Alleghany Corporation (NYSE:Y) has reached an agreement to divest its Pacific Compensation Insurance Company (PacificComp), to Copper Point Mutual Insurance Company for a total cash consideration of $150 million. The transaction is expected to close at the end of this year.

PacificComp, a wholly owned subsidiary of Alleghany Insurance Holdings, LLC, was acquired by Alleghany in 2007. It provides workers’ compensation insurance coverage to companies located in California. PacificComp is responsible for a portion of Alleghany’s insurance operations. Post divestiture, an Alleghany subsidiary will continue to settle PacificComp’s pre-acquisition reinsurance claims.

The acquisition of PacificComp seems a perfect fit for CopperPoint Mutual Insurance Company that provides workers’ compensation insurance in Arizona. The acquisition will complement as well as add capabilities to the acquirer’s portfolio besides helping it to expand geographically. Per news releases, the combined entity will have $400 million in premiums, assets of about $4.1 billion and $1.5 billion in policyholder surplus. CopperPoint Mutual Insurance has $1.3 billion in surplus and assets worth more than $3.6 billion with no debts. This could help it in financing the acquisition.

PacificComp had been incurring significant underwriting losses over the last few quarters though it reported profits in second-quarter 2017.Continued underperformance could have induced the divestment. Alleghany strives to grow via acquisitions and organic initiatives as these diversify and strengthen its portfolio. We expect strong underwriting performances by TransRe and RSUI and CapSpecialty to continue to drive growth for Alleghany.

Zacks Rank & Share Price Movement

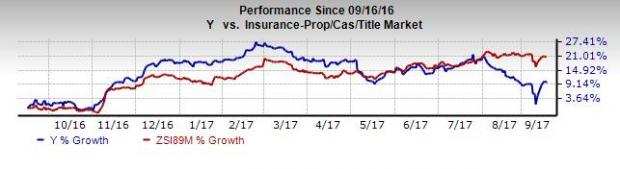

Alleghany carries a Zacks Rank #5 (Strong Sell). Shares of Alleghany have underperformed the industry over a year. While shares of the company have increased 10.1%, the industry grew 20.5%. We expect the company’s organic initiatives and solid capital position to drive its shares in the near term.

Stocks to Consider

Some better-ranked stocks from the insurance industry are Atlas Financial Holdings, Inc. (NASDAQ:AFH) , Markel Corporation (NYSE:MKL) and Mercury General Corporation (NYSE:Y) . Each of these stocks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Atlas Financial Holdings engages in underwriting commercial automobile insurance policies in the United States. The company delivered a positive earnings surprise in two of the last four quarters, with an average beat of 57.94%.

Markel Corporation markets and underwrites specialty insurance products in the United States and internationally. The company delivered a positive earnings surprise in two out of the last four quarters, with an average beat of 21.06%

Mercury General Corporation engages in writing personal automobile insurance in the United States. The company came up with a positive earnings surprise in three of the last four quarters, with an average beat of 1.06%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Markel Corporation (MKL): Free Stock Analysis Report

Alleghany Corporation (Y): Free Stock Analysis Report

Mercury General Corporation (MCY): Free Stock Analysis Report

Atlas Financial Holdings, Inc. (AFH): Free Stock Analysis Report

Original post

Zacks Investment Research