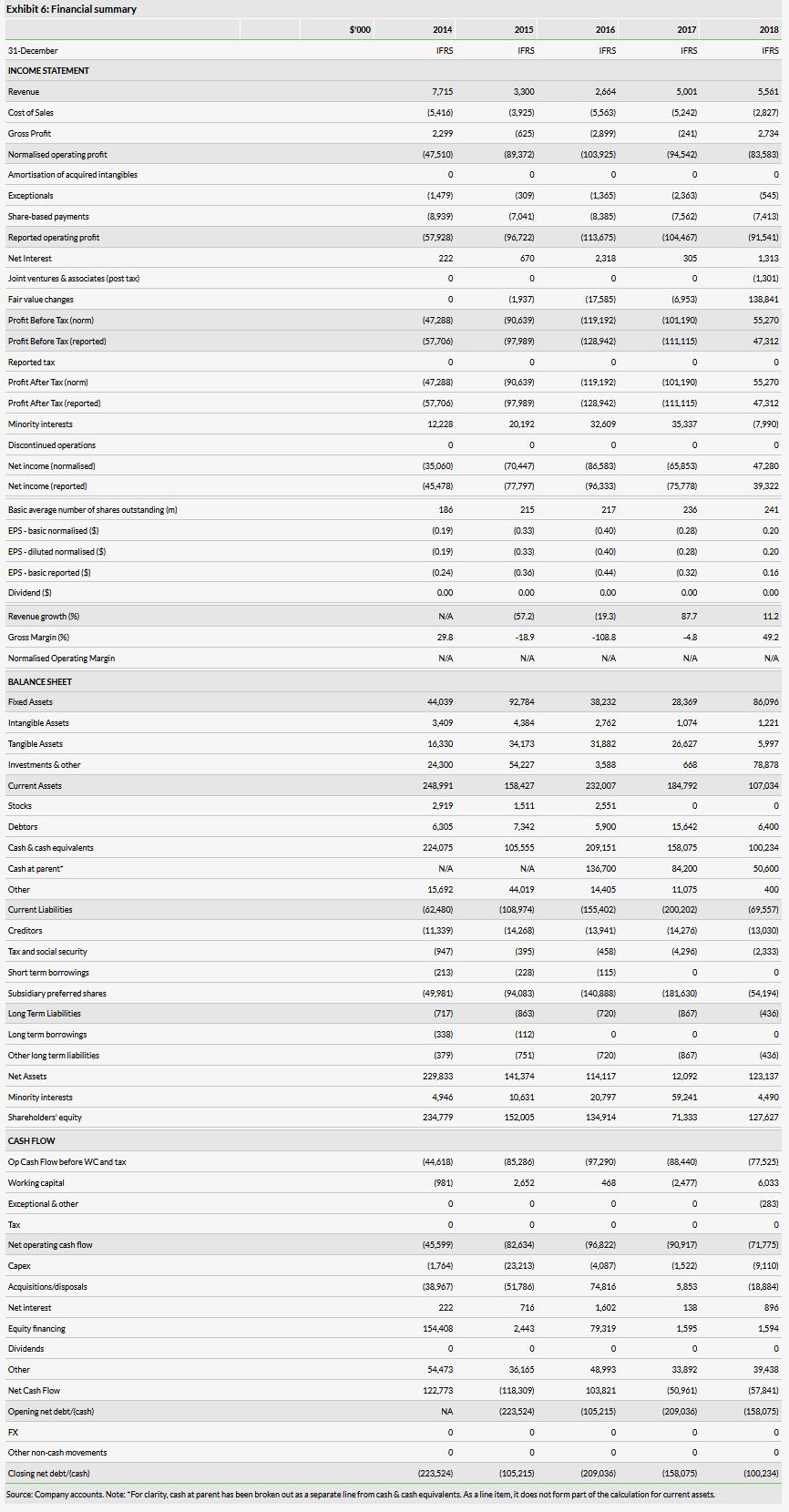

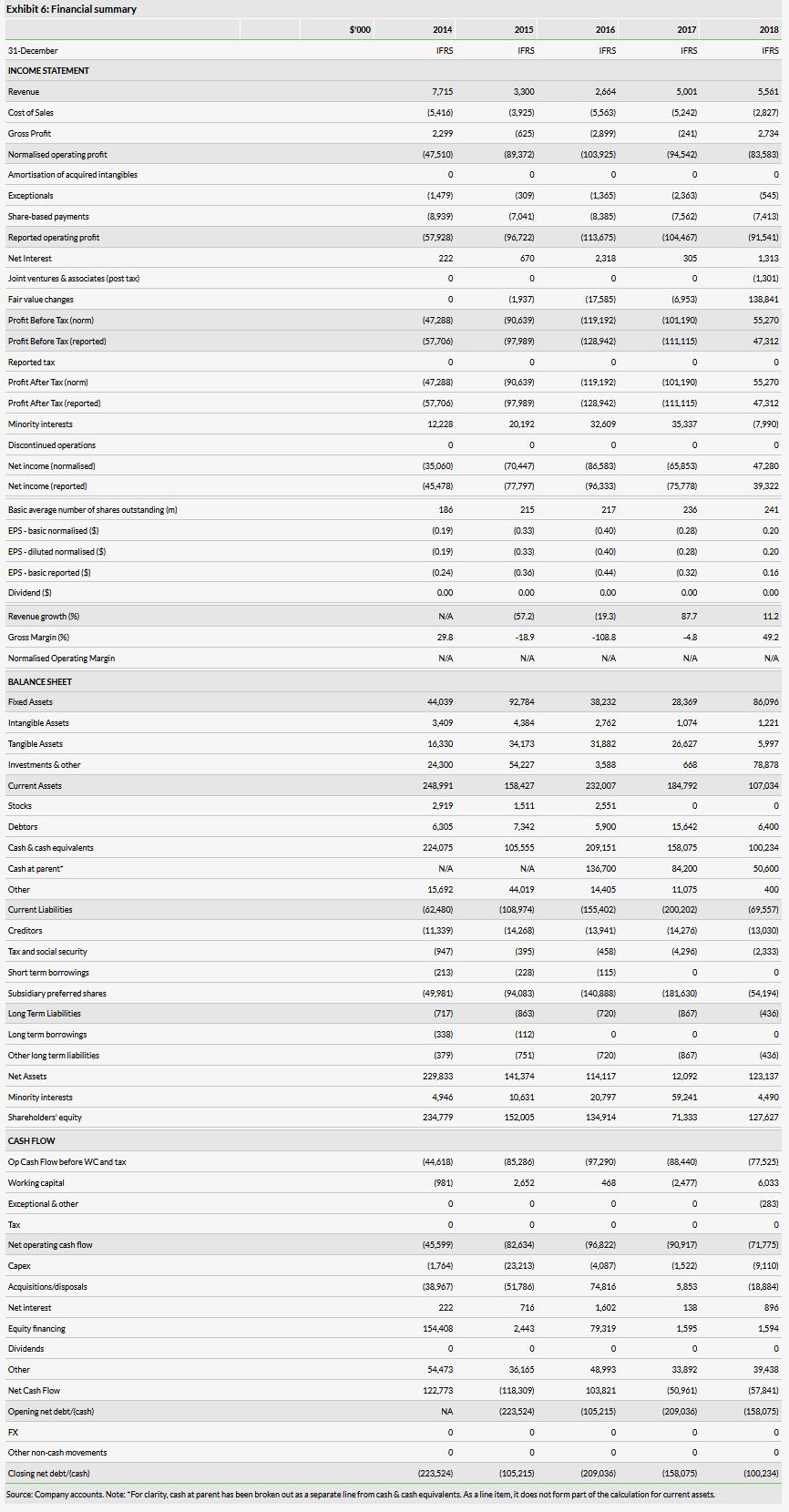

During H119, revenue decreased to $1.5m in H119 (H118: $2.1m), primarily due to deconsolidation of two of the company’s subsidiaries, SciFluor and Precision Biopsy. Net finance income fell to $5.5m (H118: $49.4m), largely as a result of the deconsolidation. Other income increased to $24.7m (2018: zero), reflecting a $33.9m in gain on investments held at fair value, offset by losses from the deconsolidated entities. Total comprehensive income for the year decreased to $2.3m for H119 (H118: $4.1m).

