Alphabet (NASDAQ:GOOGL) shares were a solid 5% lower in aftermarket trading following the unveiling of Q4 results last night; the first set of results under new Chief Executive Sundar Pichai. The decline slashed $40 billion off the value off the firm whilst removing its membership to the exclusive $1 trillion market cap club.

Sundat Pichai gave investors what they have long been after – a new level of disclosure and transparency. It was unfortunate then that despite the new more transparent approach, the numbers didn’t quite live up to expectations.

Results

Slowing Revenue Growth

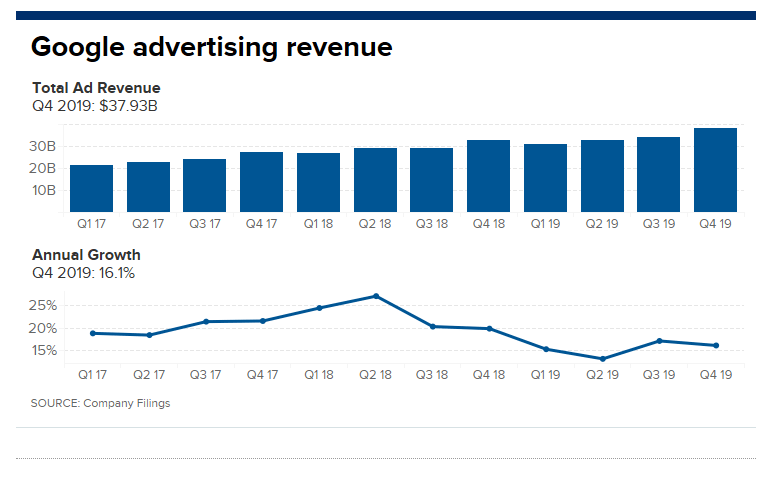

Revenue growth at Google parent Alphabet (NASDAQ:GOOGL) slowed by more had expected in Q4. Whilst a moderate slowdown had been on the cards following Q3’s 20.5% revenue growth, Q4’s 16.1% advance in the holiday shopping period was not only disappointing but also the slowest level of growth in 4 years.

The slowdown was almost entirely caused by weak non-advertising revenue, a side of the business which accounts for around 20% of the group total. Growth from these divisions which include cloud computing, hardware and the Play app was just 22%, well down from 39% in Q3.

Losses from its moonshot projects, such as the driverless car, drone delivery and drug discovery units increased by 50% to a staggering $2 billion, raising a few eyebrows.

YouTube transparency backfires

As part of the increased transparency, YouTube ad revenue was $15 billion, up 36% whilst accounting for 14% of total advertising from Google’s properties. These figures highlight the importance of the video network. However, this was expected to have been closer to 20% meaning YouTube is smaller than generally assumed.

Google cloud computing

Cloud computing division reported results separately for the first time, revealing that revenue grew 53% to $2.6 billion in the last quarter. Most of the revenue coming from its G-Suite of online applications. However, compared to Microsoft (NASDAQ:MSFT) Azure’s 62% growth in most recent quarter, Google’s cloud division’s growth rate looks mediocre.