Forex News and Events

Can Draghi “overdeliver”?… Unlikely.

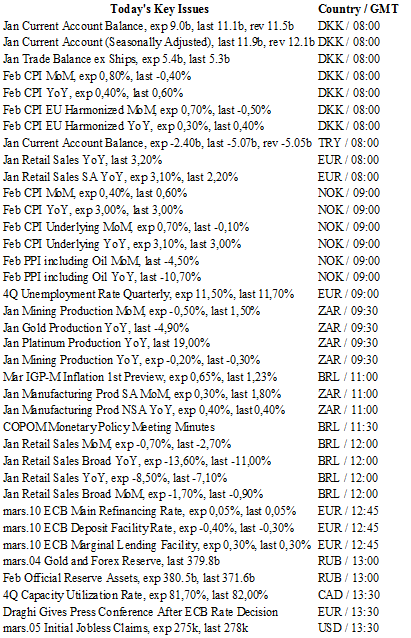

The surprise rate cut by the RBNZ highlights three key issues: weakness in the global economy, mounting disinflationary pressure and the important role central bank policy plays in asset pricing. If there was not an overwhelming expectation for today’s ECB rate decisions, then the RBNZ move just raises the stakes.

It will be difficult for the ECB to “over-deliver” given the misgivings of the actual effectiveness of the current policy mix. It’s widely expected that the ECB will lower its inflations forecast and ease policy further. Aside from some micro-tuning, we expect Draghi to cut the deposit rate 10bp (a 20bp cut is possible but less likely as Europe faces Brexit, possible new Spanish elections, Greek debt issues, as well as immigration discourse where additional stimulus might be required) and adjust the size and make-up of the current QE program. We suspect that launching a tiered system for negative rates is more likely in the future than today, as Draghi still needs to keep some cards up his sleeve.

Other potential surprises could be hidden in cuts in refi, credit purchase and within the LTRO program. Despite ECB members suggesting that rates are far from their lower bound, we suspect that we are in fact very close. This thinking is based on the limited effectiveness negative rates have had thus far, and the risk that unexpected consensus going deeper into negative territory might bring. Germany has been vocal about their displeasure over utilizing negative rates.

In our view it’s unlikely Draghi will unveil a policy “bazooka”, so after some empty threats of more aggressive stimulus we should see EUR rally. Please understand this is not an indictment of Draghi and ECB, but a general statement over global central bank’s policy incapability. EU-JP rate differentials are unlikely to widen significantly (yet European yields curves are steeper than Japan’s) and general easing of risk environment EUR/JPY should head back to 127.29 (50% fibo lvl) then key resistance at 130.80 (declining trend line).

Japan’s PPI declines again

Deflation continues in Japan and it is not ready to stop. Despite massive efforts over the last decade, the producer price index has declined 3.4% y/y in February, down for the 11th straight month. Strong easing has not yet provided the necessary impulse to pull the country out of deflation and we doubt it ever will.

Abenomics can be considered everything but a success. Shinzo Abe has failed to stimulate the economy. Consumer spending, which accounts for 60% of the Japanese economy, has failed to be stimulated. Indeed, the fiscal arrow of the Abenomics had a larger impact than expected in 2014 when the sales tax rate increased to 8% from 5%. We believe that the Japanese Government is very reluctant to increase the sales tax to 10% as it would certainly prevent inflation from reaching the inflation target of 2%.

The central bank of Japan is already all in. The world is witnessing Japan’s debt increasing to stratospheric amounts without inflation ever picking up. Governor Kuroda ends his term in March 2018 and it is very unlikely that the vicious circle will end by this time. For the time being, the yen is only appreciating on safe haven status, which is very ironic being a shelter to one of the most indebted countries in the world.

Silver - Struggling To Take Off

The Risk Today

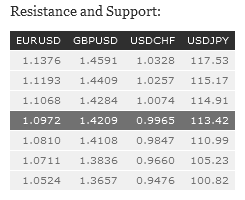

EUR/USD EUR/USD is moving sideways before ECB meeting tpday. Yet, the short-term technical structure still suggests a further bearish move. Hourly resistance lies at 1.1068 (26/02/2016 high). Hourly support can be located a 1.0940 (07/03/2016 low) then 1.0810 (29/01/2016 low). Expected to show continued weakness. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD GBP/USD's short-term bullish momentum is fading. Major resistance is given at 1.4409 (19/02/2016 high). Hourly resistance lies at 1.4284 (07/03/2016 high) while hourly support can be found at 1.4108 (04/03/2016 low). The technical structure suggests further consolidation. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY USD/JPY remains in a range between strong resistance at 114.91 (16/02/2016 high) and support at 110.99 (11/02/2016 low). Hourly support lies at 112.23 (intraday low). Expected to show continued weakness. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF USD/CHF is definitely trading mixed. An hourly support lies at 0.9940 (09/03/2016 low), while a key support stands at 0.9847 (16/02/2016 low). Hourly resistance is located at 1.0039 (09/03/2016 high). Expected to remain in range around psychological level at 1.0000. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.