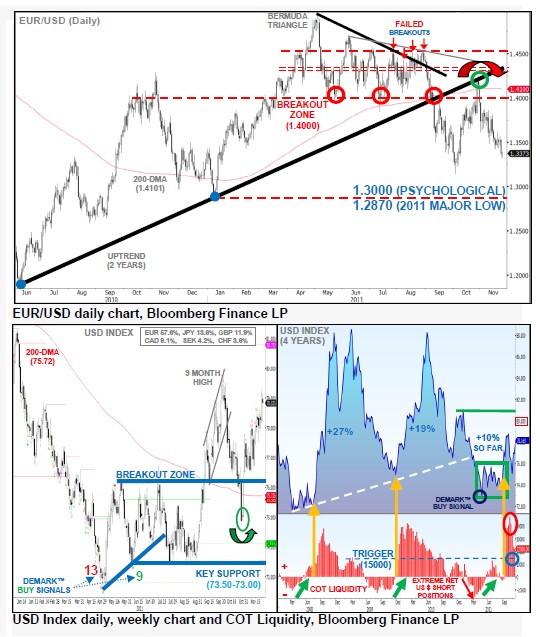

EUR/USD

Bearish decline targets 1.3146.

EUR/USD is holding steady, after extending its sharp decline from key overhead resistance (primarily a 2 year trend and its 200-day average). Bearish momentum remains anchored by heightened contagion fears driven from greater European sovereign debt risk.

Expect further downside scope into 1.3146 (Oct swing low) and psychological level at 1.3000, then 1.2870 (2011 major low).

Further pressure may also weigh from broad risk-related proxies. The euro continues to share a high correlation with the S&P500 and AUD/USD.

Inversely, the USD Index is holding its recovery above long-term 200-day MA. The bulls are likely to recapture the recent 9-month highs near 80.

Speculative (net long) liquidity flows have unwound from recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversoldextremes (momentum, sentiment and liquidity).

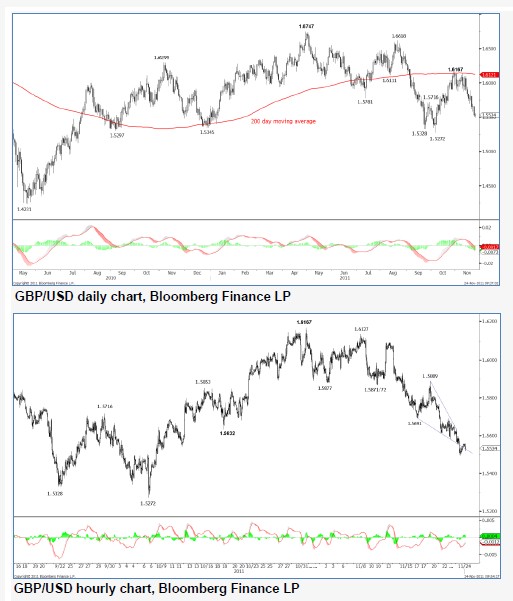

GBP/USD

Extending decline lower.

GBP/USD has broken under 1.5632 warning of a breakdown in the recovery structure seen since 1.5272. This now warns of a near-term return to weakness, although a rise is sought to enable a short strategy to be formulated.

However, we remain wary of getting aggressively bearish due to the rangebound nature of this market over the last year.

The falling wedge that has been developing in the hourly timeframe is suggestive of an exhaustion of the recent down phase.

A sustained break under 1.5272 is required to turn the medium-term bias decidedly bearish.

USD/JPY

Probability favours retracement to pre-intervention levels.

USD/JPY is continuing to edge lower, with the growing probability of another price retracement back to pre-intervention levels (PIR) and potentially even a new post world war record low beneath 75.35 (PINL).

Furthermore, sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone in the market continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40 year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

Keep in mind that such a scenario would help reactivate the longer-term technical bias, including prior monthly DeMark™ exhaustion signals, within the ending diagonal pattern, launching a powerful recovery into 91.00.

