Have you ever wondered why the recovery from the Great Recession is so weak? We hear a calliope of reasons including:

- too little investment

- too small of government stimulus

- too much debt

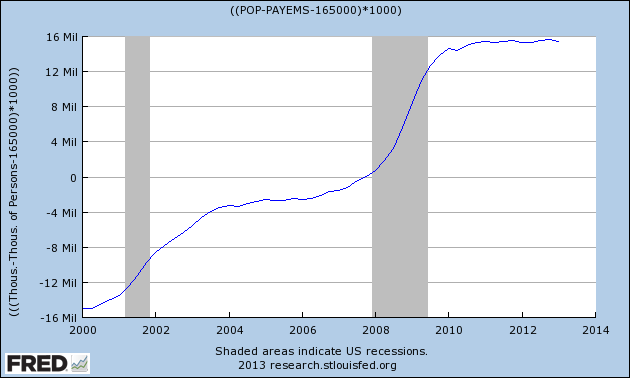

One should note that the progress made to date is that the jobs situation is not worsening. But what effect does 16 million jobs have on the economy. In 2009, the median family income expressed in 2009 dollars was $49,777. In 2009 there were 117,538,000 households, and the end of year population was 308,633,000 – which puts the median income per capita at $18,957 (2009 dollars) or roughly $17,000 (expressed in 2005 dollars – Real GDP is chained 2005 dollars).

This lack of 16 million jobs shorts Real GDP by $260 billion. Note that this is a back-of-an envelope calculation that ignores taxes (the government takes but also re-spends), savings, and economic multipliers. I am suggesting this $260 million shortfall is very conservative, and easily with multipliers could be more, perhaps more than double.

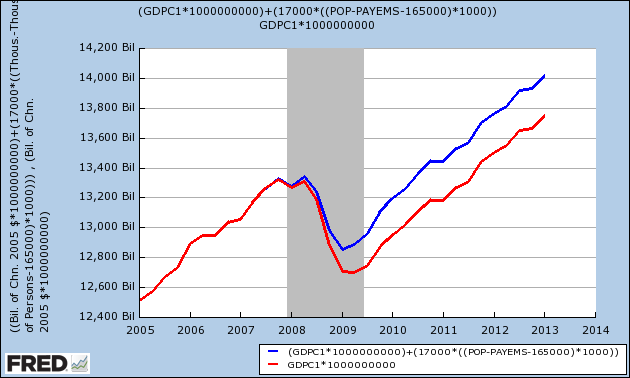

Real Inflation Adjusted GDP (red line) and Blue Line Shows the Minimum GDP Had There Not Been Any Job Losses

If the government could have found a way to create jobs, the recession would have ended sooner and the economy would have been fully recovered per capita by 2012.

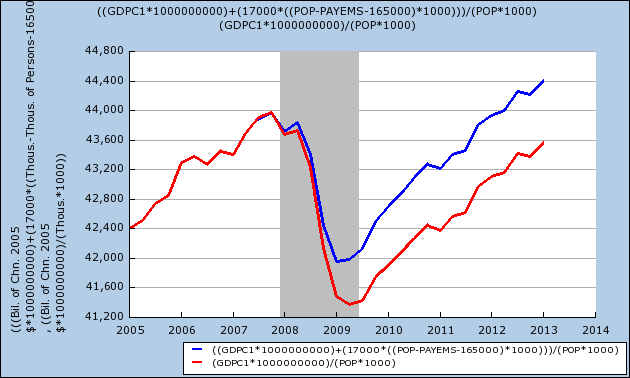

Real Inflation Adjusted per Capita GDP (red line) and Blue Line Shows the Minimum per Capita GDP Had There Not Been Any Job Losses

The government needs to foster job growth. The major reason the economy remains weak is that too small of a percentage of the population has a job. The USA is a consumer consumption based economy. Without re-gearing to a different economic model – true economic expansion cannot occur until jobs are created putting more money in the hands of the consumer.

Yet, how do (government) economists believe jobs are created. Should they trickle down some money from government either directly or indirectly (through incentives to business)? Seriously, does anyone still believe trickle down anything is a solution? And how has the Federal Reserves “dual mandate” monetary policy done in creating jobs? The Fed is taking credit that their monetary policy is working. If one is happy that the jobs situation is not getting worse – then the Fed’s policies are working.

It is no secret small businesses (less than 500 employees) drive jobs growth. What has been done to stimulate this small business jobs incubator? Obamacare? Minimum wages? Tort laws? Regulations that only the big corporations can cost effectively comply? Complicated tax codes? Unfortunately there is no real time data on small business starts and death to develop tools for lawmakers to use to make decisions on how to grow this sector. But the little evidence available since 2000 shows a deteriorating trend in the number of small business starts, and a decline of small businesses in general.

The chicken or egg question of the day – Is the weak economy creating the low employment, or are the low employment levels causing the weak economy? Are the business start-ups “too-small-to-succeed”?

Other Economic News this Week:

The Econintersect economic forecast for June 2012 again declined marginally, and remains under a zone which would indicate the economy is about to grow normally. The concern is that consumers are spending a historically high amount of their income.

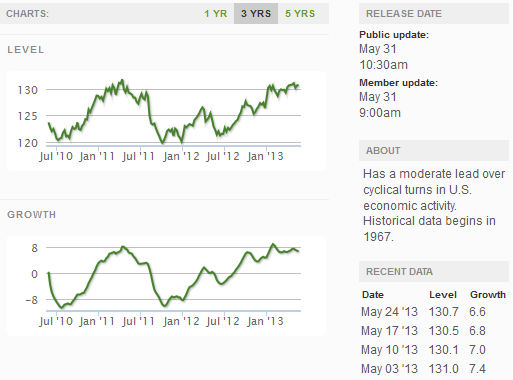

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

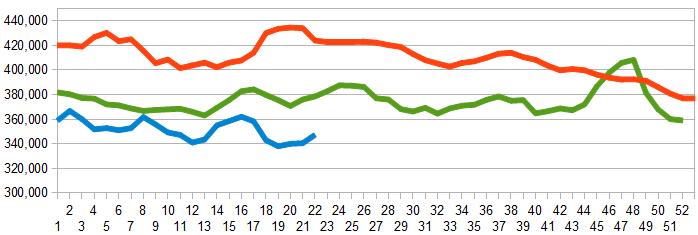

Initial unemployment claims rose from 340,000 (reported last week) to 354,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here).

The real gauge – the 4 week moving average – was worsened from 339,500 (reported last week) to 347,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

Bankruptcies this Week: Sound Shore Medical Center

Data released this week which contained economically intuitive components (forward looking) were:

- Rail movements are beginning to show a modest growth trend.

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: