Brazil retail sales: not pretty at all

April retail sales printed way below median forecast with a contraction of -0.4%m/m while analysts were expecting an expansion of 0.7% (-3.5% versus -1.8% consensus on a year-over-year basis). The Brazilian economy is bearing the cost of the BCB's fight against inflation. Brazilian people preferred to switch to saving mode and therefore spent less money on clothes (-3.8%m/m), personal and household items (-5.1%m/m) and communication equipment (-12.2%m/m). Unfortunately, the hawkish tone of the last Copom minutes suggest that the BCB is committed to tightened monetary policy further as inflation accelerated in May - IPCA printed at 8.47%y/y versus 8.30% expected.

Nevertheless, the BRL didn’t drop on the news. In our opinion, the absence of negative headlines regarding the ongoing fiscal consolidation process, coupled with low volatility had renew traders’ interest in the carry embedded in long BRL position. On the fiscal front, the lower house (Chamber of Deputies) is expected to vote on the payroll tax break bill this week, which will allow the government to improve its budget (if approved).

US: Fed to maintain its fund rate (by Yann Quelenn)

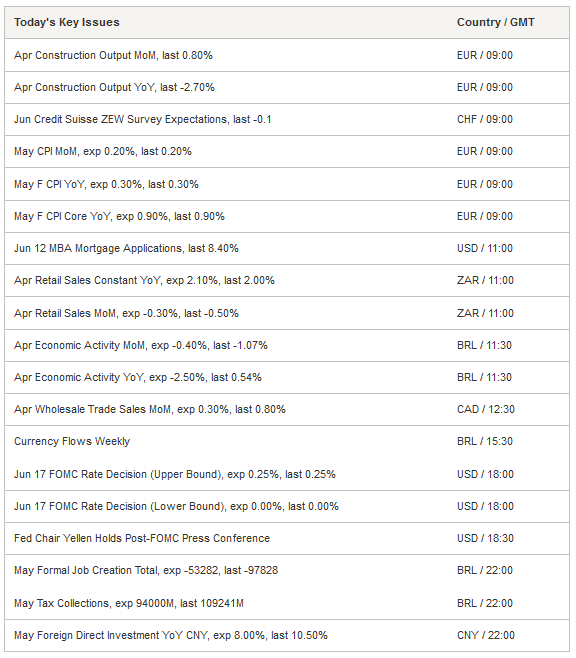

This Wednesday, the Fed is meeting to release its latest economic policy decision after a two day meeting. We expect the rate to remain unchanged as data for Q1 remain fragile despite strong NFP two weeks ago, which came in better than expected with 280K new jobs created in May. Indeed, Q1 GDP growth shrank -0.7% year-over-year (annualised). At the same time, latest CPI report indicated that inflation is still negative with a read of -0.2%y/y in April (0.3%y/y core inflation) which is below the 2% target. Inflation has been driven downward by the strong dollar as price of imported goods are lowered.

Fed Chairwoman Janet Yellen dropped the word patience from her wording earlier this year. Yet in practice, markets still have to be patient to see the Fed raising rates as a few Fed officials suggested that no rate hike will take place in June. Thus, the Fed’s growth projections on growth and inflation will provide hints regarding a potential rate hike before the end of the year. In between, US Equities are likely to keep on increasing.

For the time being, market participants are focused on the Greek situation and as long as there is no concrete deal, markets will remain volatile and particularly the EUR/USD. The pair is currently moving sideways from news to news. In addition, traders are waiting on the side-line for reloading their long USD positions. For now, the big winner is the Swiss franc which is gaining upside momentum in a context of global uncertainties. USD/CHF is targeting this morning its 1-month low at 0.9234.

EUR/CHF - Challenging the support at 1.0399

The Risk Today

Yann Quelenn

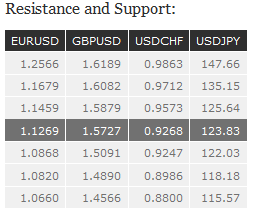

EUR/USD is increasing toward the resistance at 1.1386 (10/06/2015 high). Stronger resistance is given at 1.1459 (15/05/2015 high). Hourly support can be found at 1.1151 (12/06/2015 low). The technical structure suggests an upside momentum. In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD is now in a short-term rising channel toward the resistance at 1.5700 (21/05/2015 high). Hourly support is given at 1.54220 (11/06/2015 low). Key resistance lies at 1.5815 (14/05/2015 high). In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY is still trading slightly below its 13- year highest level below 124.00. We remain bullish for the pair as we stay largely above the 200-dma. However, the pair is gaining bearish momentum on the short term. Hourly support is given at 122.46 (10/06/2015 low). Key resistance lies at 135.15 (14-year high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF is decreasing toward the support at 0.9234(10/06/2015 low). Hourly resistance can be found at 0.9408 (11/06/2015 high). Stronger resistance can be found at 0.9573 (29/05/2015 high) and stronger support lies at 0.9072 (07/05/2015 low). In the short-term, the pair is setting lower highs, therefore we remain bearish over the next few weeks. In the long-term, there is no sign to suggest the end of the current downtrend. After failure to break above 0.9448 and reinstate bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).