Non-current assets rose to $117.0m at 30 June 2019 (FY18: $83.7m), mainly due to a $36.4m portfolio company fair value increase. Current assets decreased to $63.1m (FY18: $107.0m), reflecting a fall in cash and cash equivalents to $40.9m.

The group’s net cash outflow from operating activities of $26.3m in H119 (H118: $39.7m) reflected the $27.7m net operating losses for the period (H118: $45.1m), together with an increase in working capital and other finance costs of $8.2m (H118: $3.5m).

The group had a net cash outflow from investing activities of $5.0m in H119 (H118: -$2.0m), predominantly related to purchases of property and equipment and intangibles of $2.5m (H118: $1.6m) and a $2.5m investment in Spin Memory in April 2019. Net cash outflow from financing activities of $12.0m in H119 (H118: $11.9m) partly reflects $12.0m cash distributions to shareholders from the dissolution of Signature Medical and the remaining ABLS companies in the first half of 2019.

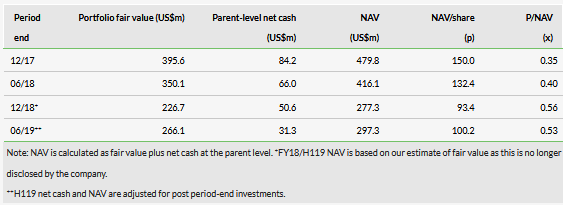

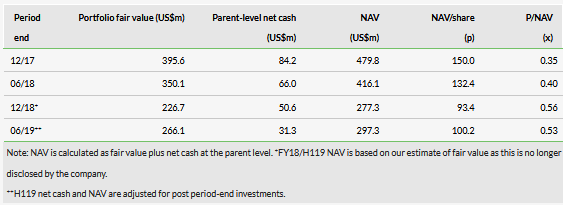

Net cash and investments at 30 June 2019 stood at $56.8m (FY18: $97.7m), of which $46.6m is held at parent level (FY18: $50.6m).

Outlook: Further progress expected across portfolio

Allied Minds has now largely delivered on the key terms of the April strategic review, intended to give it the best opportunity to maximise shareholder returns over the medium term, without further recourse to the financial markets:

focus remaining cash resources on key assets in the current portfolio;

new investment on indefinite hold; and

further cuts to central costs (to reduce opex to $5–6m pa).

The company has made good progress in terms of cost reduction, with a number of measures taken, including a reduction in headcount to eight staff and subletting its HQ office space, both by 1 November 2019. However, it has also revised its estimate of ongoing annualised HQ operating expenses to c $7.5m in FY20, driven primarily by a substantial increase in the cost of director and officer insurance. Of the estimated $7.5m in central costs for FY20, $2.9m represents public company costs.

With adjusted net cash of $31.3m at 30 June 2019 (adjusted for $15.3m of investments), together with cash of $32.8m from the sale of its stake in HawkEye 360, management expects to have sufficient cash to allow it to continue to invest in existing assets and maximise the value of its portfolio to shareholders over the medium term, which we understand to mean potentially a three- to four-year time horizon.

In terms of its three principal assets (ex HawkEye 360), Allied Minds also reiterated the key operational objectives for each over the course of 2019:

Portfolio: Condensed, with solid underpinnings

Third-party investors subscribed for $110.3m of portfolio company equity in H119, including $105.8m post period-end, while Allied Minds invested $24.3m, including $15.3m post period-end.

