FORECASTSTOCKS:

The European debt contagion remains front and center. Spanish and Italian short-and-long term bond yields have moderated recently given the ECB looks to step in to buy’em. This shall support stocks in the short-term, but won’t solve the overriding debt and fiscal problems...kicking the can down the road so to speak So enjoy it while it lasts; after the euphoria will come the days of reckoning. How long? Good question.

STRATEGY: The S&P 500 remains above long-term support at the 160- wma at 1212; which delineates bull/bear markets. However, the 200-dma support zone at 1266-to-1278 remains the bulls “Maginot Line,” while overhead resistance at 1340-to-1360 was extended above and now becomes support. This, coupled with the recent S&P 500 bullish weekly key reversal higher all suggest higher prices are ahead towards 1450-to-1500. Obviously this is tradable; but at that point we’d expect a larger correction to develop.

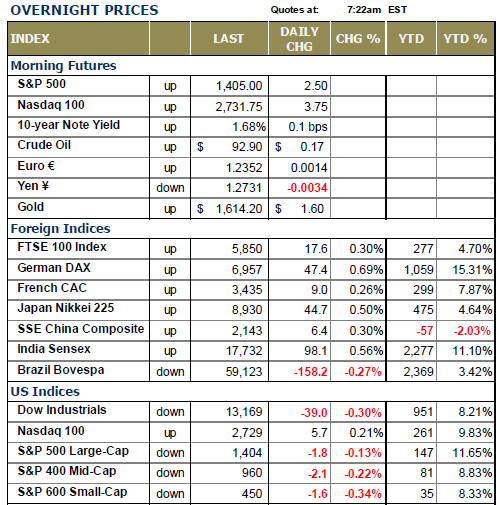

OVERNIGHT NEWS: Let’s begin with noting that all the major world bourses were higher Tuesday morning, with only China having spent any time in negative territory. This is due in part to Monday’s rather weak attempt to sell off the US markets, but it certainly didn’t qualify as a “rip-roaring” rally off the lows. In fact, volume was the worst of the year! But once again, it is European concerns that dominate; and yesterday we found both German and French GDP figures a bit better-than-expected, but the overall eurozone figures were somewhat “worse-than-expected.”

Too, there are rumors in the market that Spain shall indeed “ask” for bailout funds this week. Previously, Spain had wanted Italy to join it in asking for bailout funds; but Mr. Ranjoy wasn’t speaking from a very strong position. If this is the case, then it will provide support to Spain and put Italy front and center – another chess piece off the board for the time being. Lastly, the German Constitutional Court sees no reason to delay their September 12th decision on the constitutionality of Germany’s participation in the ESM bailout fund.

TRADING STRATEGY: We are long; and for the time being – we’ll remain long. There is very little in the technicals to suggest anything more than a modest decline is imminent. We like Energy first and foremost at this time; and we very well may add CRR to round out a full 30% exposure to the group. The S&P Energy Sector chart shows a potentially “material breakout” is developing. Outside of this, we’ll simply continue monitoring gold and silver as they are still in developing bullish patterns. If gold breaks out above the $1645 level, then we’ll consider adding silver as a long position.

In all metal bull markets, silver leads gold – and we think this is not different.

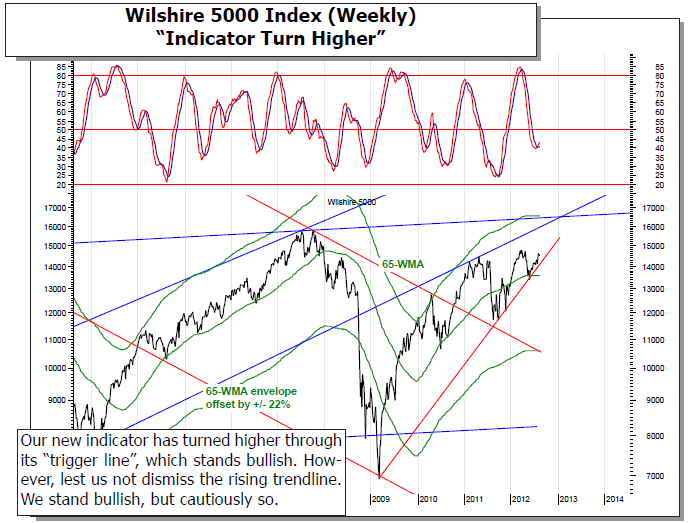

Lastly, we continue to monitor the downside potential. Our short and medium-term daily models are trending higher into overbought levels. This isn’t a reason to sell yet, but it does raise caution flags. This dovetails somewhat with our new indicator – no name yet – shown on the Wilshire 5000 weekly chart of just now breaking out higher. Thus, follow-through higher is imperative at this juncture.

To Read the Entire Report Please Click on the pdf File Below.