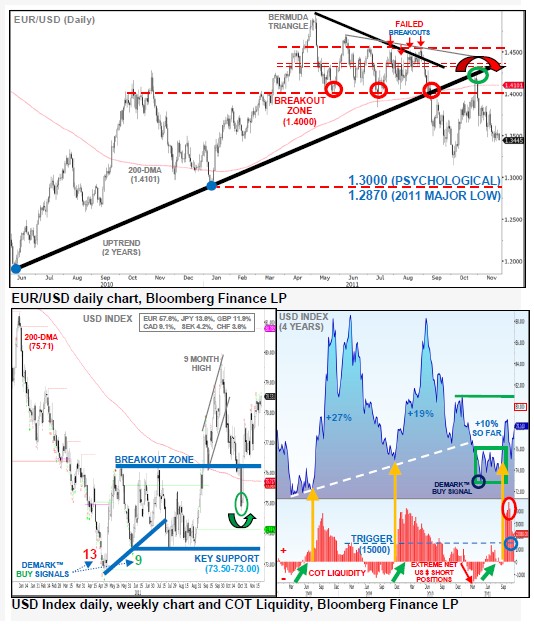

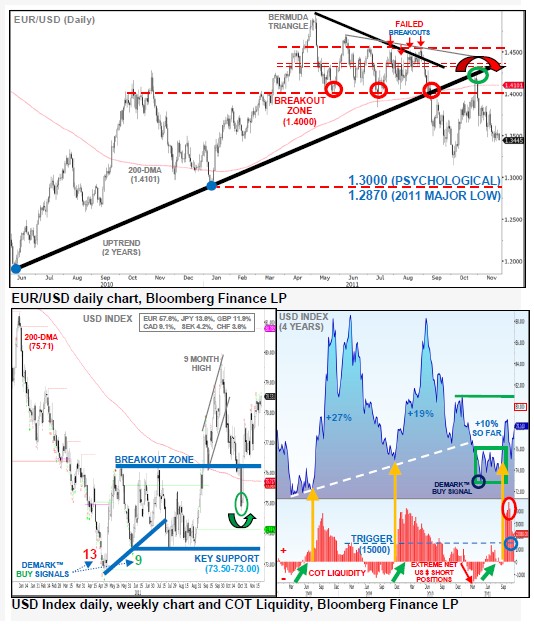

EUR/USD

Bearish decline targets 1.3146.

EUR/USD is resuming its sharp decline from key overhead resistance (primarily an important 2 year trend and its 200-day average). Bearish momentum remains anchored by heightened contagion fears driven from greater European sovereign debt risk.

Expect further downside scope into 1.3146 (Oct swing low) and psychological level at 1.3000, then 1.2870 (2011 major low).

Further pressure may also weigh from broad risk-related proxies. The euro continues to share a high correlation with the S&P500 and AUD/USD.

Inversely, the USD Index is holding its recovery above long-term 200-day MA. The bulls are likely to recapture the recent 9-month highs near 80.

Speculative (net long) liquidity flows have unwound from recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