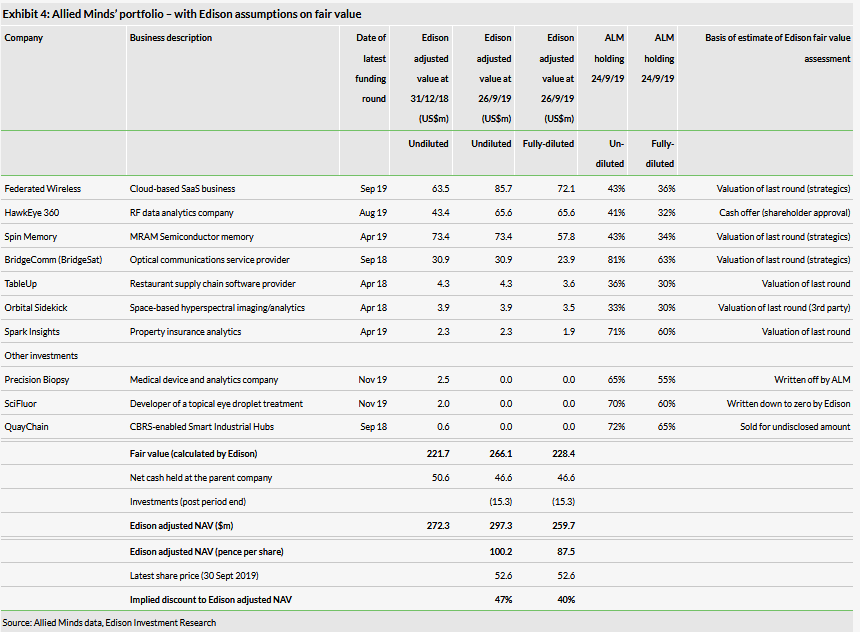

Allied Minds’ portfolio has now been reduced to eight assets (including HawkEye 360 and SciFluor), with four principal assets (HawkEye 360, Federated Wireless, BridgeComm and Spin Memory). We have already highlighted the progress at HawkEye 360 and Federated Wireless. However, although less newsworthy, we understand that the remaining technology portfolio companies also continue to make good technical and commercial progress.

During the period, management took the decision to cease operations at Precision Biopsy and sold its stake in QuayChain for an undisclosed amount. With no material newsflow from SciFluor following its Q4 bridge round (ALM, Woodford), we have prudently ascribed zero value to SciFluor (FY18: $2m), pending further positive news.

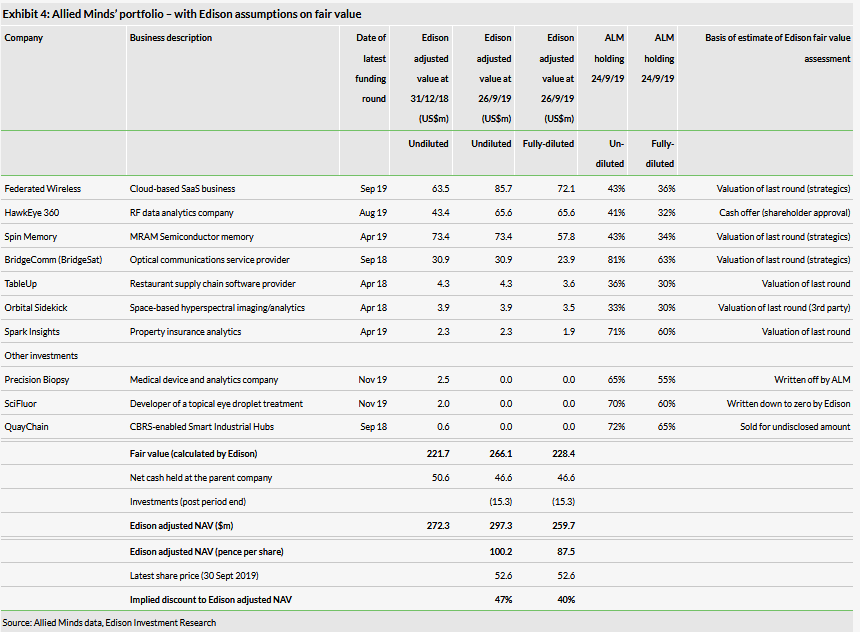

We believe that the write-downs in value of Precision Biopsy, QuayChain and SciFluor provide a solid NAV on which Allied Minds should build over time, with our adjusted NAV per share of 100.2p (or 87.5p on a fully-diluted basis).