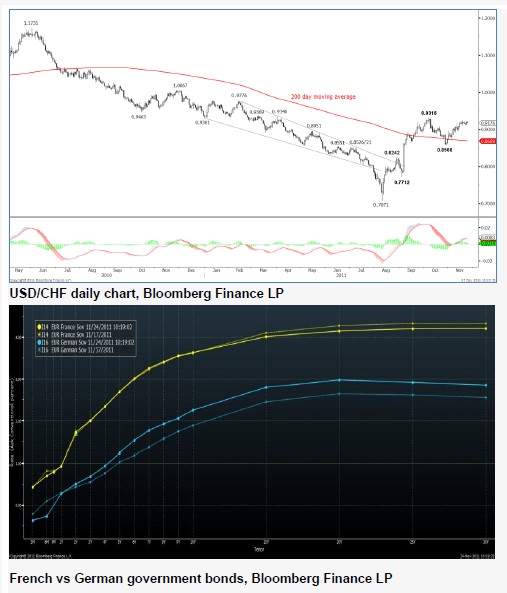

USD/CHF

Resistance maintains weakness under 0.9316.

USD/CHF continues to encounter resistance close to the 0.9316 level. Demand for Swiss Francs are likely to continue while yields on Spanish and Italian government bonds remain elevated, currently trading at 6.582% and 6.904% respectively.

In fact while below 0.9316 a return to the region close to 0.8242 remains possible. However, if a break above 0.9316 can be achieved without breaking under 0.8568, a structural change will occur, increasing the probability of further gains ahead.

One thing to note, that has been taking place over the last week, is that the spread between French government bonds and their German counterparts is beginning to narrow again, after a period of widening. However, we now need to watch the behaviour of the German curve itself to try and determine how this core yield curve is behaving. If yields in Germany continue to rise this will likely mark an acceleration of deterioration in the Euro Zone.

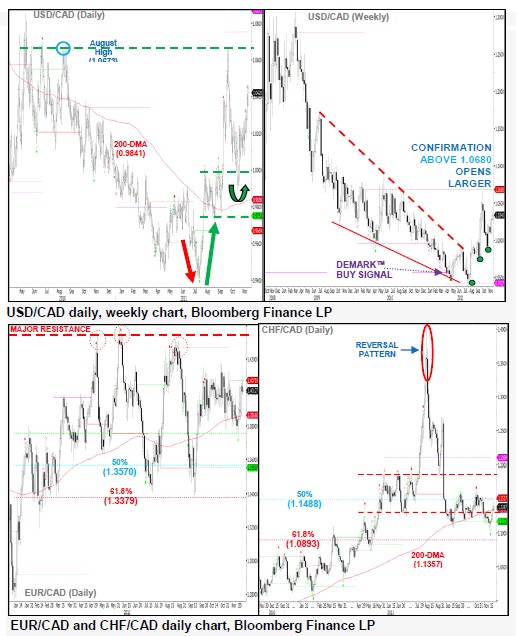

USD/CAD

Bulls charging higher into 1.0658.

USD/CAD’s short-term price activity remains positive, following the sharp bullish reversal from the psychological 1.0000 level (prior trading range).

Positive momentum needs to hold above 1.0400 (on a daily close) to rebuild the potential major upside reversal higher above the old resistance level at 1.0673 (August high & Congestion zone).

A strong directional confirmation above here will open a much larger recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott Wave cycle. Only a sustained close beneath parity will unlock bearish setbacks into the long-term 200-day MA at 0.9841 and 0.9726 (31st Aug low).

EUR/CAD is holding above its 200-day MA, within a large multi-month trading range. Key resistance continues to hold at 1.4379 (June swing high), which has for some time marked a strong distribution pattern.

CHF/CAD continues to hold beneath the 200-day MA at 1.1357, following the dramatic price slide lower (triggered by the SNB intervention). The cross-rate has now retraced more than half of its 2011 gains.