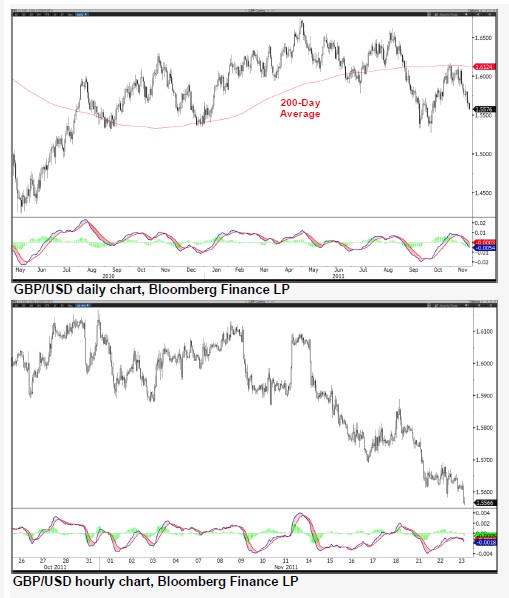

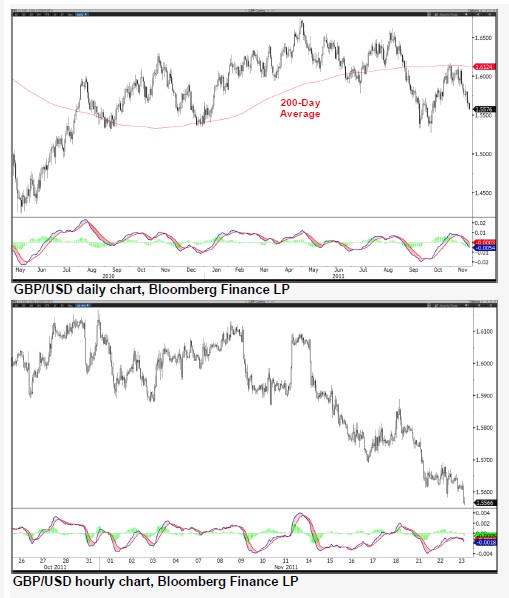

GBP/USD

Extending decline lower.

GBP/USD saw a clear break under the 1.5871-77 floor that had been containing weakness off the recent 1.6167 high. The recent failure to realise a return to 1.6200, to complete the rising phase off 1.5272, is another warning sign of a messy sideways market, with impulsive moves failing to materialise where expected.

Continued settlement beneath the 1.5632 region will favour further downside scope. Failure to hold above this level will warn that strength from 1.5272 is complete, keeping downside pressure on this market. The falling wedge that has been developing in the hourly timeframe is suggestive of an exhaustion of the recent down phase.

USD/JPY

Probability favours retracement to pre-intervention levels.

USD/JPY is continuing to edge lower, with the growing probability of another price retracement back to pre-intervention levels (PIR) and potentially even

a new post world war record low beneath 75.35 (PINL).

Furthermore, sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone in the market continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40 year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

Keep in mind that such a scenario would help reactivate the longer-term technical bias, including prior monthly DeMark™ exhaustion signals, within the ending diagonal pattern, launching a powerful recovery into 91.00.

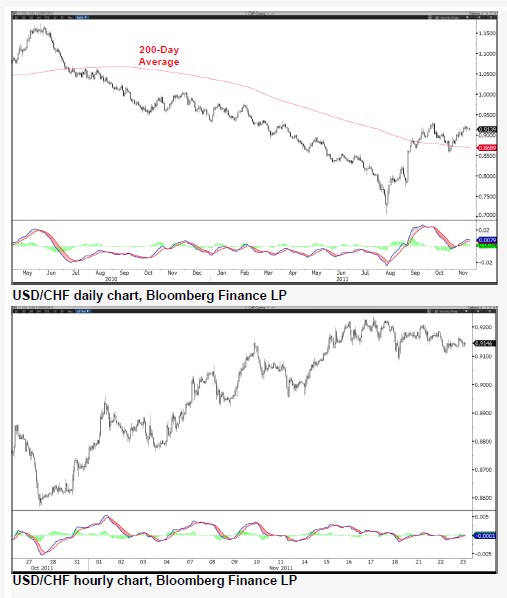

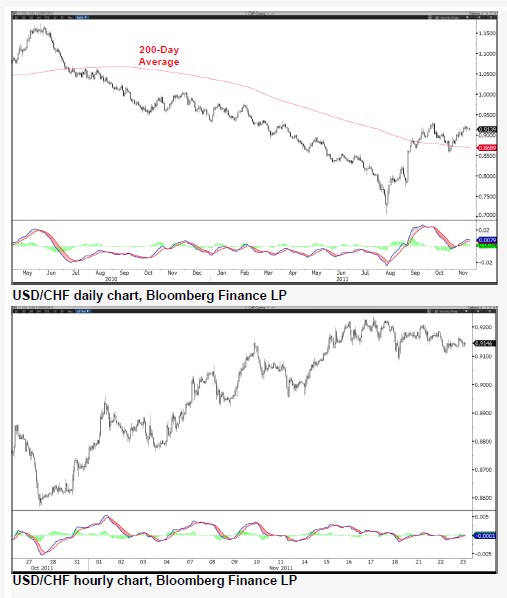

USD/CHF

Below 0.9316 suggests a corrective phase is more likely.

USD/CHF is unwinding from the hourly channel which we have been highlighting. A fall back down to 0.9110, after pushing over 0.9200, would

lead to a break down in positive structure, giving any long trade a weaker probability of success.