Valuation: 47% discount to firm-looking NAV

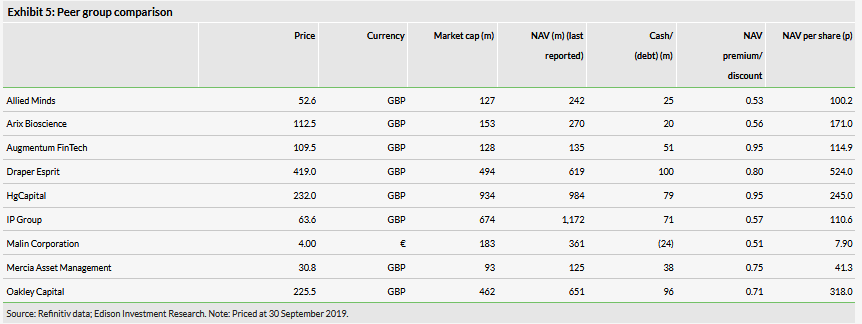

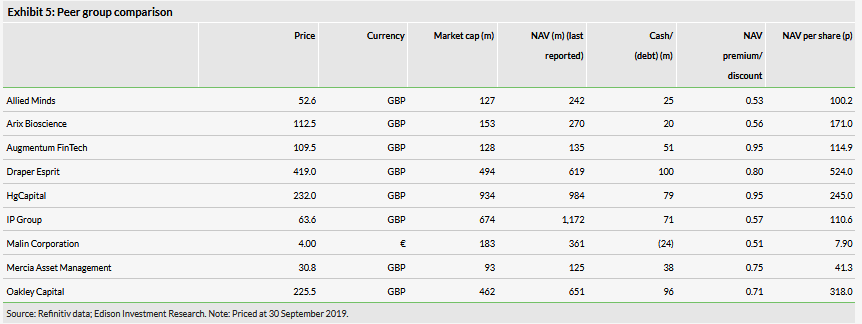

As we have noted previously, given its narrowed portfolio, Allied Minds now looks less like its patient capital and IP commercialisation peers, as it offers look-through to a concentrated number of emerging technology businesses.

Allied Minds’ shares currently trade at a 47% discount to our adjusted estimate of H119 NAV of 100.2p (Exhibit 4), or a 40% discount on a fully-diluted basis.

H119 has been a period of real progress for Allied Minds, with strategic funding rounds for Federated Wireless and HawkEye 360 and the $65.6m sale of Allied Minds’ stake in HawkEye 360 to Advance. With the transaction subject to shareholder approval, 50% of the sale proceeds ($32.8m, c 11p/share) are expected to be returned to shareholders in Q419. Management expects HQ operational costs to reduce to c $7.5m for FY20. It has also taken the opportunity to rationalise the investment portfolio, with the remaining assets showing good progress. Parent cash at 30 June 2019 was $46.6m ($31.3m adjusted for post period-end investments). With NAV no longer disclosed by the company, our latest assessment, adjusted for post period-end investments, is 100.2p/share (87.5p/share fully-diluted).