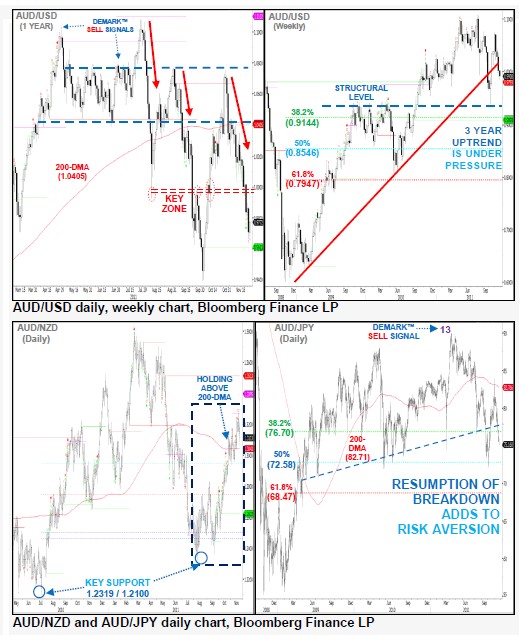

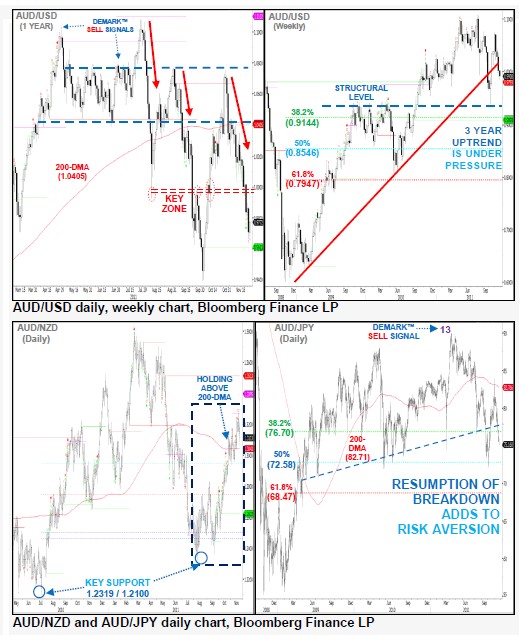

AUD/USD

Unwinding from oversold conditions.

AUD/USD is unwinding from oversold conditions, following its accelerated decline through the 1.0000 psychological level.

The move must be sustained below 1.0000 to further compound downside pressure on the rate’s multi-year uptrend and push back towards 0.9611. Elsewhere, the Aussie dollar remains strong against the New Zealand dollar. The pair is now is within a temporary positive cycle structure while it holds above its 200-day MA.

The Aussie dollar has reversed gains against the Japanese yen and is now trading back below the long-term 200-day MA which is currently at 82.71. Watch for further downside scope into 72.00 which would signal further unwinding of risk appetite.

GBP/JPY

Short-term weakness grinds lower.

GBP/JPY has now returned to the base of the extension higher that occurred at the end of October. Failure to find support in the current region will warn of a re-test of the 116.84 region. We do however note, that further weakess in GBP/JPY will likely be associated with an extension of recent losses in the S&P500.

Strictly speaking the break under 120.85 breaks down the positive structure seen since 116.84.

However, the bulls would need to turn back above the 122.38/65 platform to suggest that an interim low has been seen.