In fact while below 0.9316 a return to the region close to 0.8242 remains possible. However, if a break above 0.9316 can be achieved without

breaking under 0.8568, a structural change will occur, increasing the probability of further gains ahead.

Focus still remains on Italian and Spanish sovereign yields. Also of interest is that French government bonds are widening across the whole curve

versus their German counterparts, when compared to the spread just one month ago. This is a further warning sign.

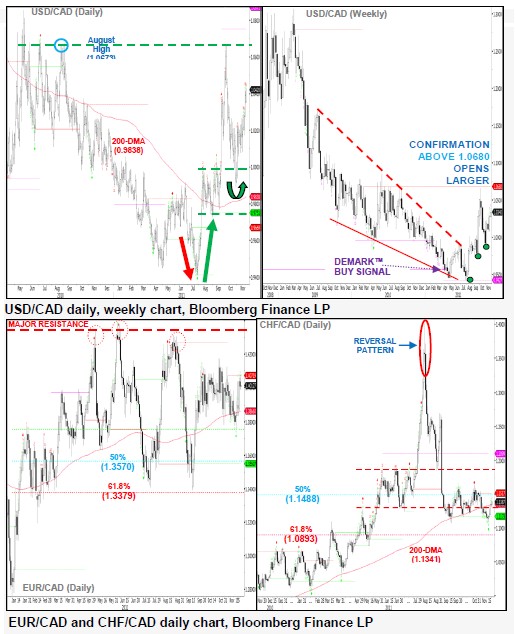

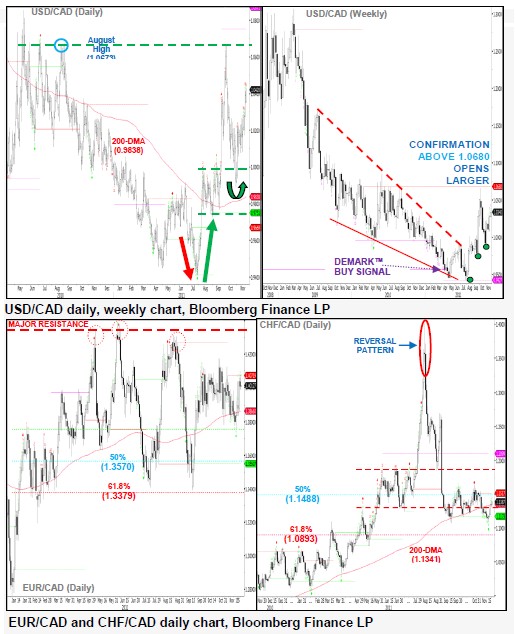

USD/CAD

Bulls charging higher into 1.0658.

Stop raised to breakeven, thereby ensuring a risk-free trade. USD/CAD’s short-term price activity remains positive, following the sharp bullish reversal

from the psychological 1.0000 level (prior trading range).

Positive momentum needs to hold above 1.0400 (on a daily close) to rebuild the potential major upside reversal higher above the old resistance level at

1.0673 (August high & Congestion zone).

A strong directional confirmation above here will open a much larger recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott Wave cycle. Only a sustained close beneath parity will unlock bearish setbacks into the long-term 200-day MA at 0.9835 and 0.9726 (31st Aug low).

EUR/CAD is extending above its 200-day MA, within a large multi-month trading range. Key resistance continues to hold at 1.4379 (June swing high), which has for some time marked a strong distribution pattern.

CHF/CAD continues to hold beneath the 200-day MA at 1.1347, following the dramatic price slide lower (triggered by the SNB intervention). The cross-rate has now retraced more than half of its 2011 gains.

AUD/USD

Extending decline into 0.9611.

Exited Short position. All 3 objectives met. AUD/USD is extending its decline, having recently broken through the 1.0000 psychological level. The sustained move below 1.0000 is now compounding downside pressure on the rate’s multi-year uptrend and push back towards 0.9611.

Elsewhere, the Aussie dollar remains strong against the New Zealand dollar. The pair is now is within a temporary positive cycle structure while it

holds above its 200-day MA.

The Aussie dollar has reversed gains against the Japanese yen and is now trading back below the long-term 200-day MA which is currently at 82.80.

Watch for further downside scope into 72.00 which would signal further unwinding of risk appetite.

GBPJPY

Hourly falling wedge warns of downside exhaustion.