H119 has been a period of real progress for Allied Minds, with strategic funding rounds for Federated Wireless and HawkEye 360 and the $65.6m sale of Allied Minds’ stake in HawkEye 360 to Advance. With the transaction subject to shareholder approval, 50% of the sale proceeds ($32.8m, c 11p/share) are expected to be returned to shareholders in Q419. Management expects HQ operational costs to reduce to c $7.5m for FY20. It has also taken the opportunity to rationalise the investment portfolio, with the remaining assets showing good progress. Parent cash at 30 June 2019 was $46.6m ($31.3m adjusted for post period-end investments). With NAV no longer disclosed by the company, our latest assessment, adjusted for post period-end investments, is 100.2p/share (87.5p/share fully-diluted).

Interim results

Revenue decreased by $0.6m, to $1.5m for H119 (H118: $2.1m), primarily due to deconsolidation of two of the company’s subsidiaries, SciFluor and Precision Biopsy. Cost of revenue for H119 fell to ($0.6m), as did net finance income to $5.5m (H118: $49.4m), primarily reflecting the deconsolidation. Other income increased to $24.7m (2018: zero), with a $33.9m gain on investments offset by losses from deconsolidated entities. Total comprehensive income for the year fell to $2.3m for H119 (H118: $4.1m). Net cash and investments at 30 June 2019 stood at $56.8m (FY18: $97.7m), of which $46.6m was at parent level (FY18: $50.6m).

Portfolio update

Other than the funding rounds at HawkEye 360 and Federated Wireless, the remaining technology portfolio companies continue to report technical and commercial progress. However, Allied Minds took the decision to cease operations at Precision Biopsy and sold its stake in QuayChain for an undisclosed amount. With no material newsflow from SciFluor following its Q4 bridge round, we have prudently ascribed zero value to SciFluor (FY18: $2m) pending further news.

Valuation: 47% discount to firm-looking NAV

Allied Minds has delivered additional validation for two of its three principal portfolio companies since its strategic review in April and will effect a material return of capital to shareholders (with the transaction subject to shareholder approval). With this validation of its assets, together with a focus on preserving cash and delivery of material cash exits, we believe this provides a solid NAV on which Allied Minds should build over time, with our adjusted NAV per share of 100.2p (or 87.5p on a fully-diluted basis).

Interim results summary

Interim results

Revenue decreased by $0.6m, to $1.5m for H119 (H118: $2.1m), primarily due to deconsolidation of two of the company’s subsidiaries, SciFluor and Precision Biopsy. Cost of revenue for H119 fell to ($0.6m), as did net finance income to $5.5m (H118: $49.4m), primarily reflecting the deconsolidation. Other income increased to $24.7m (2018: zero), with a $33.9m gain on investments offset by losses from deconsolidated entities. Total comprehensive income for the year fell to $2.3m for H119 (H118: $4.1m). Net cash and investments at 30 June 2019 stood at $56.8m (FY18: $97.7m), of which $46.6m was at parent level (FY18: $50.6m).

Portfolio update

Other than the funding rounds at HawkEye 360 and Federated Wireless, the remaining technology portfolio companies continue to report technical and commercial progress. However, Allied Minds took the decision to cease operations at Precision Biopsy and sold its stake in QuayChain for an undisclosed amount. With no material newsflow from SciFluor following its Q4 bridge round, we have prudently ascribed zero value to SciFluor (FY18: $2m) pending further news.

Valuation: 47% discount to firm-looking NAV

Allied Minds has delivered additional validation for two of its three principal portfolio companies since its strategic review in April and will effect a material return of capital to shareholders (with the transaction subject to shareholder approval). With this validation of its assets, together with a focus on preserving cash and delivery of material cash exits, we believe this provides a solid NAV on which Allied Minds should build over time, with our adjusted NAV per share of 100.2p (or 87.5p on a fully-diluted basis).

Interim results summary

During H119, revenue decreased to $1.5m in H119 (H118: $2.1m), primarily due to deconsolidation of two of the company’s subsidiaries, SciFluor and Precision Biopsy. Net finance income fell to $5.5m (H118: $49.4m), largely as a result of the deconsolidation. Other income increased to $24.7m (2018: zero), reflecting a $33.9m in gain on investments held at fair value, offset by losses from the deconsolidated entities. Total comprehensive income for the year decreased to $2.3m for H119 (H118: $4.1m).

