacks Consensus Estimate of $4.9 billion by 1.6%.

In e-vapor, Altria’s subsidiary Nu Mark LLC continues to boost MarkTen volume and retail share. Encouragingly, MarkTen has become the second most preferred e-vapor brand nationally, with a second-quarter national retail market share of approximately 13% in mainstream retail channels.

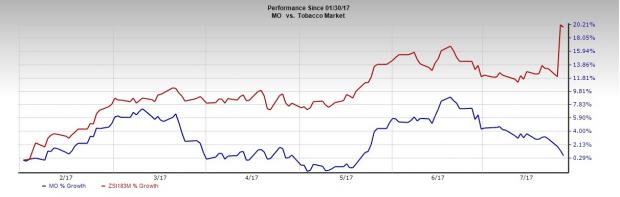

However, if we look into Altria’s stock performance over the last six months, we note that the stock has moved up just 0.6%, in comparison to the industry’s growth of 19.8% and broader Consumer Staples sector’s growth of 8.1% in the same time frame.

We believe declining demand for cigarettes due tothe ongoing anti-tobacco campaigns, government restrictions and higher cigarette prices in response to rising taxes have been weighing on the stock. Strict Food and Drug Administration (FDA) regulations on cigarette packaging dissuade customers from smoking. Additionally, consumers’ preference for e-cigarettes or substitutes for cigarettes are largely affecting the cigarette volume. Evidently, Altria’s top line lagged the Zacks Consensus Estimate in six of the last eight quarters, including this quarter.

Segment Details

Smokeable Products Segment: Despite a large cigarette excise tax increase in California, which negatively impacted volume and retail share in the second quarter, revenues net of excise taxes increased 1.6% year over year to $5.9 billion. The increase was primarily driven by strong pricing, partially offset by lower volume and higher promotional investments. Total shipment volume decreased 2.9% year over year to 30.6 billion units. Cigarettes retail market share declined 0.4 share point to 50.8% in the quarter.

Adjusted operating companies income (OCI) increased 6.4%, while adjusted OCI margins expanded 1.6 percentage points to 51.7%.

Smokeless Products: Revenues net of excise taxes increased 7.8% to $564 million in the second quarter, as it rebounded from the preceding quarter’s decline of 2.5% which was impacted by the recall of some of its smokeless tobacco products. The second quarter was driven by higher pricing and volume, partially offset by unfavorable mix. Volumes grew 1.4% to 221 million units, where Copenhagen and Skoal shipment volumes grew 1.3% and others increased 2.3% in the quarter. Total smokeless products retail share decreased 0.8 share points to 54.1% in the second quarter.

Adjusted OCI surged 9.8% and margins increased 0.7 percentage points to 70.0%.

Wine: The segment’s revenues went down 12.3% year over year to $150 million due to trade inventory reductions and increased competitive activity. Wine shipment volume declined 14.5% to 1.8 million units.

Ste. Michelle’s adjusted OCI declined 32.4%, primarily due to lower volume. OCI margins decreased 5.2 percentage points to 17.2%.

Financial Updates

Altria ended the quarter with cash and cash equivalents of $5.23 billion, long-term debt of $13.89 billion, and total shareholders’ equity of $12.26 billion.

In May 2017, Altria’s board declared a regular quarterly dividend of 61 cents per share, which means that Altria had paid almost $1.2 billion in dividends in the second quarter and nearly $2.4 billion for the first half of 2017. During the second quarter, Altria repurchased 14.4 million shares under its existing share repurchase program for approximately $1.05 billion. As of June 30, 2017, Altria had approximately $335 million remaining in the share repurchase program. In July, Altria’s board authorized a $1 billion expansion to the program. Altria expects to complete the expanded $4 billion share repurchase program by the end of the second quarter of 2018.

Altria expects to continue to return a large amount of cash to shareholders in the form of dividends by maintaining a dividend payout ratio target of approximately 80% of its adjusted earnings.

Consolidation of Manufacturing Facilities

In Oct 2016, Altria announced the consolidation of several of its manufacturing facilities to streamline operations and achieve greater efficiencies. The consolidation, scheduled to be completed by the first quarter of 2018 is expected to deliver approximately $50 million in cost.

Outlook

Altria reaffirmed earnings guidance for full-year 2017 and expects adjusted earnings in a range of $3.26–$3.32, up 7.5% to 9.5% compared with adjusted earnings of $3.03 in 2016. Further, it anticipates higher adjusted diluted EPS growth in the second half of the year compared with the first half. Altria continues to expect 2017 full-year effective tax rate on operations to be approximately 36%.

Zacks Rank & Stocks to Consider

Altria currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the consumer staple sector are Nomad Foods Limited (NYSE:NOMD) , Post Holdings, Inc. (NYSE:POST) and Kellogg Company (NYSE:K) . While Nomad Foods and Post Holdings sport a Zacks Rank #1 (Strong Buy), Kellogg carries a Zacks Rank #2 (Buy). You can seethe complete list of today’s Zacks #1 Rank stocks here.

Nomad posted a positive earnings surprise of 3.8% in the last quarter. While Post Holdings has a long-term earnings growth of 14.0%, Kellogg has expected long-term earnings growth of 5.9%, for the next three to five years.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Kellogg Company (K): Free Stock Analysis Report

Post Holdings, Inc. (POST): Free Stock Analysis Report

Altria Group (MO): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Free Stock Analysis Report

Original post

Zacks Investment Research