-

Alphabet’s earnings come amid geopolitical tensions and rising AI competition.

-

Strong cloud and ad growth support the stock, but expectations are high.

-

Even with past earnings beats, Alphabet must prove its AI investments can drive growth.

- Are you looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners using this link.

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) finds itself caught in the crossfire of the ongoing trade war between the U.S. and China.

As the company prepares to release earnings today after the market closes, geopolitical tensions add another layer of uncertainty to an already high-stakes moment for Big Tech.

Beijing has placed Google under scrutiny, launching an antitrust investigation in response to the U.S. decision to raise tariffs on Chinese imports by 10%.

While Google’s presence in China is already limited by strict regulations, the investigation fuels investor anxiety at a time when tech stocks are navigating multiple challenges.

Beyond trade tensions, Alphabet has also faced pressure from the rise of DeepSeeck, a startup shaking up the AI landscape and challenging the dominance of U.S. tech giants.

Despite these headwinds, Alphabet’s stock remains resilient, hovering around all-time highs above $200 per share.

Alphabet’s Strengths and Weaknesses

Alphabet’s financial health remains a key advantage. The company boasts a robust 32% return on equity, strong cash flow generation, and impressive 14% year-over-year revenue growth in Google Services.

Google Cloud’s 35% expansion further highlights Alphabet’s ability to compete in the AI-driven economy.

The integration of Gemini AI across seven major products—reaching over 2 billion monthly users—underscores its commitment to technological leadership. Meanwhile, YouTube continues to dominate, delivering 70 billion daily video views.

However, Alphabet’s dominance comes with risks. The company still relies heavily on advertising revenue, making diversification crucial. Regulatory challenges also pose a threat, with antitrust lawsuits in the U.S. and Europe presenting greater concerns than China’s latest probe.

Can Alphabet Outperform in the Face of Rising Competition?

With expectations running high, investors are watching to see whether Alphabet can navigate these challenges and deliver a strong quarterly report.

Source: InvestingPro

While concerns about AI competition and regulatory scrutiny may already be priced into the stock, Alphabet now faces direct comparisons with domestic rivals Amazon (NASDAQ: NASDAQ:AMZN) and Microsoft (NASDAQ: NASDAQ:MSFT), both of which reported earnings last week.

Markets were unimpressed by Microsoft’s 21% growth in cloud services revenue, sending its stock down 6.2% post-earnings. Alphabet won’t get a free pass either.

Cloud and Advertising Revenues Take Center Stage

Analysts expect Google Cloud revenues to hit $12.1 billion, a 33% increase from last year—outpacing forecasts for Microsoft’s Azure. Advertising revenue is also projected to grow, rising from $65.5 billion to $71.7 billion.

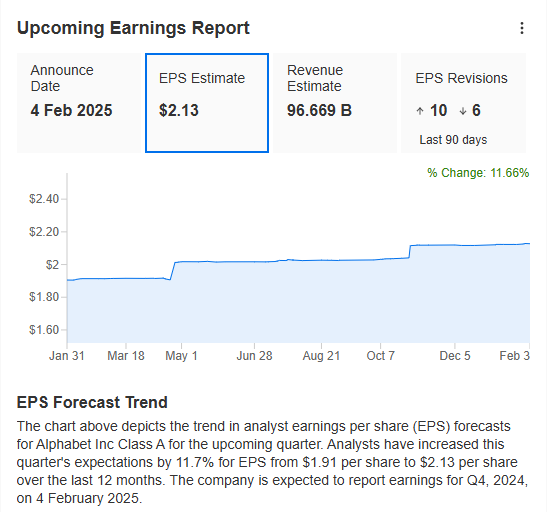

Overall, sentiment remains positive. Analysts have raised Q4 EPS expectations by 11.7% over the past year, projecting $2.13 per share, up from $1.64 a year ago. Total (EPA:TTEF) quarterly revenue is expected to reach $96.7 billion, reflecting 12% year-over-year growth.