GBP/JPY has broken clearly under the 122.38/65 platform, which warns of a breakdown in positive structure. However, the hourly timeframe is currently exhibiting a falling wedge formation which is suggestive of a degree of downside exhaustion. We will thus await a bounce higher ahead of the possible formulation of a short strategy.

Strictly speaking the break under 120.85 breaks down the positive structure seen since 116.84.

However, the bulls would need to turn back above the 122.38/65 platform to suggest that an interim low has been seen.

EUR/JPY

Initial signs of support seen close to 104.00.

EUR/JPY is testing support 103.41-104.00. Failure to hold above here will lead to a complete breakdown in positive structure, with a return to 100.76

then favoured.

A move back over 106.74 is required to neutralise the outlook in the shortterm. A sustained hold over the 200 day moving average will turn the mediumterm

outlook more bullish.

We will now monitor the price action close to 103.41-104.00 to try and determine if a short-term buying opportunity will present itself.

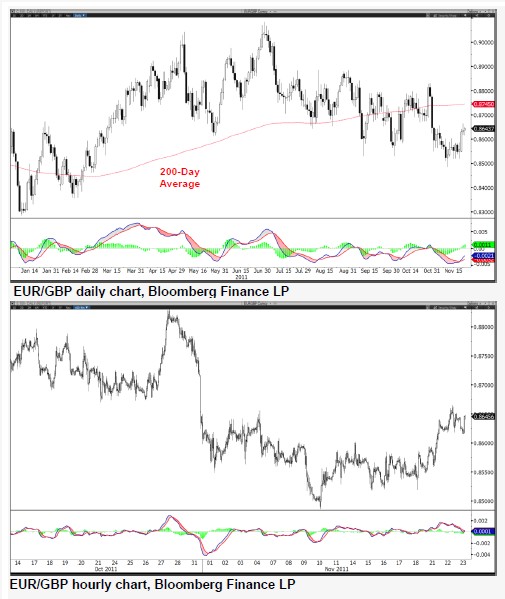

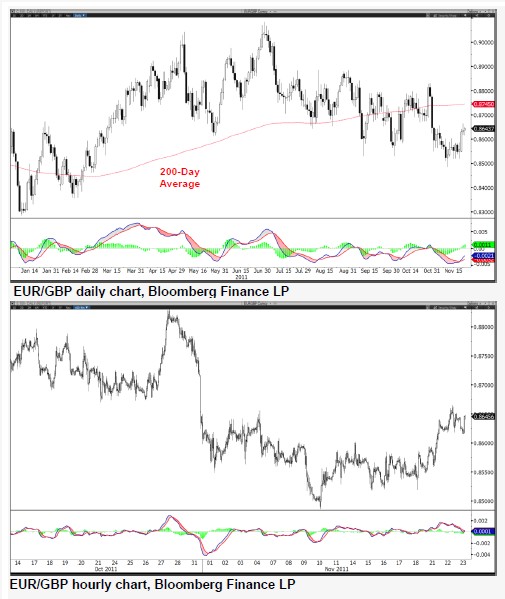

EUR/GBP

Short-term outlook is neutralised.

EUR/GBP is undergoing a near-term recovery, which has neutralized the outlook once again.

Resistance can be found at 0.8744 and 0.8784. Only a sustained break under 0.8486 will open up a return to the January 2011 low at 0.8285.

If a large move to the downside were to materialise in this environment, it is likely to be associated with Sterling being perceived as a safe haven. In this

respect we need to monitor the yields on Italian, French and Spanish government bonds, noting that the ten year yield in both Italian and Spanish sovereigns are trading above 6.00%.

Failure to hold under the old double bottom and trend-line will warn of a false break lower, with a danger that trade returns back into the old range.

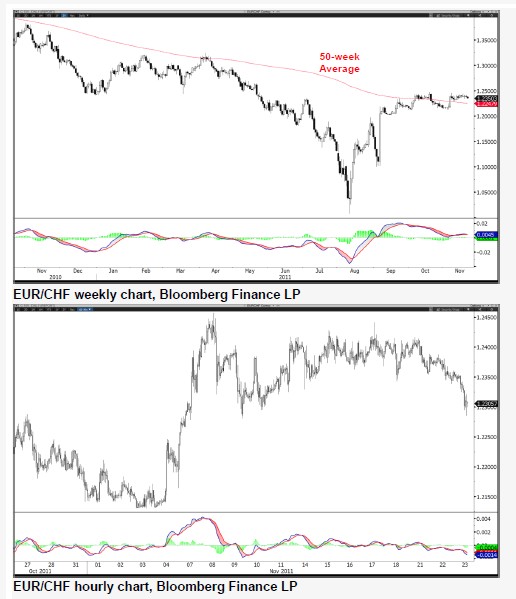

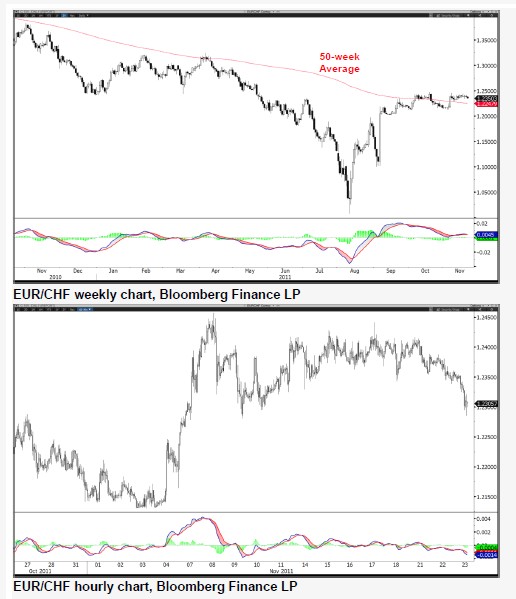

EUR/CHF

Approaches the 1.2500 region once again.

EUR/CHF is maintaining its tight trading range just under the 1.2500 level. It is anticipated that this zone may see a degree of resistance, particularly in

light of the movement in periphery yield spreads versus bunds. Over time, this may lead to a renewed desire for a safe haven, with downside pressure

returning to EUR/CHF.

We would prefer to trade this from a momentum perspective, awaiting a return to the 1.2000 region. Should a re-test of the 1.2000 region take place with a fall under 1.1973 also following, this would warn of the end of the recovery seen since 1.0075, increasing the probability of a return to this level.

It remains to be seen if the SNB will be able to hold back the possible flow of funds into Swiss Francs, that may occur, if further stresses lead to yet

higher yields in Italian government bonds.

Bearish decline targets 1.3146.

EUR/USD is resuming its sharp decline from key overhead resistance (primarily an important 2 year trend and its 200-day average). Bearish momentum remains anchored by heightened contagion fears driven from greater European sovereign debt risk.

Expect further downside scope into 1.3146 (Oct swing low) and psychological level at 1.3000, then 1.2870 (2011 major low).

Further pressure may also weigh from broad risk-related proxies. The euro continues to share a high correlation with the S&P500 and AUD/USD.

Inversely, the USD Index is holding its recovery above long-term 200-day MA. The bulls are likely to recapture the recent 9-month highs near 80.

Speculative (net long) liquidity flows have unwound from recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

GBP/USD

Extending decline lower.

GBP/USD saw a clear break under the 1.5871-77 floor that had been containing weakness off the recent 1.6167 high. The recent failure to realise a return to 1.6200, to complete the rising phase off 1.5272, is another warning sign of a messy sideways market, with impulsive moves failing to materialise where expected.

Continued settlement beneath the 1.5632 region will favour further downside scope. Failure to hold above this level will warn that strength from 1.5272 is complete, keeping downside pressure on this market. The falling wedge that has been developing in the hourly timeframe is suggestive of an exhaustion of the recent down phase.

USD/JPY

Probability favours retracement to pre-intervention levels.

USD/JPY is continuing to edge lower, with the growing probability of another price retracement back to pre-intervention levels (PIR) and potentially even

a new post world war record low beneath 75.35 (PINL).

Furthermore, sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone in the market continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40 year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

Keep in mind that such a scenario would help reactivate the longer-term technical bias, including prior monthly DeMark™ exhaustion signals, within the ending diagonal pattern, launching a powerful recovery into 91.00.

USD/CHF

Below 0.9316 suggests a corrective phase is more likely.

USD/CHF is unwinding from the hourly channel which we have been highlighting. A fall back down to 0.9110, after pushing over 0.9200, would

lead to a break down in positive structure, giving any long trade a weaker probability of success.

In fact while below 0.9316 a return to the region close to 0.8242 remains possible. However, if a break above 0.9316 can be achieved without

breaking under 0.8568, a structural change will occur, increasing the probability of further gains ahead.

