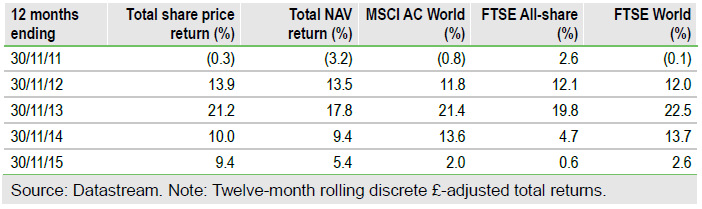

Alliance Trust (L:ATST) is a global equity investment trust differentiated by its focus on sustainable businesses and long-term investment in subsidiaries. Significant changes announced in October 2015 give ATST a simpler organisational structure and clarify the investment proposition. Measures include focusing on the global equity portfolio, introducing the MSCI AC World Index as a formal performance benchmark for the trust, appointing ATI as investment manager with a 0.35% fee and a target 0.45% ongoing charge, confirming the progressive dividend policy and committing to share buybacks to help maintain the discount below 10%.

Investment strategy: Fundamental stock selection

The investment team seeks to identify high quality companies able to distribute a sizeable proportion of earnings as income and deliver long-term earnings growth, which they expect will translate into capital growth. Stocks need to meet all three investment criteria to be considered for selection in the portfolio. The team expects to maintain between 60 and 70 equity positions and has a minimum investment horizon of three years. The portfolio is unconstrained by sector and geographic allocations, but regard is given to the risk associated with divergence from the benchmark MSCI AC World index. Stock selection and position sizes are based on the stock’s underlying volatility, strength of conviction and portfolio diversification.

To read the entire report Please click on the pdf File Below