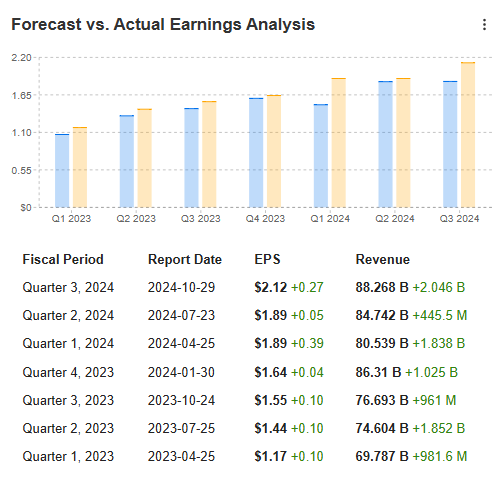

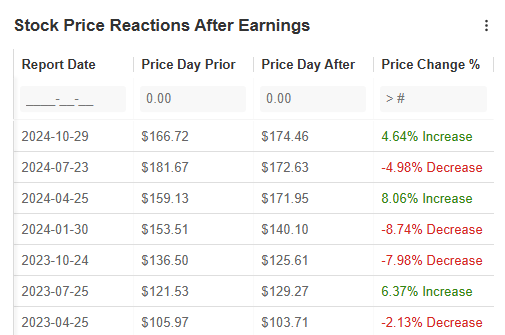

Yet, exceeding forecasts doesn’t always translate into stock gains. Over the past year, Alphabet has consistently delivered strong results, but market reactions have been mixed. Even after surpassing expectations, the stock has seen sharp corrections—sometimes dropping more than 8% post-earnings.

Source: InvestingPro

Alphabet’s 40% stock surge over the past year has outpaced Amazon by one percentage point and dwarfed Microsoft’s 2% gain. While the setup for another earnings beat is in place, the real question is whether the market will reward it.

Source: InvestingPro

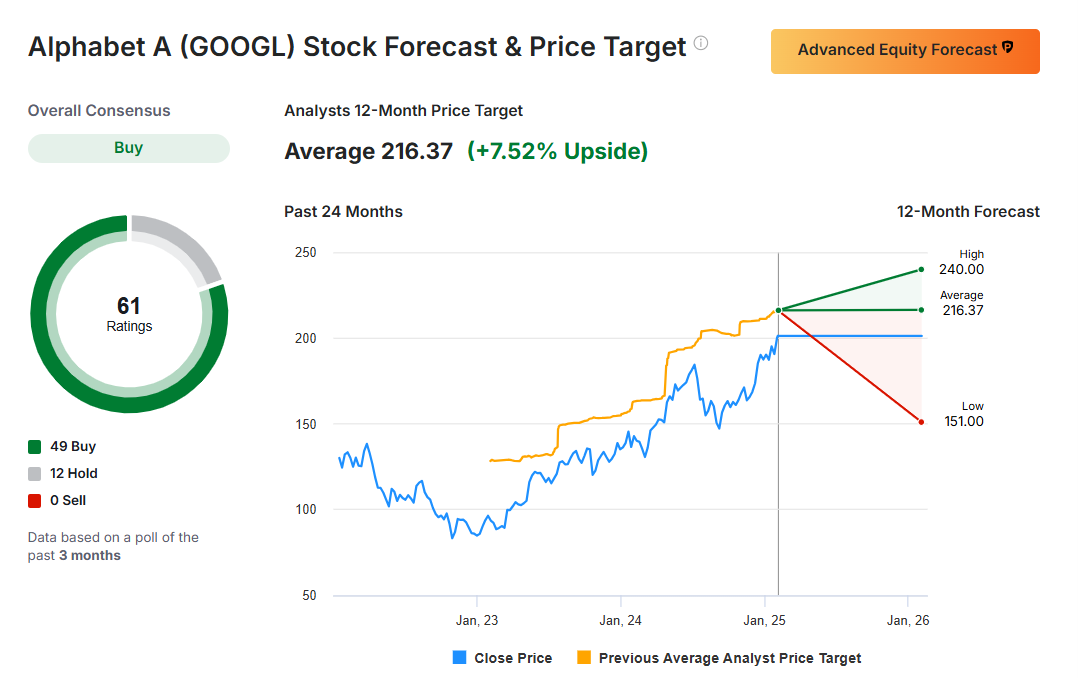

With a price-to-earnings ratio above 26x, Alphabet must prove that its cloud and advertising businesses justify its valuation. More importantly, it must demonstrate that its AI investments are driving sustainable growth—showing that in the AI revolution, quality matters more than quantity.

Source: Investing.com

For now, analysts remain bullish, setting a 12-month target price 7.5% above yesterday’s close of $201.23.

But in today’s fast-moving market, sentiment can shift quickly.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.