Focus still remains on Italian and Spanish sovereign yields. Also of interest is that French government bonds are widening across the whole curve

versus their German counterparts, when compared to the spread just one month ago. This is a further warning sign.

USD/CAD

Bulls charging higher into 1.0658.

Stop raised to breakeven, thereby ensuring a risk-free trade. USD/CAD’s short-term price activity remains positive, following the sharp bullish reversal

from the psychological 1.0000 level (prior trading range).

Positive momentum needs to hold above 1.0400 (on a daily close) to rebuild the potential major upside reversal higher above the old resistance level at

1.0673 (August high & Congestion zone).

A strong directional confirmation above here will open a much larger recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott Wave cycle. Only a sustained close beneath parity will unlock bearish setbacks into the long-term 200-day MA at 0.9835 and 0.9726 (31st Aug low).

EUR/CAD is extending above its 200-day MA, within a large multi-month trading range. Key resistance continues to hold at 1.4379 (June swing high), which has for some time marked a strong distribution pattern.

CHF/CAD continues to hold beneath the 200-day MA at 1.1347, following the dramatic price slide lower (triggered by the SNB intervention). The cross-rate has now retraced more than half of its 2011 gains.

AUD/USD

Extending decline into 0.9611.

Exited Short position. All 3 objectives met. AUD/USD is extending its decline, having recently broken through the 1.0000 psychological level. The sustained move below 1.0000 is now compounding downside pressure on the rate’s multi-year uptrend and push back towards 0.9611.

Elsewhere, the Aussie dollar remains strong against the New Zealand dollar. The pair is now is within a temporary positive cycle structure while it

holds above its 200-day MA.

The Aussie dollar has reversed gains against the Japanese yen and is now trading back below the long-term 200-day MA which is currently at 82.80.

Watch for further downside scope into 72.00 which would signal further unwinding of risk appetite.

GBPJPY

Hourly falling wedge warns of downside exhaustion.

GBP/JPY has broken clearly under the 122.38/65 platform, which warns of a breakdown in positive structure. However, the hourly timeframe is currently exhibiting a falling wedge formation which is suggestive of a degree of downside exhaustion. We will thus await a bounce higher ahead of the possible formulation of a short strategy.

Strictly speaking the break under 120.85 breaks down the positive structure seen since 116.84.

However, the bulls would need to turn back above the 122.38/65 platform to suggest that an interim low has been seen.

EUR/JPY

Initial signs of support seen close to 104.00.

EUR/JPY is testing support 103.41-104.00. Failure to hold above here will lead to a complete breakdown in positive structure, with a return to 100.76

then favoured.

A move back over 106.74 is required to neutralise the outlook in the shortterm. A sustained hold over the 200 day moving average will turn the mediumterm

outlook more bullish.

We will now monitor the price action close to 103.41-104.00 to try and determine if a short-term buying opportunity will present itself.

EUR/GBP

Short-term outlook is neutralised.

EUR/GBP is undergoing a near-term recovery, which has neutralized the outlook once again.

Resistance can be found at 0.8744 and 0.8784. Only a sustained break under 0.8486 will open up a return to the January 2011 low at 0.8285.

If a large move to the downside were to materialise in this environment, it is likely to be associated with Sterling being perceived as a safe haven. In this

respect we need to monitor the yields on Italian, French and Spanish government bonds, noting that the ten year yield in both Italian and Spanish sovereigns are trading above 6.00%.

Failure to hold under the old double bottom and trend-line will warn of a false break lower, with a danger that trade returns back into the old range.

EUR/CHF

Approaches the 1.2500 region once again.

EUR/CHF is maintaining its tight trading range just under the 1.2500 level. It is anticipated that this zone may see a degree of resistance, particularly in

light of the movement in periphery yield spreads versus bunds. Over time, this may lead to a renewed desire for a safe haven, with downside pressure

returning to EUR/CHF.

We would prefer to trade this from a momentum perspective, awaiting a return to the 1.2000 region. Should a re-test of the 1.2000 region take place with a fall under 1.1973 also following, this would warn of the end of the recovery seen since 1.0075, increasing the probability of a return to this level.

It remains to be seen if the SNB will be able to hold back the possible flow of funds into Swiss Francs, that may occur, if further stresses lead to yet

higher yields in Italian government bonds.