Non-current assets rose to $117.0m at 30 June 2019 (FY18: $83.7m), mainly due to a $36.4m portfolio company fair value increase. Current assets decreased to $63.1m (FY18: $107.0m), reflecting a fall in cash and cash equivalents to $40.9m.

The group’s net cash outflow from operating activities of $26.3m in H119 (H118: $39.7m) reflected the $27.7m net operating losses for the period (H118: $45.1m), together with an increase in working capital and other finance costs of $8.2m (H118: $3.5m).

The group had a net cash outflow from investing activities of $5.0m in H119 (H118: -$2.0m), predominantly related to purchases of property and equipment and intangibles of $2.5m (H118: $1.6m) and a $2.5m investment in Spin Memory in April 2019. Net cash outflow from financing activities of $12.0m in H119 (H118: $11.9m) partly reflects $12.0m cash distributions to shareholders from the dissolution of Signature Medical and the remaining ABLS companies in the first half of 2019.

Net cash and investments at 30 June 2019 stood at $56.8m (FY18: $97.7m), of which $46.6m is held at parent level (FY18: $50.6m).

Outlook: Further progress expected across portfolio

Allied Minds has now largely delivered on the key terms of the April strategic review, intended to give it the best opportunity to maximise shareholder returns over the medium term, without further recourse to the financial markets:

focus remaining cash resources on key assets in the current portfolio;

new investment on indefinite hold; and

further cuts to central costs (to reduce opex to $5–6m pa).

The company has made good progress in terms of cost reduction, with a number of measures taken, including a reduction in headcount to eight staff and subletting its HQ office space, both by 1 November 2019. However, it has also revised its estimate of ongoing annualised HQ operating expenses to c $7.5m in FY20, driven primarily by a substantial increase in the cost of director and officer insurance. Of the estimated $7.5m in central costs for FY20, $2.9m represents public company costs.

With adjusted net cash of $31.3m at 30 June 2019 (adjusted for $15.3m of investments), together with cash of $32.8m from the sale of its stake in HawkEye 360, management expects to have sufficient cash to allow it to continue to invest in existing assets and maximise the value of its portfolio to shareholders over the medium term, which we understand to mean potentially a three- to four-year time horizon.

In terms of its three principal assets (ex HawkEye 360), Allied Minds also reiterated the key operational objectives for each over the course of 2019:

Portfolio: Condensed, with solid underpinnings

Third-party investors subscribed for $110.3m of portfolio company equity in H119, including $105.8m post period-end, while Allied Minds invested $24.3m, including $15.3m post period-end.

Allied Minds’ portfolio has now been reduced to eight assets (including HawkEye 360 and SciFluor), with four principal assets (HawkEye 360, Federated Wireless, BridgeComm and Spin Memory). We have already highlighted the progress at HawkEye 360 and Federated Wireless. However, although less newsworthy, we understand that the remaining technology portfolio companies also continue to make good technical and commercial progress.

During the period, management took the decision to cease operations at Precision Biopsy and sold its stake in QuayChain for an undisclosed amount. With no material newsflow from SciFluor following its Q4 bridge round (ALM, Woodford), we have prudently ascribed zero value to SciFluor (FY18: $2m), pending further positive news.

We believe that the write-downs in value of Precision Biopsy, QuayChain and SciFluor provide a solid NAV on which Allied Minds should build over time, with our adjusted NAV per share of 100.2p (or 87.5p on a fully-diluted basis).

Valuation: 47% discount to firm-looking NAV

As we have noted previously, given its narrowed portfolio, Allied Minds now looks less like its patient capital and IP commercialisation peers, as it offers look-through to a concentrated number of emerging technology businesses.

Allied Minds’ shares currently trade at a 47% discount to our adjusted estimate of H119 NAV of 100.2p (Exhibit 4), or a 40% discount on a fully-diluted basis.