Allocate has confirmed that full year results are expected to be in line. While the large win with the Australian Defence Force was a major factor in the H2 uplift, helped by a broadened product offering, demand within healthcare appears to have remained robust. For 2013 we see plenty of scope for earnings growth through cross-selling, a new platform rollout and licence extensions in the NHS. We see the shares as at least 20% undervalued.

Review Of Progress

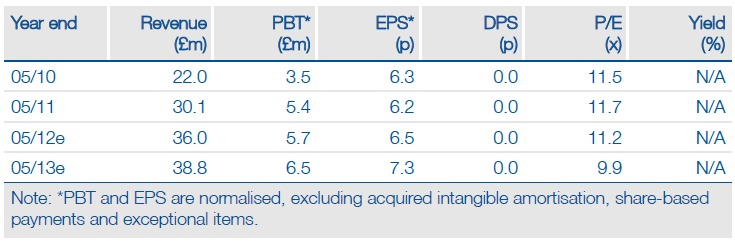

In a trading update, Allocate has confirmed that full year results are expected to be in-line. Our estimates assume 20% sales growth (6% organic) over the full year, with sales and profitability being particularly H2 weighted due to the contribution from the multi-million deal with the Australian Defence Force. Reaffirming our view that the ‘spend to save’ nature of Allocate’s solutions would stand the company in good stead, appetite from the NHS is said to have remained strong. Both of H1’s acquisitions, Zircadian and RosterOn, are said to be performing in line. Health Assure has also made its first sale to Clinical Commissioning Group, indicating that the company is starting to regain customers lost following the dissolution of the PCTs.

Platform For Growth Looks Sound

Our 2013 estimates are unchanged. We see good scope for sales growth through cross-selling the enlarged portfolio. Within the NHS Allocate is the dominant supplier of rostering software (supplying c 45% of trusts), and now supplies over 90% of trusts with at least one product. In particular, the addition of doctor rostering capability through the Zircadian acquisition significantly enlarges Allocate’s addressable market. The rollout of HealthRoster V10, a completely new version of the core healthcare software platform, should help competitiveness and also benefit margins through enabling new features to be implemented more quickly and cost effectively. Longer term, the multi-lingual capability should facilitate further geographical expansion.

Valuation: Track Record And Opportunity Unrewarded

Allocate’s 2013 P/E of 9.9x is a 20% discount to most healthcare software peers. We do not believe this is merited considering the company’s track record, market position and scope for growth. The EV/sales ratio of 1x compares to peers at 1.7x (ACS) and 4.3x (EMIS). While this reflects the company’s lower forecast margins than peers, with the roll-out of HealthRoster V10 and acquisitions being integrated, we see plenty of scope for EBIT margins to expand beyond the 17% we have forecast for 2013.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Allocate Software: Update

Robust Performance Continues

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.