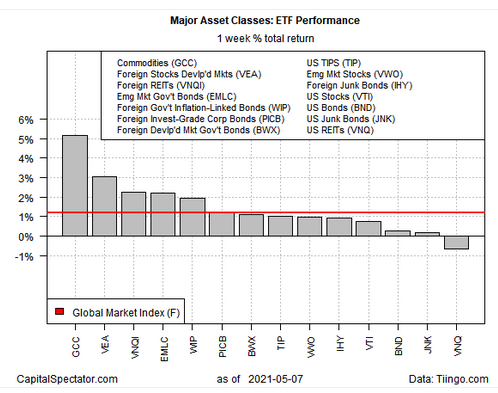

Rallies broke out across nearly all the major asset classes last week, based on a set of exchange traded funds. The lone exception: US real estate investment trusts (REITs), which posted the only setback for the trading week through Friday, May 7.

The star for last week’s gainers: commodities. WisdomTree Continuous Commodity Index Fund (NYSE:GCC), which tracks a broadly defined, equal-weighted benchmark, jumped 5.2%. The advance marks the sixth straight weekly increase.

The combination of higher inflation expectations and a recovering economy are driving many commodities prices higher. This week’s April report on consumer prices (Wed., May 12) is expected to show that the headline consumer price index rose 3.6% in year-over-year terms, up sharply from 2.6% in March.

If the forecast is correct, CPI will post the fastest annual gain since 2011. Economists are debating if the runup in inflation is temporary, due to fading pandemic effects, or the start of a new cycle of firmer inflation. Regardless, the outlook for firmer pricing pressure is lifting many commodities.

Last week’s only loss: Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ), which fell 0.7%. The ETF was probably due for a correction after running higher in each of the previous six weeks.

The Global Markets Index (GMI.F) rebounded last week, rising 1.2%. The increase marks the sixth weekly gain in the past seven for this unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETF proxies.

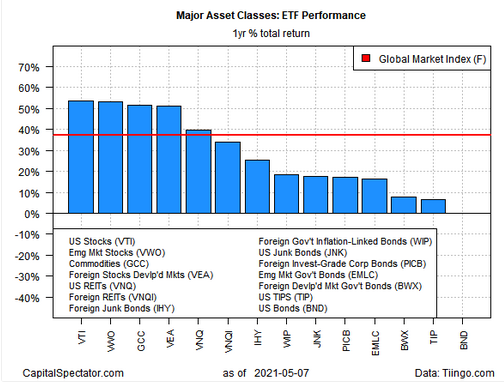

For the one-year trend, everything is posting a gain, led by US stocks: Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) is up 53.5% on a total return basis vs. the year-ago level.

Note that one-year returns for some corners of the global markets are unusually high at the moment because year-ago prices were dramatically depressed due to the coronavirus crash.

Accordingly, trailing one-year results will remain temporarily elevated due to extreme year-over-year comparisons until last year’s markets collapse washes out of the annual comparisons.

The weakest one-year performer: US bonds. Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) is up by the smallest of margins, rising just 0.1% for the trailing one-year window.

GMI.F’s one-year return is currently a sizzling 37.1%, although the bounce-back effect from the pandemic effects in 2020 explains much of the current advance—a gain that will fade as one-year returns normalize in the months ahead.