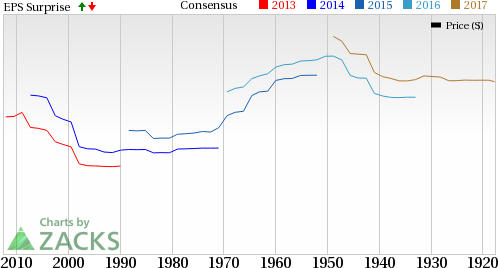

Alliance Data Systems Corporation’s (NYSE:ADS) operating earnings of $3.59 per share in the second quarter of 2017 surpassed the Zacks Consensus Estimate of $3.47. Earnings improved 4.3% year over year.

All the segments – Epsilon, LoyaltyOne and Card Services delivered a solid performance in the quarter.

Behind the Headlines

Alliance Data’s revenues came in at $1.82 billion, up 4% year over year. The top line missed the Zacks Consensus Estimate of $1.84 billion.

Operating expenses increased 2.9% year over year to $1.5 billion, primarily due to a rise in provision for loan losses. Operating income improved 9.6% year over year to $351.4 million.

However, adjusted earnings before interest tax depreciation and amortization (EBITDA) were $499 million, up 6% year over year.

Segment Update

LoyaltyOne: Revenues totaled $280 million, down 21% year over year. Adjusted EBITDA declined 28% to $56.7 million. AIR MILES’ saw its reward miles issued decreased 1% while redeemed declined 13%.

Epsilon: Revenues were $543.3 million in the quarter, up 5% year over year. Adjusted EBITDA increased 4% year over year to $106.8 million. The quarter witnessed growth in core product offerings revenues (Auto, CRM, Agency).

Card Services: Revenues came in at $1 billion, up 13% year over year. Adjusted EBITDA was $305 million, up 11% year over year. Average credit card receivables, excluding amounts reclassified as assets held for sale, advanced 17% year over year to $15.7 billion. Net principal loss rates for the reported quarter were 6.2%, up 110 basis points year over year, chiefly due to lower recovery rates.

Financial Update

As of Jun 30, 2017, cash and cash equivalents were $1.96 billion compared with $1.86 billion as of Dec 31, 2016.

At the end of the quarter, debt climbed 12.5% from 2016-end to $6.4 billion.

Capital expenditure at Alliance Data decreased 8.5% year over year to $116.8 million in the first half of 2017.

Guidance

Alliance Data projects 2017 core earnings to be $18.10 per share, lowered from $18.50 per share, guided earlier. Revenues of $7.8 billion are raised from $7.7 billion, guided earlier.

For 2018, the company expects a core EPS of $21.50 on revenues of $8.7 billion. While bottom line reflects a 19% year over year growth, top line represents a 12% increase over 2017.

Zacks Rank and Other Stocks

Alliance Data carries a Zacks Rank #4 (Sell).

American Express Co. (NYSE:AXP) and Visa Inc (NYSE:V) from the same space also came up with flying colors, with bottom-lines beating their respective Zacks Consensus Estimate in the reported quarters

A better ranked financial transaction service provider MasterCard Inc (NYSE:MA) with Zacks Rank #2 is set to release its second quarter results next week.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge. With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research. It's not the one you think. See This Ticker Free >>

American Express Company (AXP): Free Stock Analysis Report

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Alliance Data Systems Corporation (ADS): Free Stock Analysis Report

Original post

Zacks Investment Research