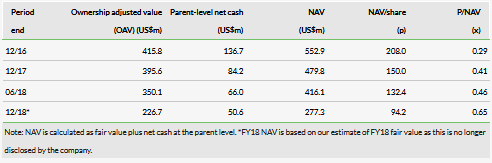

HawkEye 360, one of Allied Minds’ principal portfolio companies, has announced a Series B funding round with new investors, Airbus and Esri, investing alongside Allied Minds and existing investors. The round was struck at a pre-money valuation of $200m (c 122% uplift in headline value), raising $70m of capital in two equal tranches, the second with certain conditions precedent. After Allied Minds’ recent portfolio downgrades, this highlights the material embedded value in its remaining investments. By our calculation, the round represents a $27–44m uplift in fair value for Allied Minds, or 9–15p per share. The shares now trade at a 41% discount to our adjusted estimate of FY18 NAV of a minimum of 103.5p.

HawkEye 360 Series B funding round

Allied Minds today confirmed that one of its principal portfolio companies, HawkEye 360, has announced a Series B funding round with major strategic investors, Airbus Industries and Esri (an international supplier of mapping software), investing alongside Allied Minds and existing investors, Razor’s Edge Ventures and Shield Capital Partners. The round was struck at a pre-money valuation of $200m, raising $70m of capital in two equal tranches. Allied Minds invested $5m in the initial tranche, with the second tranche subject to conditions including approval by the Committee on Foreign Investments in the United States.

Use of proceeds

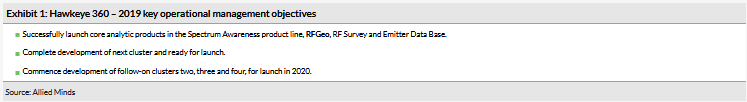

HawkEye 360 has already launched and deployed its first satellite cluster (now operational) and the previous A-3 funding round allowed it to fabricate and launch a second cluster. As well as cementing a partnership with Airbus (providing exceptional access to distribution in European markets) and Esri, this latest round supports fabrication and launch of a further four satellite clusters, forming a fully operational constellation of 18 satellites with rapid global revisit.

Valuation: Material 41% discount to a rising NAV

Despite Allied Minds’ limited cash resources (FY18: $50.6m), management’s stated intention has been to ensure it retains the strategic flexibility to participate in major funding rounds like this to maximise shareholder value in the medium term. This funding round goes some way to validate that strategy. By our calculation, the round represents a $27–44m uplift in fair value for Allied Minds, or 9–15p per share. The company’s shares now trade at a 41% discount to our adjusted estimate of FY18 NAV of a minimum of 103.5p.

Business description

Allied Minds is an IP commercialisation company with a concentrated investment portfolio focused on early-stage companies within life sciences and technology. Its portfolio companies are spin-outs from US federal government laboratories and universities.

April 2019 strategic review

Following the portfolio rationalisation over 2017/18 to focus the business on its principal portfolio companies, together with the cash management measures announced in February 2019, management enacted further measures in April 2019 to deliver value creation:

Focus remaining cash resources on key assets in the current portfolio.

New investment on indefinite hold.

Further cuts to central costs (to reduce opex to $5–6m pa).

Together, these measures are intended to give Allied Minds the best opportunity to deliver on the promise of its investment model, without further recourse to the financial markets, to maximise shareholder returns over the medium term.

Looking ahead to commercialisation

As we reiterated in our previous note, CEO steps down, Allied Minds has set out clear milestones in 2019 for its three most promising assets (HawkEye 360 – multiple product launches, funding, Federated Wireless – FCC approval, funding and Spin Memory – foundry contracts).

With the funding round for HawkEye 360 now successfully announced, we are hopeful that 2019 will start to deliver a reversal in sentiment.

Background on HawkEye 360

HawkEye 360 is a Radio Frequency (RF) data analytics company. It operates a first-of-its-kind commercial satellite constellation to identify, process and geolocate a broad set of RF signals. It extracts value from these data through proprietary algorithms, creating analytical products for global customers. Products include maritime domain awareness and spectrum mapping and monitoring; customers include a wide range of commercial, government and international entities. A more detailed review of its business can be found in our initiation note, Portfolio rebased for growth.

27 June 2019: Robert Cardillo has joined advisory board. Cardillo is the former director of the National Geospatial-Intelligence Agency (NGA), and a highly experienced national security professional and geospatial expert. Prior to the NGA, he served as the first deputy director for intelligence integration at the Office of the Director of National Intelligence, where he was responsible for delivering the President’s Daily Brief, and overseeing the National Intelligence Council and the National Intelligence Managers.

22 May 2019: HawkEye 360 and Windward partner to provide deeper insights and better visibility on vessel behaviour. Combining unique RF analytics with a powerful maritime platform promises significant improvements for global maritime domain awareness. ‘HawkEye 360 and Windward, a world leader in maritime risk analytics, have partnered to offer new global insights into maritime domain awareness through their combined capabilities. HawkEye 360 will contribute its unique RF dataset for use on Windward’s digital platform with select customers.’ (source: www.he360.com)

7 May 2019: Chris Herndon joins HawkEye 360 as CIO. Former director of White House Information Technology brings extensive cybersecurity and policy expertise. ‘HawkEye 360 today announced that Chris Herndon has joined the company as CIO. Herndon brings more than 30 years of experience in building advanced information technology systems. Most recently, Herndon served in the Trump Administration as the White House deputy assistant to the president and the director of White House Information Technology, where he created the White House IT strategic plan and transformed enterprise services across all 12 components of the Executive Office of the president.’ (source: www.he360.com)

4 April 2019: HawkEye 360 launches first commercial product – RFGeo. RF signal mapping reveals new patterns of life. ‘HawkEye 360 announced that it has launched RFGeo, a first-of-its-kind RF signal mapping product. RFGeo uses the unique data generated by the HawkEye Constellation of space-based RF sensing satellites to identify and geolocate RF signals, providing a new global geospatial data layer. RFGeo is the company’s first commercially available product.’ (source: www.he360.com)

Valuation: Material 41% discount to a rising NAV

By our calculation, the HawkEye 360 funding round represents a $27–44m uplift in fair value for Allied Minds (9–15p per share), depending on the dilution of Allied Minds’ stake. The shares now trade at a 41% discount to our adjusted estimate of FY18 NAV of a minimum of 103.5p.

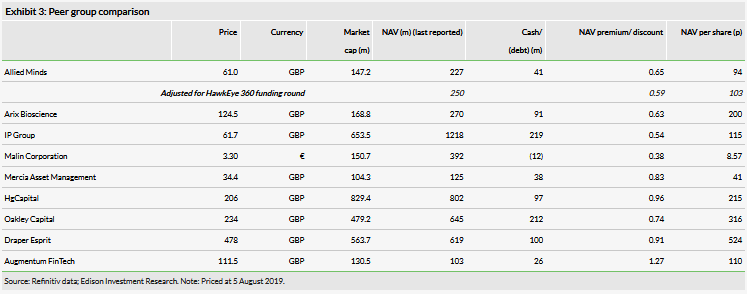

As we have noted previously, given its narrowed portfolio, Allied Minds now looks less like its IP commercialisation peers as it offers look-through to only a small number of emerging technology businesses.

Allied Minds’ shares trade at a 41% discount to our adjusted estimate of FY18 NAV of a minimum of 103.5p (Exhibit 3).