About a month has gone by since the last earnings report for Allergan PLC (NYSE:AGN) . Shares have lost about 8.3% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Allergan Beats Q2 Earnings & Sales Top

Allergan’s second-quarter 2017 earnings came in at $4.02 per share, beating the Zacks Consensus Estimate of $3.95 by 1.8%. Earnings rose 20% year over year driven by higher revenues, lower share count and interest expense, which offset lower gross margins and higher tax rates.

Revenues came in at $4.01 billion, up 8.8% from the year-ago period, and beat the Zacks Consensus Estimate of $3.95 billion by 1.4%.

While key products like Botox and new products like Vraylar, Namzaric and Viberzi did well in the quarter, sales were once again hurt by sales erosion from Namenda XR and loss of exclusivity, mainly from Asacol HD and Minastrin. Also, lower sales of Restasis and Aczone hurt the top line.

Second-quarter revenues, however, gained from the addition of Alloderm from LifeCell (Jan 2017) and CoolSculpting body contouring system from ZELTIQ (Apr 2017) acquisitions.

Segment Discussion

Allergan reports revenues under three segments – U.S. General Medicine, U.S. Specialized Therapeutics and International.

U.S. Specialized Therapeutics’ net revenues increased 15.2% to $1.72 billion driven by strong growth in Botox and the addition of LifeCell’s Alloderm and ZELTIQ’s CoolSculpting businesses. Botox (cosmetic) raked in sales of $210.3 million (up 10.7%). Botox Therapeutic revenues were $346.9 million, up 17.2%. In addition, Juvéderm Collection of fillers rose 7.3% and Ozurdex sales increased 15.8%, which contributed to the upside. Alloderm added $84.6 million while CoolSculpting added $78.9 million to sales in the second quarter.

Importantly, Restasis sales declined 9.4% to $336.4 million in the quarter due to unfavorable trade buying patterns. The company expects stable Restasis revenues this year.

U.S. General Medicine net revenue declined 1.5% to $1.43 billion in the reported quarter with sales declining in the Diversified Brands, Women's Health, and the Gastrointestinal franchises. Anti-Infectives sales rose 7.4% to $67.8 million while Central Nervous System sales rose 9.2% to $346.6 million.

Established products like Linzess and Lo Loestrin as well as new products like Viberzi, Namzaric and Vraylar did well in the quarter. Linzess’ sales rose 11.5% in the quarter to $167.8 million, driven by strong demand and continued OTC conversion. Lo Loestrin sales rose 11.9% to $113.0 million backed by strong prescription growth.

However, lower Namenda XR sales hurt the performance of the CNS franchise. Namenda XR sales declined 28.7% to $118.7 million in the quarter due to lower demand, lower pricing and shift of promotional efforts to Namzaric. The company does not expect a generic version of Namenda XR to be launched until first quarter of 2018, delayed from the prior expectation of fourth quarter of 2017. Also, Allergan does not expect any generic version of Estrace Cream to be launched this year.

Namzaric, a once-daily, fixed-dose combination of Namenda XR and Aricept, recorded sales of $33.4 million compared with $23.6 million in the previous quarter. Continued conversion from Namenda XR and higher demand following an expanded label with new dosages pulled up sales of Namzaric.

Asacol/Delzicol sales declined 61.9% to $45.6 million due to a generic competition for Ascaol HD, following the launch of an authorized generic in Aug 2016 as well as lower demand for Delzicol.

In the Women’s Health segment, Minastrin 24 revenues declined 86.3% to $11.4 million in the quarter due to loss of exclusivity in Mar 2017.

The International segment recorded net revenue of $858.8 million, up 16.2% (excluding currency impact) from the year-ago period, driven by growth in Facial Aesthetics, Botox Therapeutic and the addition of LifeCell and CoolSculpting.

Profits Decline

Adjusted operating income increased 16% to $1.9 billion in the second quarter. Adjusted operating margins, however, declined 330 basis points in the quarter to 47.1% quarter due to higher operating expenses and the addition of lower margin LifeCell and ZELTIQ acquisitions.

Selling, general and administrative (SG&A) expenses rose 17.1% to $1.22 billion in the quarter, primarily due to higher foreign exchange transactional losses, costs related to acquisitions and promotional expenses for key products. R&D expenses increased 14.2% to $393.9 million to support an advancing pipeline.

2017 Outlook

The company raised its previously issued earnings and sales guidance for 2017 following a strong first-half performance and solid outlook for the rest of the year.

Allergan expects total revenue in the range of $15.85 billion to $16.05 billion compared with $15.8 billion to $16.0 billion previously. Currency headwinds are now not expected to hurt revenues versus a negative impact of approximately $100 million expected previously.

The company said that revenues are expected to be the highest in the fourth quarter, mainly driven by seasonality and formulary coverage dynamics, while third quarter revenues are expected to be at similar levels to the second quarter.

Adjusted earnings per share are expected in the range of $16.05–$16.45 compared with $15.85–$16.35 previously. Adjusted earnings guidance continues to reflect strong double-digit growth in the range of 17% to 22%.

Adjusted gross margin is expected between 86.5% and 87% slightly more than 86% and 87% expected previously due to higher-than-expected gross margins in the first half. Second half gross margins are expected to be lower than the first half.

R&D expenses are expected to be approximately $1.6 billion (maintained). SG&A spend is expected between $4.5 billion to $4.6 billion compared with $4.45 billion and $4.55 billion previously. Meanwhile, SG&A and R&D expenses are expected to be higher in the third quarter versus the fourth quarter. Higher promotional activities given the timing of new launches and continued strong promotion for key brands is expected to lead to higher sales and marketing costs in the third quarter.

How Have Estimates Been Moving Since Then?

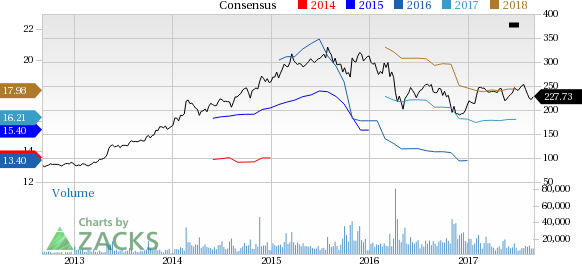

Following the release, investors have witnessed a downward trend in fresh estimates. There have been four revisions higher for the current quarter compared to eight lower.

VGM Scores

At this time, the stock has a subpar Growth Score of C, a grade with the same score on the momentum front. Charting a somewhat similar path, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than growth and momentum investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are looking for an inline return from the stock in the next few months.

Allergan PLC. (AGN): Free Stock Analysis Report

Original post

Zacks Investment Research