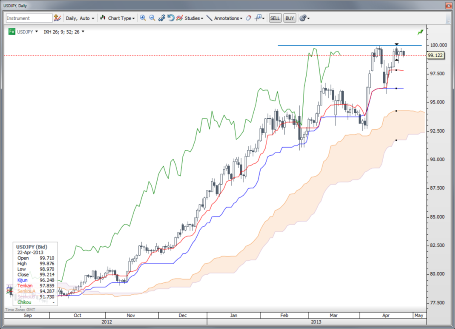

We’ve been trading up under the 100 level in USD/JPY all week -- it’s time for either a test of that level or a steep consolidation as there is too much anticipation out there for the pair to stay in a tight range.

Another positive session in equities in Asia has the USD on the defensive and non-JPY Asian currencies snapping back higher. The EUR/USD test below the magnetic 1.3000 level failed yesterday despite almost universally poor European and German data over the last couple of days and increased anticipation of a rate cut at next week’s ECB meeting. Whenever the market fails to react according to the “fundamentals” of the news flow, it’s a warning sign and this suggests that the near term pressure is on the upside until the bears are able to prove themselves, especially if 1.3070/1.3100 is taken out today. Still, EUR/USD has gone absolutely nowhere for most of April (we first hit 1.3000 on April 5) and some of the inability for a directional move to develop may be on the market waiting for the other side of the BoJ before making its move and have to do with this 1.3000 level in general. Let’s see how we close the week. As well, it seems like several days have seen Europre reversing course from whatever mood Asia establishes.

The UK GDP is on tap this morning and will likely hit GBP crosses one way or another -- 0.8500 has been a rather sticky level in EURGBP and this could serve as support if the Euro is looking firm elsewhere and the UK data proves weaker than expected. It’s hard to look for EUR/GBP downside when EUR/USD is looking well supported -- the two pairs have been tightly correlated over the last couple of weeks. As for GBP/USD, let’s wait until either 1.5400 or 1.5200 gives way again as it’s been in an ugly chop-fest for about two weeks now. I still prefer the downside, but the USD needs to perk up and take this thing out of the range.

The overnight moves continue to encourage CHF weakness if we continue to see the pro-carry stance in today’s trading. With the USD on the defensive, the more impressive move may come from EUR/CHF, with plenty more upside potential if all stays quiet on the systemic risk front in Europe. Even if we don’t carry through immediately higher here (for example, as the market holds its breath ahead of the BoJ meeting), there is plenty of room for consolidation in EURCHF without threatening the impressive impulse higher, starting with 1.2300/1.2280 area.

Looking Ahead

The Asian session will be an interesting one tonight with Japanese national inflation figures for March and the Tokyo figures for April. Core inflation has actually been trending lower in recent months, though the year-on-year comparisons will become more favourable after April. It will take at least four to six months of data before we can start calling a trend change, in any case. I would guess that the inflation releases begin to take on more importance as soon as next month, in terms of triggering more or less anticipation of BoJ tinkering with its policy options. For now, there are few expectations for tonight’s meeting, given that we’re only a few weeks removed from the most massive barrage of QE ever conceived or unleashed on an economy.

We’ve been hovering near the 100 mark in USD/JPY for most of this week and this meeting will either trigger a new rally leg higher or a larger consolidation lower -- it’s hard to believe, given how far we’ve travelled, that we remain in the same nervous zone here just under that big figure. Short-dated options are one way to trade this, either picking a direction or going long a strangle (long a put and a call at strike prices well below and above the market, respectively.) Seems like the magnet of 100 means that we have to have a look at this figure soon -- even if we don’t succeed in taking it out definitively. That’s what happened the last time 100 traded in USD/JPY just over four years ago -- the levels was criss-crossed for a few days before the market decided it didn’t like things up there and then it never looked back except for one throwback attempt a few weeks later to a 99.70 high. If we don’t take out the level by the end of the trading on Friday, I would think the risk rises of a larger scale consolidation starting next week or even late tomorrow.

USD/JPY

100 has neared and nearly traded on a handful of occasions over the last few weeks – there are undoubtedly barrier options in play as well as market psychology. It’s interesting to see the level of anticipation at this 100 round figure when there are no expectations for the BoJ tonight as it becomes a psychological question of whether the market decides that it can see its shadow or not. Note that the Kijun line for USD/JPY (blue lin) has not registered a decline since last September -- truly remarkable and a key indicator if it finally does turn lower. USD/JPY" title="USD/JPY" width="455" height="329">

USD/JPY" title="USD/JPY" width="455" height="329">

Feels like the market is very uncertain on what it wants to do – and my update reflects that as I read back over my own very uncertain words today… suggests we ought to let the market make its move before reacting and also suggests we should stay careful out there. I think the recent lull in volatility is unlikely to persist.

Upcoming Economic Calendar Highlights

- Euro Zone ECB’s Asmussen to Speak (0755)

- United Kingdom Q1 Initial GDP (0830)

- Sweden Riksbank’s Svensson to Speak (0845)

- UK BoE’s Haldane to Speak (1130)

- US Weekly Initial Jobless Claims (1230)

- US Weekly Bloomberg Consumer Comfort (1345)

- US Apr. Kansas City Fed Manufacturing Activity (1500)

- New Zealand Mar. Trade Balance (2245)

- Japan Mar. National CPI and Apr. Tokyo CPI (2330)

- Japan BoJ to release outlook report (0300)