- Australia Employment to Increase for Second Month; Jobless Rate to Hold at 5.8%

- Job Growth Exceeded Market Forecast in November, Led by Full-Time Employment (15.5K)

- Time of release: 01/16/20140:30 GMT, 19:30 EST

- Primary Pair Impact: AUD/USD

- Expected: 10.0K

- Previous: 21.0K

- DailyFX Forecast: -5.0K to 15.0K

- Need green, five-minute candle following the print to consider a long Australian dollar trade

- If market reaction favors a long trade, buy AUD/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle to favor a short AUD/USD trade

- Implement same setup as the bullish Australian dollar trade, just in opposite direction

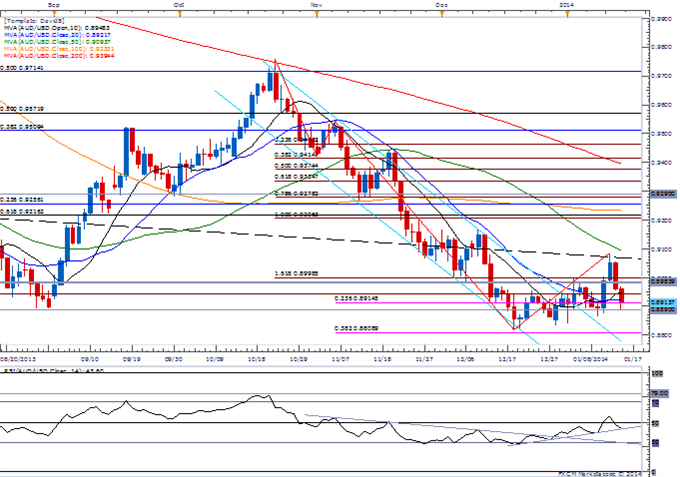

- Near-Term Correction Remains in Focus; Lower High in Place?

- RSI Threatening Bullish Trend; Break of Support to Highlight Downside Targets

- Interim Resistance: 0.9250 (23.6% retracement) to 0.9290 Pivot

- Interim Support: 0.8800 Pivot to 0.8810 (38.2% expansion)

Trading the News: Australia Employment Change

The AUD/USD may face a larger correction over the near-term as the Australian economy is expected to add another 10.0K jobs in December.

What’s Expected:

Why Is This Event Important:

Indeed, a further pickup in job growth may present the Reserve Bank of Australia (RBA) with a greater argument to move away from its easing cycle, and the AUD/USD may face a larger rebound should Governor Glenn Stevens talk down bets for another rate cut.

Expectations: Bullish Argument/Scenario

|

Release |

Expected |

Actual |

|

HIA New Home Sales (MoM) (NOV) |

-- |

7.5% |

|

Retail Sales (MoM) (NOV) |

0.4% |

0.7% |

|

Company Operating Profit (QoQ) (3Q) |

1.0% |

3.9% |

The ongoing expansion in private sector consumption may prompt firms to further expand their labor force, and a larger-than-expected rise in employment may encourage the RBA to soften its dovish rhetoric for monetary policy as growth prospects improve.

Risk: Bearish Argument/Scenario

|

Release |

Expected |

Actual |

|

ANZ Job Advertisements (MoM) (DEC) |

-- |

-0.7% |

|

AiG Performance of Services Index (DEC) |

-- |

45.1 |

|

AiG Performance of Manufacturing Index (DEC) |

-- |

47.6 |

However, the persistent slack in business outputs may drag on hiring, and a dismal jobs print may heighten bets for additional monetary support as the region continues to face an uneven recovery.

Bullish AUD Trade: Australia Adds 10.0K Jobs or More

Bearish AUD Trade: Job Growth Misses Market Expectations

Potential Price Targets For The Release

AUD/USD: Daily" title="AUD/USD: Daily" align="bottom" border="0" height="477" width="680">

AUD/USD: Daily" title="AUD/USD: Daily" align="bottom" border="0" height="477" width="680">

Chart - Created Using FXCM Marketscope 2.0

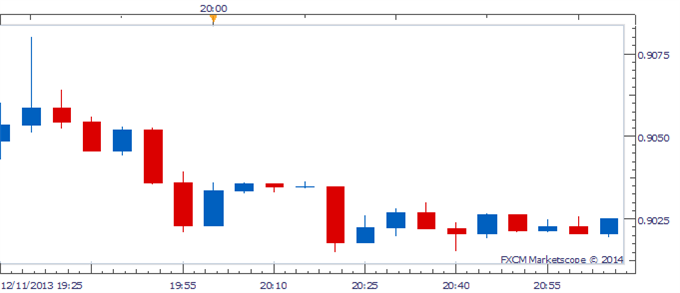

Impact that the change in Australia Employment has had on AUD during the last month

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

NOV 2013 |

12/11/2013 00:30 GMT |

10.0K |

21.0K |

-26 |

-118 |

Employment increased 21.0K in November following an unexpected 0.7% drop the month, while the jobless rate climbed to an annualized 5.8% from 5.7% as discouraged workers returned to the labor force. The market reaction was short-lived as the AUD/USD quickly pulled back from 0.9080, and the higher-yielding currency continued to lose ground throughout the day as the pair closed at 0.8935.

--- Written by David Song, Currency Analyst