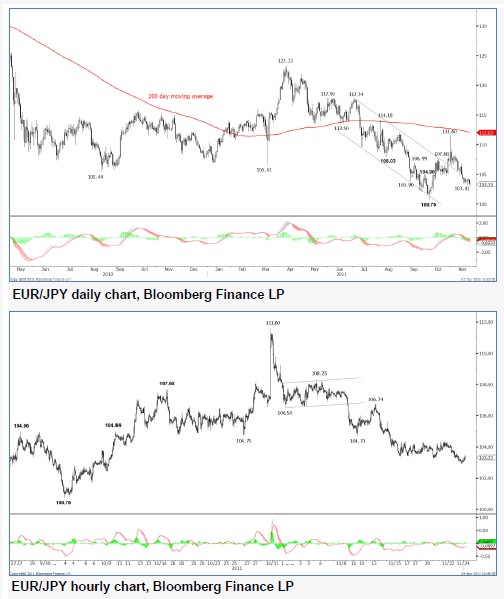

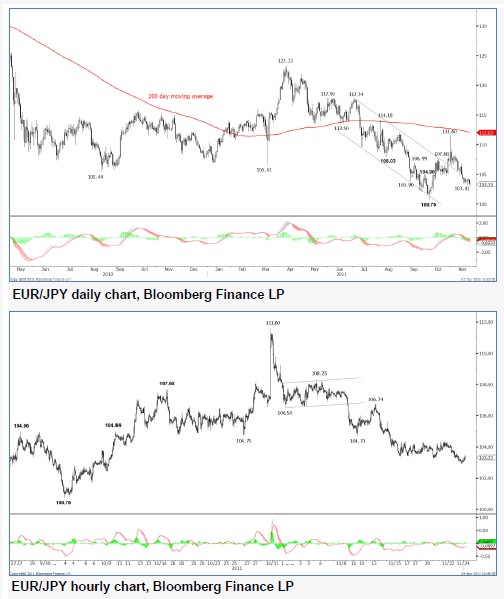

EUR/JPY

Fall from 111.60 appears corrective.

EUR/JPY continues to grind lower after failing to hold the extension higher that occurred at the end of October. In fact the fall that has taken place since 111.60 has the appearance of a corrective phase, suggesting scope for a further leg higher. With this in mind a further rise towards 111.60 is possible.

With the above in mind, we await signs of exhaustion to try to determine a reasonable region from where a long strategy may be formulated. However, we note that further weakness in the S&P500 may lead to a re-test of the 100.76 level.

A sustained hold over the 200 day moving average will turn the mediumterm outlook more bullish.

EUR/GBP

Short-term outlook is neutralised.

EUR/GBP is undergoing a near-term recovery, which has neutralized the outlook once again.

Resistance can be found at 0.8744 and 0.8784. A sustained break under 0.8486 will open up a return to the January 2011 low at 0.8285.

If a large move to the downside were to materialise in this environment, it is likely to be associated with Sterling being perceived as a safe haven. In this respect we need to monitor the yields on Italian, French and Spanish government bonds, noting that the ten year yield in both Italian and Spanish sovereigns are trading above 6.00%.

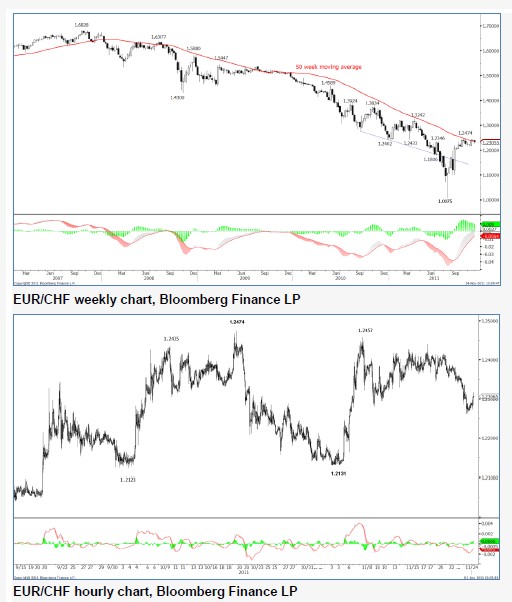

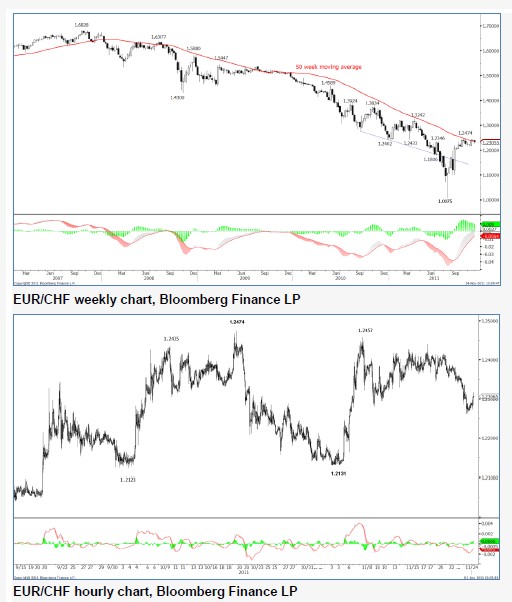

EUR/CHF

Near-term strength is contained by the 1.2500 level for now.

