The decline in oil prices has everyone from hedge-fund managers to taxi drivers betting on where the price of oil will go next. The volatility of oil prices is high and the one-day moves in the price of oil can be massive. Figuring out in which direction the price is going to move is the hard part. Investors, who want to back their projections but do not want to gamble on a distressed oil stock, may want to consider some alternative ways to grant exposure to the price of oil.

Due to the oil industry's large size, the movements in oil prices have a rippling effect on other investments. Higher oil prices can have a significant impact on investments such as Tesla (O:TSLA). The stock has performed poorly with the decline in the price of oil. Tesla’s share price declined over 45% from previous highs of $282.26 in July 2015 to $151.04 as at 16th February 2016.

Of course, there are other reasons for the decline in share price including the lead-time and delays in the production of Tesla’s sport utility vehicle, Model X, but no doubt the price of oil has also been a contributing factor. Cheaper oil reduces the savings of using electric cars and increases the relative cost of purchasing an electric car. As illustrated by the graph, there is a close correlation between Tesla and the price of USO (N:USO), which is an exchange-traded fund that tracks the price of oil.

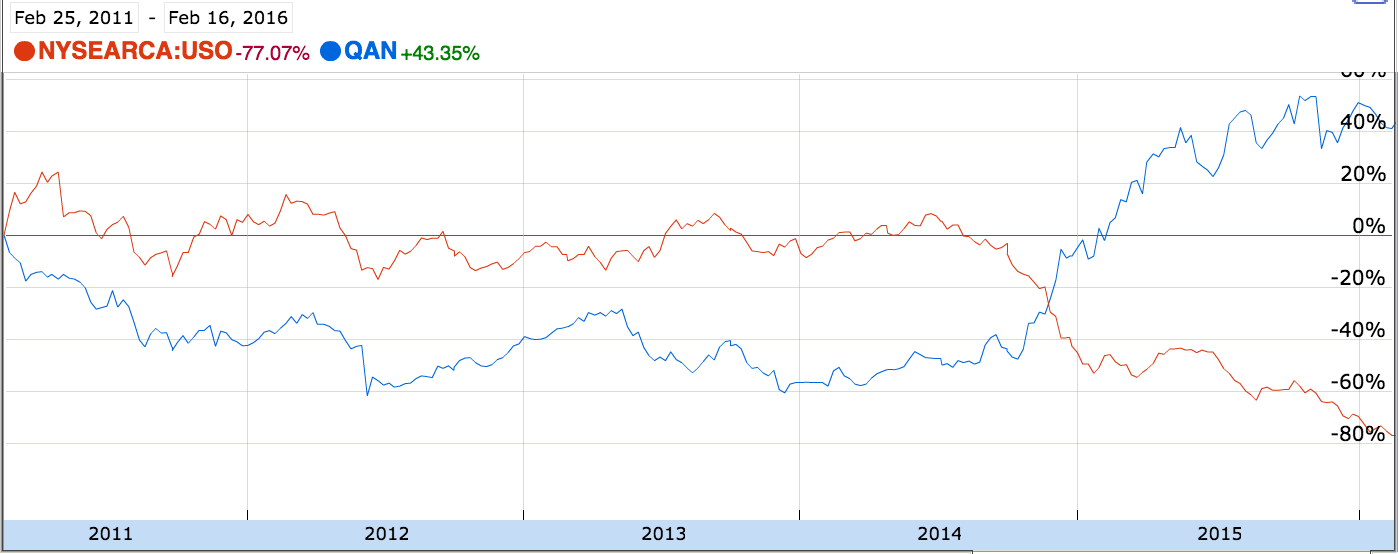

If you fall into the bear category, then purchasing stock in an airline company may be a winning bet. Airline companies are heavily exposed to the price of oil as the fuel costs on average represent 29% of their total operating expenses. Here is a price graph of the US Oil ETF in red versus Qantas Airways (AX:QAN) in blue. There is a significant inverse relationship between the two demonstrating the impact of lower oil prices on airline companies.

If the price of oil remains low for long, airline companies will continue to be the benefactors of higher operating margins, which in turn should result in increased profitability.

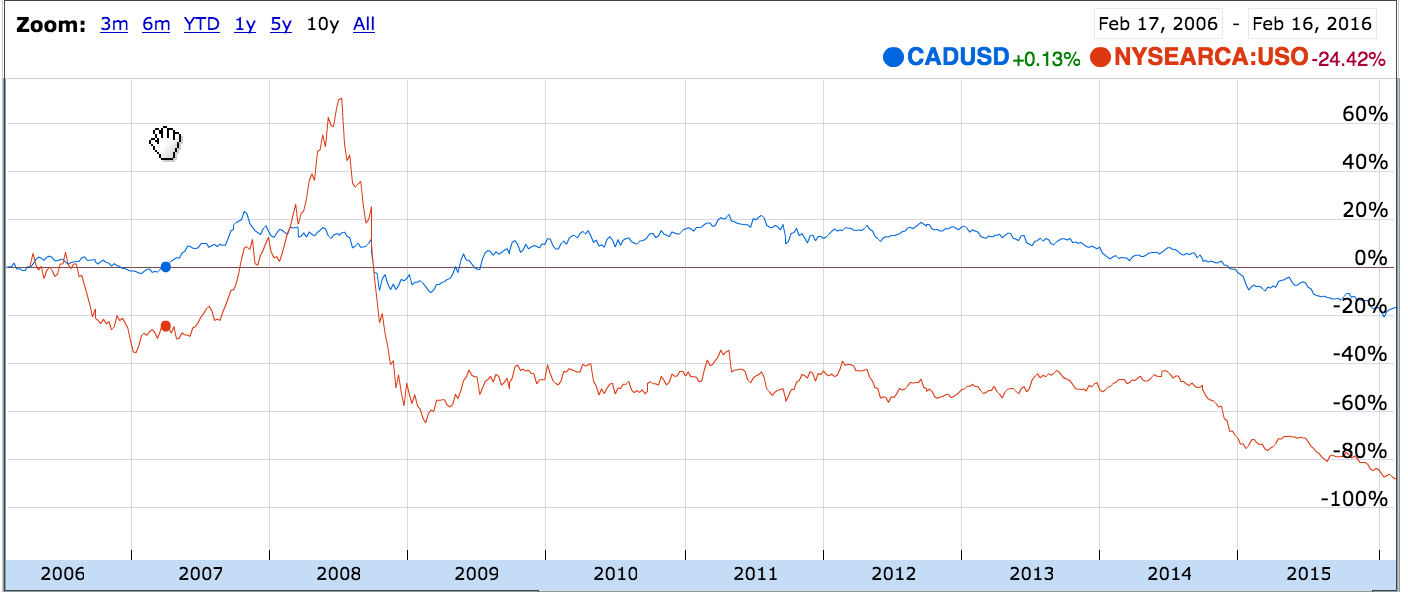

A third and indirect method of exposure to oil is through the Canadian dollar. It is commonly known that the CAD/USD currency pair tracks surprisingly close to the price of oil, with a historical correlation of 0.78. Investing in oil more directly through an oil futures exchange traded fund will give you a volatility that is comparable to a roller coaster. Investing in the CAD/USD will give you a much smoother ride. The CAD/USD pair may not offer the 12% one-day price movements that oil has given but with enough leverage a similar level of return can be replicated.