A bigger slice of the cake

Allergy Therapeutics has continued to grow its market share in Germany and other European markets while working on securing a US partner for Pollinex Quattro (PQ). The company has a US licensing campaign but is also exploring alternative ways of developing the US opportunity. The US allergy immunotherapy (AIT) market is potentially large, but undeveloped, and Allergy needs to secure a partner to commercialise PQ in the US. The US PQ opportunity is not included in our valuation; a licensing deal would transform Allergy’s prospects and substantially increase our valuation.

Diversification strategy

Allergy has made progress on its strategy to diversify its portfolio, expand into new geographical markets and identify new in-licensing opportunities. 2013 revenues in markets outside of Germany, the company’s largest market, accounted for 40% compared to 27% in 2009. Allergy introduced three new probiotic products for different allergies in 2013 and Arovac Plus, a novel product for perennial mite allergy, was also launched in Spain. The registration of mite allergy products has been initiated in Peru and Venezuela, while the registration of various allergy vaccines in Portugal will be completed in H114. A PQ Birch dose ranging study in Germany, Austria and Poland began in September 2013.

Diversification strategy

Allergy has made progress on its strategy to diversify its portfolio, expand into new geographical markets and identify new in-licensing opportunities. 2013 revenues in markets outside of Germany, the company’s largest market, accounted for 40% compared to 27% in 2009. Allergy introduced three new probiotic products for different allergies in 2013 and Arovac Plus, a novel product for perennial mite allergy, was also launched in Spain. The registration of mite allergy products has been initiated in Peru and Venezuela, while the registration of various allergy vaccines in Portugal will be completed in H114. A PQ Birch dose ranging study in Germany, Austria and Poland began in September 2013.

Business development campaign for PQ opportunity

Allergy needs to secure a partner to complete Phase III trials and commercialise PQ in the US. It launched a licensing campaign, the outcome of which may become apparent later this year, and is also exploring alternative ways of developing the US opportunity. The US AIT opportunity is significant (c US$1.7bn), but is contingent on Allergy being able to secure a partner to fund the pivotal trials and to provide the infrastructure to commercialise PQ.

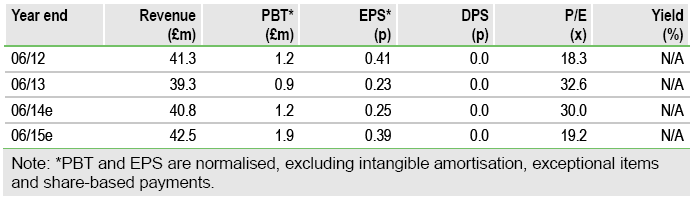

Financials: Operating profits in 2013

FY13 net revenues of £39.3m were essentially flat, in line with expectations and largely affected by foreign exchange movements. Operating profit was £0.7m; EPS was 0.13p (basic); net cash was £1.0m.

Valuation: EV of £30.5m and EV/EBITDA of 12.6x

Our financial model does not include the expected German regulatory approval or the US opportunity, which will be revised following a licensing deal, when the development programme has been clarified. On our current forecasts, our EV of £30.5m is equivalent to an FY14e EV/EBITDA of 12.6x, falling to 9.6x in FY15e.

Allergy needs to secure a partner to complete Phase III trials and commercialise PQ in the US. It launched a licensing campaign, the outcome of which may become apparent later this year, and is also exploring alternative ways of developing the US opportunity. The US AIT opportunity is significant (c US$1.7bn), but is contingent on Allergy being able to secure a partner to fund the pivotal trials and to provide the infrastructure to commercialise PQ.

Financials: Operating profits in 2013

FY13 net revenues of £39.3m were essentially flat, in line with expectations and largely affected by foreign exchange movements. Operating profit was £0.7m; EPS was 0.13p (basic); net cash was £1.0m.

Valuation: EV of £30.5m and EV/EBITDA of 12.6x

Our financial model does not include the expected German regulatory approval or the US opportunity, which will be revised following a licensing deal, when the development programme has been clarified. On our current forecasts, our EV of £30.5m is equivalent to an FY14e EV/EBITDA of 12.6x, falling to 9.6x in FY15e.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Allergy Therapeutics

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.