EUR/CHF is maintaining its tight trading range just under the 1.2500 level. It is anticipated that this zone may see a degree of resistance, particularly in light of the movement in periphery yield spreads versus bunds. Over time, this may lead to a renewed desire for a safe haven, with downside pressure returning to EUR/CHF.

We would prefer to trade this from a momentum perspective, awaiting a return to the 1.2000 region. Should a re-test of the 1.2000 region take place with a fall under 1.1973 also following, this would warn of the end of the recovery seen since 1.0075, increasing the probability of a return to this level.

Short-term structure continues to be suggestive of a further rise back towards the 1.2500 region, where resistance would be expected. It remains to be seen if the SNB will be able to hold back the possible flow of funds into Swiss Francs, that may occur, if further stresses lead to yet higher yields in Italian/Spanish/French government bonds.

Bearish decline targets 1.3146.

EUR/USD is holding steady, after extending its sharp decline from key overhead resistance (primarily a 2 year trend and its 200-day average). Bearish momentum remains anchored by heightened contagion fears driven from greater European sovereign debt risk.

Expect further downside scope into 1.3146 (Oct swing low) and psychological level at 1.3000, then 1.2870 (2011 major low).

Further pressure may also weigh from broad risk-related proxies. The euro continues to share a high correlation with the S&P500 and AUD/USD.

Inversely, the USD Index is holding its recovery above long-term 200-day MA. The bulls are likely to recapture the recent 9-month highs near 80.

Speculative (net long) liquidity flows have unwound from recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversoldextremes (momentum, sentiment and liquidity).

GBP/USD

Extending decline lower.

GBP/USD has broken under 1.5632 warning of a breakdown in the recovery structure seen since 1.5272. This now warns of a near-term return to weakness, although a rise is sought to enable a short strategy to be formulated.

However, we remain wary of getting aggressively bearish due to the rangebound nature of this market over the last year.

The falling wedge that has been developing in the hourly timeframe is suggestive of an exhaustion of the recent down phase.

A sustained break under 1.5272 is required to turn the medium-term bias decidedly bearish.

USD/JPY

Probability favours retracement to pre-intervention levels.

USD/JPY is continuing to edge lower, with the growing probability of another price retracement back to pre-intervention levels (PIR) and potentially even a new post world war record low beneath 75.35 (PINL).

Furthermore, sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone in the market continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40 year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

Keep in mind that such a scenario would help reactivate the longer-term technical bias, including prior monthly DeMark™ exhaustion signals, within the ending diagonal pattern, launching a powerful recovery into 91.00.

USD/CHF

Resistance maintains weakness under 0.9316.

USD/CHF continues to encounter resistance close to the 0.9316 level. Demand for Swiss Francs are likely to continue while yields on Spanish and Italian government bonds remain elevated, currently trading at 6.582% and 6.904% respectively.

In fact while below 0.9316 a return to the region close to 0.8242 remains possible. However, if a break above 0.9316 can be achieved without breaking under 0.8568, a structural change will occur, increasing the probability of further gains ahead.

One thing to note, that has been taking place over the last week, is that the spread between French government bonds and their German counterparts is beginning to narrow again, after a period of widening. However, we now need to watch the behaviour of the German curve itself to try and determine how this core yield curve is behaving. If yields in Germany continue to rise this will likely mark an acceleration of deterioration in the Euro Zone.

USD/CAD

Bulls charging higher into 1.0658.

