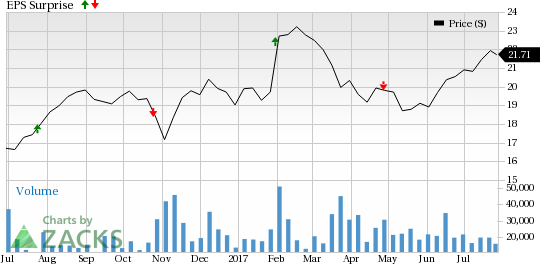

Have you been eager to see how Ally Financial Inc. (NYSE:ALLY) performed in Q2 in comparison with the market expectations? Let’s quickly scan through the key facts from this Detroit, Michigan-based automotive financial services company’s earnings release this morning:

An Earnings Beat

Ally Financial came out with adjusted earnings of 58 cents per share, surpassing the Zacks Consensus Estimate of 53 cents.

Higher revenues were largely responsible for this earnings beat.

How Was the Estimate Revision Trend?

You should note that the earnings estimate revisions for Ally Financial depicted a neutral stance prior to the earnings release. The Zacks Consensus Estimate remained stable over the last 30 days.

Before posting the earnings beat in Q2, the company delivered positive surprises in two of the trailing four quarters, with an average beat of 2.9%.

Revenues Beat Expectations

Ally Financial posted total net revenues of $1.46 billion, surpassing the Zacks Consensus Estimate of $1.42 billion. Also, it was above the prior-year quarter figure of $1.36 billion.

Key Statistics

- Auto originations of $8.6 billion in the quarter

- Retail deposit growth of 16% year over year to $71.1 billion as of Jun 30, 2017

- Net financing revenue of $1.1 billion, up 8.4% year over year

What Zacks Rank Says

The estimate revisions that we discussed earlier have driven a Zacks Rank #3 (Hold) for Ally Financial. However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. While things apparently look favorable, it all depends on what sense the just-released report makes to the analysts.

(You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.)

Check back later for our full write up on this Ally Financial earnings report!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Ally Financial Inc. (ALLY): Free Stock Analysis Report

Original post

Zacks Investment Research