The slam-dunk of monetary events is supposed to occur later today. The Reserve Bank of New Zealand is expected to tighten interest rate policy. It is the key event in a relatively quiet week for G10 economies. To many, the biggest event risk is that Governor Wheeler and company will do nothing at all later this afternoon. The RBNZ has held the OCR (overnight cash rate) at +2.5% for three-years now, and in that time, not at all dissimilar to other developed countries, Kiwi monetary policy has become very expansionary. Business confidence is running at a two-decade high, while consumer confidence just under a decade high, construction is booming and property prices are still rising. Probably more importantly is that inflation expectations are increasing. It's no wonder that both dealers and investors have priced in a +25bp interest rate hike that will likely have a limited effect on the Kiwi dollar. With a plethora of reasons to want to hike, there is probably an "even" chance that a +50bp hike is on the cards - If this does occur it would be a surprise and probably immediately catapult the currency towards last year's highs around 0.8677. Domestically, the NZD's strength is a "political hot potato" - any rate increase will most likely be accompanied by a "gentle" tightening bias and not an aggressive "hawkish" one. Under this scenario, it could scare most of those investors 'long' positions to consider off-loading a few kiwi dollars out there.

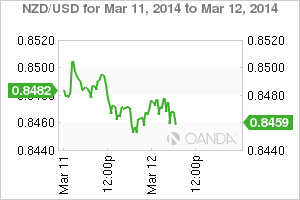

NZD/USD" title="NZD/USD" align="bottom" border="0" height="200" width="300">

NZD/USD" title="NZD/USD" align="bottom" border="0" height="200" width="300">Money markets have noted that they have priced in a +25bp hike 100%, and have also priced in a +86% chance of three rate hikes in a row actually occurring. That would currently drag the record low overnight rate of +2.50% through the psychological +3% handle in a matter of months. In December Kiwi policy makers argued that the NZD was going up because they had "a term of trades boost and a structural change in the demand for their assets." The NZD continues to trade close to the upper end of its 10-month trading band - this afternoon's highly anticipated decision could well be a case of "buy the rumor and sell the fact." The market is long Kiwi and has been for some time.

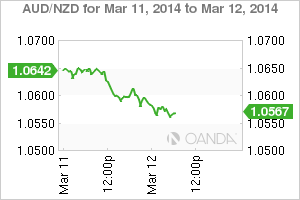

AUD/NZD" title="AUD/NZD" align="bottom" border="0" height="200" width="300">

AUD/NZD" title="AUD/NZD" align="bottom" border="0" height="200" width="300">Australasian currencies have held in rather well despite what has transpired in China over the past week. Figures out of the country showed that Chinese exports sank +18.1%, y/y, in February, in contrast to the +5% increase that was expected. China is one of Australia and New Zealand's largest trading partners and obviously any slow down from the worlds second largest economy is bound to have a trickle down negative growth effect throughout the region. Both these commodity and interest rate sensitive currencies values are highly influenced by China. The weak trade data initially weighed on the NZD, but the market somehow believes that February's distortions is due to the long Lunar New-Year being a contributing factor to China's miserable start.

The fixed income market will be taking its cues from today's outcome. Because +25bps is already being priced in what is in more important to the dealing community will be the "RBNZ's published 90-day bank bill track." Once the hiking cycle actually starts all "forward" debates will be on the "peak of the cash rate.' For the RBNZ to be proactive and contain inflation many are considering a +5% cash peak by the end of next year. Under this scenario Governor Wheeler would be required to move above "neutral" to contain inflation and that today is an aggressive pitch. Original post

Original post