USD/CAD’s short-term price activity remains positive, following the sharp bullish reversal from the psychological 1.0000 level (prior trading range).

Positive momentum needs to hold above 1.0400 (on a daily close) to rebuild the potential major upside reversal higher above the old resistance level at 1.0673 (August high & Congestion zone).

A strong directional confirmation above here will open a much larger recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott Wave cycle. Only a sustained close beneath parity will unlock bearish setbacks into the long-term 200-day MA at 0.9841 and 0.9726 (31st Aug low).

EUR/CAD is holding above its 200-day MA, within a large multi-month trading range. Key resistance continues to hold at 1.4379 (June swing high), which has for some time marked a strong distribution pattern.

CHF/CAD continues to hold beneath the 200-day MA at 1.1357, following the dramatic price slide lower (triggered by the SNB intervention). The cross-rate has now retraced more than half of its 2011 gains.

AUD/USD

Unwinding from oversold conditions.

AUD/USD is unwinding from oversold conditions, following its accelerated decline through the 1.0000 psychological level.

The move must be sustained below 1.0000 to further compound downside pressure on the rate’s multi-year uptrend and push back towards 0.9611. Elsewhere, the Aussie dollar remains strong against the New Zealand dollar. The pair is now is within a temporary positive cycle structure while it holds above its 200-day MA.

The Aussie dollar has reversed gains against the Japanese yen and is now trading back below the long-term 200-day MA which is currently at 82.71. Watch for further downside scope into 72.00 which would signal further unwinding of risk appetite.

GBP/JPY

Short-term weakness grinds lower.

GBP/JPY has now returned to the base of the extension higher that occurred at the end of October. Failure to find support in the current region will warn of a re-test of the 116.84 region. We do however note, that further weakess in GBP/JPY will likely be associated with an extension of recent losses in the S&P500.

Strictly speaking the break under 120.85 breaks down the positive structure seen since 116.84.

However, the bulls would need to turn back above the 122.38/65 platform to suggest that an interim low has been seen.

EUR/JPY

Fall from 111.60 appears corrective.

EUR/JPY continues to grind lower after failing to hold the extension higher that occurred at the end of October. In fact the fall that has taken place since 111.60 has the appearance of a corrective phase, suggesting scope for a further leg higher. With this in mind a further rise towards 111.60 is possible.

With the above in mind, we await signs of exhaustion to try to determine a reasonable region from where a long strategy may be formulated. However, we note that further weakness in the S&P500 may lead to a re-test of the 100.76 level.

A sustained hold over the 200 day moving average will turn the mediumterm outlook more bullish.

EUR/GBP

Short-term outlook is neutralised.

EUR/GBP is undergoing a near-term recovery, which has neutralized the outlook once again.

Resistance can be found at 0.8744 and 0.8784. A sustained break under 0.8486 will open up a return to the January 2011 low at 0.8285.

If a large move to the downside were to materialise in this environment, it is likely to be associated with Sterling being perceived as a safe haven. In this respect we need to monitor the yields on Italian, French and Spanish government bonds, noting that the ten year yield in both Italian and Spanish sovereigns are trading above 6.00%.

EUR/CHF

Near-term strength is contained by the 1.2500 level for now.

EUR/CHF is maintaining its tight trading range just under the 1.2500 level. It is anticipated that this zone may see a degree of resistance, particularly in light of the movement in periphery yield spreads versus bunds. Over time, this may lead to a renewed desire for a safe haven, with downside pressure returning to EUR/CHF.

We would prefer to trade this from a momentum perspective, awaiting a return to the 1.2000 region. Should a re-test of the 1.2000 region take place with a fall under 1.1973 also following, this would warn of the end of the recovery seen since 1.0075, increasing the probability of a return to this level.

Short-term structure continues to be suggestive of a further rise back towards the 1.2500 region, where resistance would be expected. It remains to be seen if the SNB will be able to hold back the possible flow of funds into Swiss Francs, that may occur, if further stresses lead to yet higher yields in Italian/Spanish/French government bonds.