Alphabet Inc. (NASDAQ:GOOGL) owned Google is ready with another software update. It will launch a backup and sync tool on Jun 28.

Following this, users will be able to back up files and photos from any folder inside their computers and not necessarily from the drive folder. The app is the latest version of Google Drive for Mac/PC and is linked with Google Photos desktop uploader.

The tool is aimed at regular users and therefore Google has recommended business users to keep on using the existing version of Drive for Mac/PC until Drive File Stream, the new enterprise focused tool, gets a wider roll out.

The new app will also be available with iOS 11 and support third party cloud services including Google Drive. Free accounts will come with a 15 GB limit while paid accounts start from $1.99 a month for 100 GB.

Alphabet Inc. Net Income (Quarterly)

Google’s speed and scale of technological improvements clearly indicate that it refuses to rest on its past laurels and continues to adapt to changing market trends. There have been requests for an update of this kind for quite some time and therefore it’s good to see that the company is finally adding a pretty handy feature.

With an unparalleled history of execution, huge cash balance, continuous focus on innovation, technological prowess, futuristic approach to business and fingers in almost every pie, we see a clear path of profitability for Alphabet in the foreseeable future.

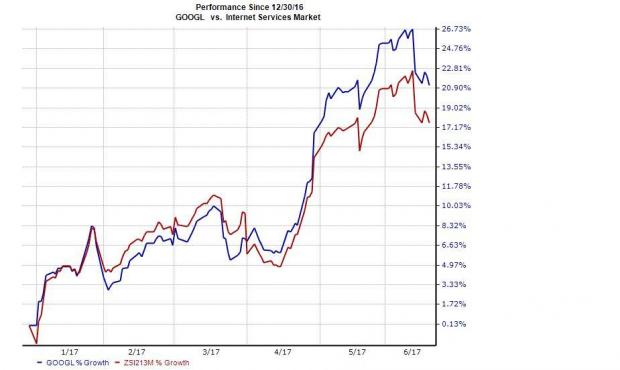

We believe Alphabet’s technology and innovation are contributing significantly toward driving up its shares. The stock has rallied 21.2% compared with the Zacks Internet-Services industry’s gain of 17.6% on a year-to-date basis.

Zacks Rank and Other Picks

Alphabet currently carries a Zacks Rank #2 (Buy). Other stocks worth considering in the broader technology sector include Autohome (NYSE:ATHM) , InterXion (NYSE:INXN) and Square (NYSE:SQ) , each carrying the same Zacks Rank as Alphabet. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term expected earnings per share (EPS) growth rate for Autohome, InterXion and Square are a respective 15.9%, 13.6% and 22.5%.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Autohome Inc. (ATHM): Free Stock Analysis Report

InterXion Holding N.V. (INXN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Square, Inc. (SQ): Free Stock Analysis Report

Original post

Zacks Investment Research