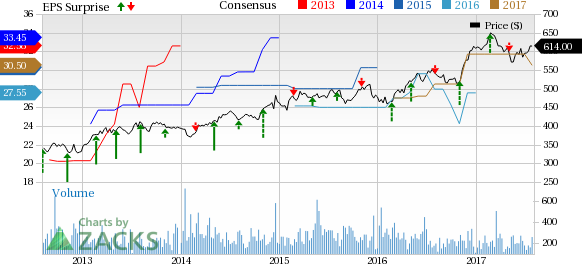

Alleghany Corporation ( (NYSE:Y) ) reported second-quarter 2017 operating earnings of $6.37 per share, missing the Zacks Consensus Estimate of $8.10 by 27.5%. However, the bottom line improved 115% from the prior-year quarter.

The company witnessed solid underwriting discipline in the reported quarter despite a decline in the investment income and weak segmental performance.

Including one-time items, the company reported net income of $6.60 per share, up 32.3% year over year.

Operational Update

Operating revenues of $1.5 billion fell 1.8% year over year due to lower premiums earned and investment income. Revenues surpassed the Zacks Consensus Estimate of $1.3 billion by 13.7%.

Net premiums written declined 3.1% year over year to $1.3 billion.

Net investment income came in at $101.7 million in the quarter, down 4.9% year over year. The decrease in the reported quarter is attributable to $12.6 million charge related to the company’s equity investment in Ares, partially offset by higher income from partnerships and high interest income from bonds. Interest expenses were $20.9 million, up 2.7% year over year.

Underwriting profit surged 155.5% to $95.3 million. Combined ratio improved 460 basis points year over year.

Segment Update

Reinsurance Segment: Net premiums written declined 3.1% to $978.9 million driven by cancellation, non-renewals and reduced participation in international treaties, interest rate pressures, increased retention by cedants and foreign currency fluctuation rates. Underwriting profit skyrocketed 418.3% to $62.2 million.

Insurance Segment: Net premiums written declined 3% to $314.3 million. Underwriting profit increased 30.8% to $33.1million.

Financial Update

Alleghany exited the quarter with cash of $643.6 million compared with $594 million at the end of 2016.

Debt balance of $1.5 billion inched up 0.7% from Dec 2016-end level.

Allegheny’s shareholder equity at the end of the quarter was $8.4 billion compared with $7.9 billion at the 2016-end level.

Book value per share increased 6.2% from year-end 2016 to $547.06 as of Jun 30, 2017.

Zacks Rank

Alleghany currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported their second-quarter earnings so far, the bottom line of Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc. (NYSE:FNF) have topped their respective Zacks Consensus Estimates, while The Progressive Corporation (NYSE:PGR) lagged the same.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively. And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Alleghany Corporation (Y): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post