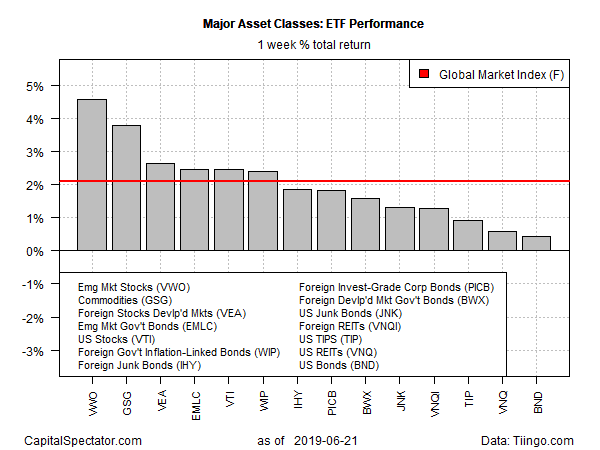

It was hard to lose money in the markets last week as all the major asset classes posted gains, based on a set of exchange traded funds. The rally in everything marks the second week in the past three that the bulls dominated and lifted all the main slices of the global markets.

Emerging market stocks scored the biggest increase. Vanguard FTSE Emerging Markets (NYSE:VWO) surged 4.6% for the trading week ended June 21. The rally marks the biggest advance for VWO since November, leaving the fund near its highest close in more than a month.

The rebound follows comments by some analysts that raise doubts about the outlook for emerging markets. Robin Brooks, chief economist at the Institute of International Finance, earlier this month told FT: “More and more, there is a discussion that the growth story for emerging markets is just over. There is no growth premium to be had any more.”

Perhaps, but last week’s hefty advance for VWO suggests that the crowd isn’t willing to abandon these markets just yet. One factor is renewed optimism that this week’s scheduled meeting between President Donald Trump and Chinese President Xi Jinping will dial down trade tensions between the two countries. Then again, if nothing comes of the talks, sentiment could take a hit.

“The Trump-Xi meeting at the G-20 summit in Japan [June 27-29] holds the potential to dramatically reshape the outlook for trade tensions,” advised the team at Bloomberg Economics. “A rocky outcome would compel the Fed to act sooner.”

Last week’s widespread market gains pushed an ETF-based version of Global Market Index (GMI.F) higher for a third straight week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights, rose 2.1%. On Thursday, GMI.F ticked up to a record high before pulling back fractionally on Friday.

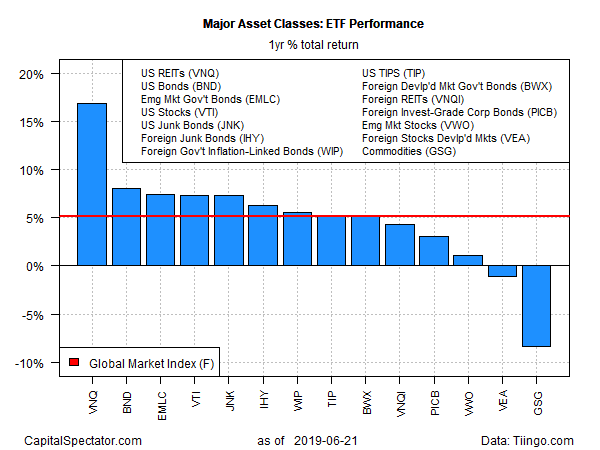

For the one-year trend (252 trading days), US real estate investment trusts remain firmly in the lead for the major asset classes. Vanguard Real Estate (NYSE:VNQ) is up a solid 16.9% on a total return basis through last week’s close.

VNQ’s one-year lead is still well ahead of the second-best performer: a broad measure of investment-grade US bonds. Vanguard Total Bond Market (NYSE:BND) gained 8.0% for the trailing 12-month period after factoring in distributions.

On the flip side, broadly defined commodities are still dead last for the one-year change. The iShares S&P GSCI Commodity Indexed Trust (NYSE:GSG) has lost 8.4% over the past 252 trading days.

Meanwhile, the benchmark for global assets – GMI.F – is currently posting a 5.2% total return for the year through June 21.

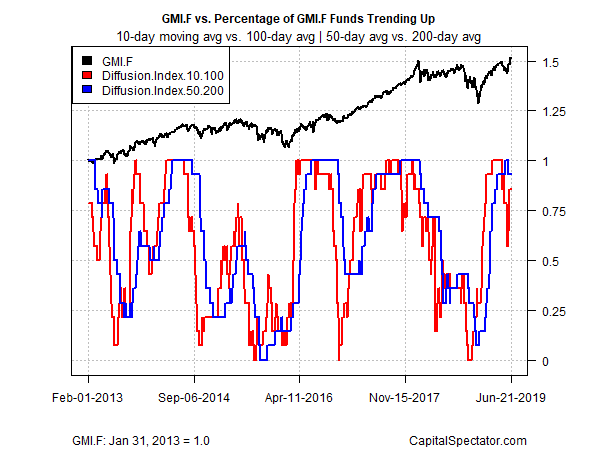

Profiling price momentum for major asset classes shows a degree of revival in animal spirits for the ETFs listed above. The analysis is based on two sets of moving averages. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) offers an intermediate measure of the trend (blue line). As of last week’s close, a majority of funds are enjoying a strong bullish trend, slightly more compared with the week before.