VALUATION WATCH: Overvalued stocks now make up 36.07% of our stocks assigned a valuation and 11% of those equities are calculated to be overvalued by 20% or more. Two sectors are calculated to be overvalued.

Forbidden Fruit? All Eyes on Apple

Apple Inc. (NASDAQ:AAPL) is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers, and portable digital music players. The company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and Mac OS X operating systems, iCloud, and a range of accessory, service and support offerings. It sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers. Apple Inc. is headquartered in Cupertino, California.

Tomorrow is a big day in any Apple fan boy's calendar. September 9, 2015 is the day for the fall release of new products and updates known as "Hey Siri." It's key for hard-core Apple devotees, and also extremely important for analysts and investors who follow the tech giant. However, it is worthwhile to note that in the past, this event has NOT been correlated with bug changes for the company's bottom line, stock price, fundamentals, etc.

The rumored new products and updates include a re-vamped Apple TV box for home media use and of extra interest for consumers seeking to "cut the cable." The new box is rumoured to accept the installation of 3rd party apps and to promote the purchase of even more of Apple's home hardware. Apple TV is supposed to get a dual-core A8 processor chip. The remote will include a touch screen to allow better gaming. This comes at a price, however. The cost of the device will increase more than 100%--from $69 to $149. Along with this, there are rumours of a TV package to use on Apple TV, which would include 25 channels (including local TV) for around $30-$40/month.

iPhone lovers expect two new models, a 6s and 6s Plus with "Force Touch" technology designed to allow the device to discern how hard you are pressing on the screen for even more sensitivity. The smart phones are also supposed to in include an improved camera. An upgrade to a faster processor, the A9 chip, is also expected--as is an upgrade to 2GB of RAM. Most analysts expect the company to stick with scheduling and traditions here, which call for design changes in even-numbered years and "s" iPhone versions with no changes to design--just added functions without design tweaks--in odd-numbered years.

In the tablet realm, the iPad Pro is a hot rumour. This is a bigger version of the popular iPad tablet with a 12-13 inch screen. Some analysts believe this is a false hope, as bigger tablets don't seem to have that much of a potential market. iPads may also be easier to use thanks to an improved keyboard designed specifically for the tablets. Some sort of new stylus form/function is also a big part of the rumour mill here.

As we have noted in the past, Apple simply cannot continue to perform as it has because it is now far too large. The only real way to go is down when one has been so dominant for so long. Not that the company cannot maintain dominance, but that to maintain growth is far more difficulty every time you consider what a behemoth this company has become since inventing the iPod.

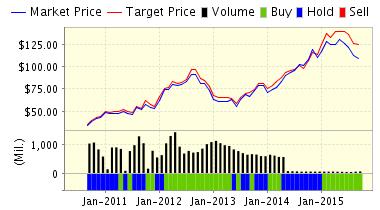

But, betting against this company has been a bad move in the past, and dips were best considered to be buying opportunities. The stock is now significantly cheaper than it has been for most of 2015. It's essentially flat for the year right now, but down big from its peaks of about $133 in February, April, and--most recently--July. It's bounced back from that dip in late August and is currently up @8% since that point.

For now, our models like the shares. We keep a "5-Engine" STRONG BUY on them as we have for most of 2015. ValuEngine continues its STRONG BUY recommendation on APPLE INC for 2015-09-04. Based on the information we have gathered and our resulting research, we feel that APPLE INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Sharpe Ratio.

Below is today's more extensive data on AAPL: