Allegheny Technologies Inc. (NYSE:ATI) reported earnings of $10.1 million or 9 cents per share for second-quarter 2017 against a loss of $18.8 million or 18 cents a year ago. Earnings per share beat the Zacks Consensus Estimate of 7 cents.

Revenues for the quarter rose 8.6% year over year to $880.2 million, also topping the Zacks Consensus Estimate of $876.1 million.

Segment Highlights

Revenues from the High Performance Materials & Components (HPMC) segment improved 6% year over year to $526.4 million in the second quarter due to increased sales of aerospace and defense market. Operating profit increased to $68 million from $38.8 million in the prior-year quarter. The segment’s profit reflects a better product mix, cost structure improvements and higher volumes.

The Flat-Rolled Products (FRP) segment’s sales rose 13% year over year to $353.8 million on the back of improved pricing for both high-value and standard stainless products and higher volumes. Segment operating profit was $2.9 million against operating loss of $31.8 million in the year-ago quarter. Results were driven by benefits of cost reductions and restructuring actions and higher operating levels.

Financial Position

Allegheny’s cash in hand as of Jun 30, 2017 was $154.6 million, down 52% year over year. Long-term debt increased 0.3% to $1,876.6 million.

The company generated operating cash flows of $25 million in the quarter. Total debt to total capitalization was 58.1% at the end of the second quarter, up from 48.7% a year ago.

Outlook

Moving ahead, Allegheny expects its HPMC unit to maintain robust performance in the second half of 2017, especially in the commercial aerospace. Further, the company expects the unit to continue to deliver a low-double-digit level of operating margin.

The FRP unit is expected to continue to witness operational improvements in the third-quarter on the back of improved product mix. However, the company cautiously noted that the quarter could be negatively impacted by the recent fall in raw material prices, especially nickel and ferrochrome, which is expected to considerably decrease profit margins due to out-of-phase raw material surcharges.

The condition could persist until raw materials prices stabilize. The company expects the FRP segment to report a loss in the third quarter and to be modestly profitable for the full year. The company projects average capital expenditure of not more than $100 million annually for the next several years.

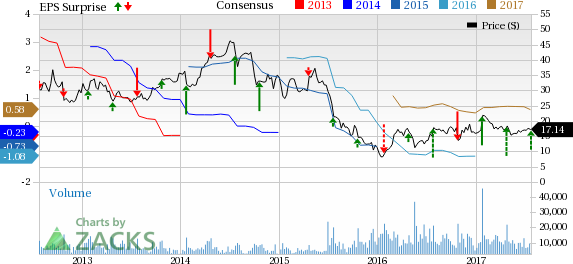

Price Performance

Shares of Allegheny have declined 13.8% in the last three months, underperforming the industry’s decline of 10.9%.

Zacks Rank & Key Picks

Allegheny currently carries a Zacks Rank #4 (Sell).

Some better-ranked companies in the basic materials space include The Sherwin-Williams Company (NYSE:SHW) , Ternium S.A. (NYSE:TX) and Westlake Chemical Corporation (NYSE:WLK) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Ternium has expected long-term earnings growth rate of 18.4%.

Westlake Chemical has expected long-term earnings growth rate of 7.15%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI): Free Stock Analysis Report

Original post

Zacks Investment Research