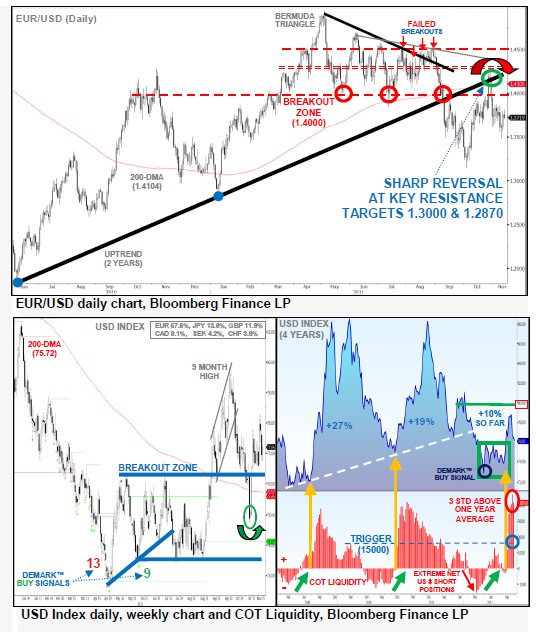

EUR/USD

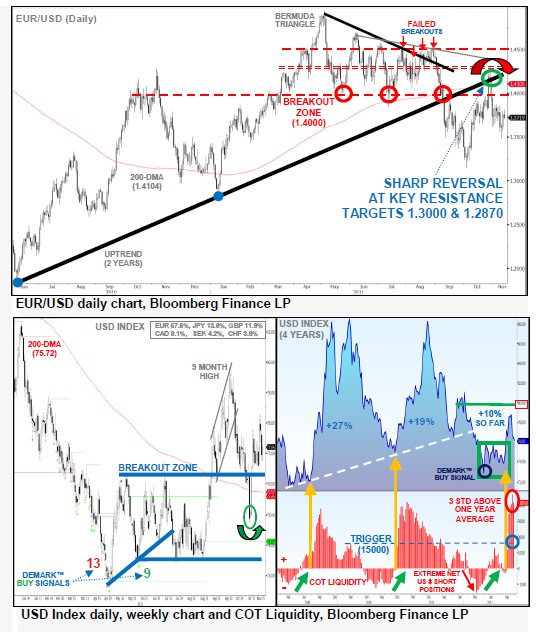

Resuming sharp reversal into 1.3140.

EUR/USD is resuming its sharp reversal from key overhead resistance (primarily an important 2 year trend-line).

The bearish move is now being further anchored down by heightened European soverign debt risk after Italian Govt. yields launched above 7%. The recent break under 1.3653 (18th Oct low) unlocks further downside scope into 1.3146 (Oct swing low) and psychological level at 1.3000. Further pressure is also weighing from broad risk-related proxies. The euro currently shares a high correlation of 0.85% with the S&P500 which is now falling sharply from its recent multi-week highs.

Inversely, USD Index has turned back higher above its long-term 200-day MA. The bulls are likely to recapture the recent 9-month highs near 80. Speculative (net long) liquidity flows are holding steady around their recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

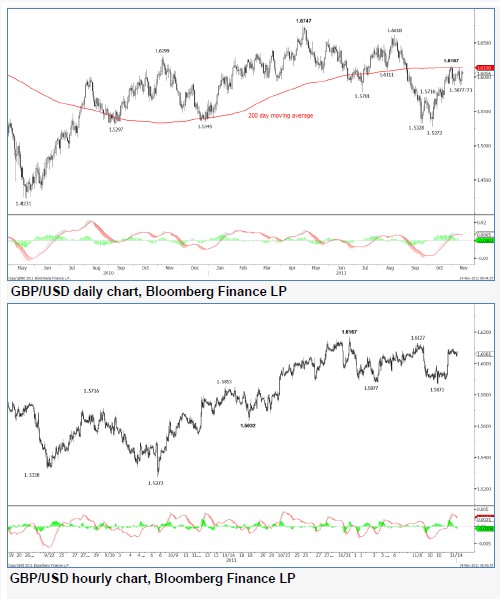

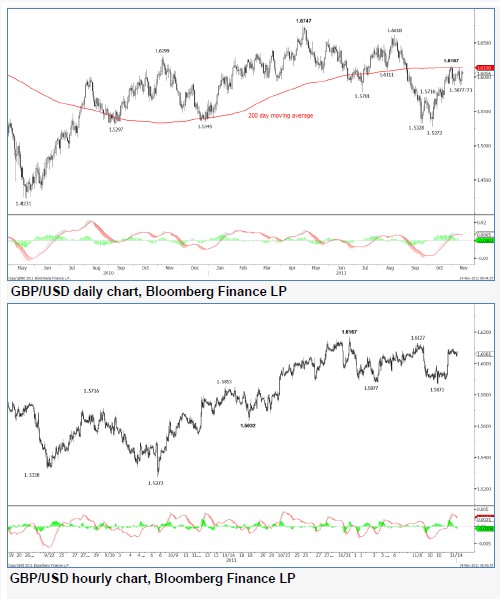

GBP/USD

Support near 1.5853 suggests a return to 1.6200.

Long strategy raised to 1.6000, with all three objectives at 1.6200. This was communicated to clients via e-mail and through the MT4 platform.

GBP/USD has potentially completed a corrective phase off the recent 1.6167 high, with scope now for a return to 1.6167 ahead of a test of 1.6200, where a lower high may form. However, should the 1.6200 region be met, a degree of resistance may be encountered, for a further pullback.

This year has seen a generally range bound environment, with a return to the highs of the annual range possible, near 1.6618/1.6747. Our bias remains positive due to the near-term bullish structure that is in place.

While above 1.5632 further strength is favoured. However, if this region fails to contain the current corrective phase, then the bias will turn negative again.

Sterling is expected to stay stronger then most, should the US Dollar enter into a strengthening phase.

USD/JPY

Probability now favours retracement to pre-intervention levels.

USD/JPY is continuing to edge lower, with the growing probability of another price retracement back to pre-intervention levels (PIR) and potentially even a new post world war record low beneath 75.35 (PINL).

Furthermore, sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone in the market continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40 year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

Keep in mind that such a scenario would help reactivate the longer-term technical bias, including prior monthly DeMark™ exhaustion signals, within the ending diagonal pattern, launhcing a powerful recovery into 91.00.

USD/CHF

Under 0.8960 will warn of the end to the corrective phase.

Sell strategy at 0.9100 removed.

USD/CHF may have completed a symmetrical correction from the low at 0.8568, after reaching 0.9151 in recent trade. We now wait to see if the 0.9151 high can contain price on the upside.

In particular we look to see if a break under 0.8923 can be realised as this would increase the probability of a return to weakness.

While below 0.9316, medium-term structure is suggestive of a re-test of the zone close to 0.8242, ahead of a possible return to 0.9316. However, we are mindful of the effect a return to 1.2000 in EUR/CHF may have in USD/CHF. Back under 0.7712 is required to change the medium-term bullish bias.

As Italian government bond yields have eased away from the highs, this takes the pressure off the Swiss Franc as a safe haven, for now.

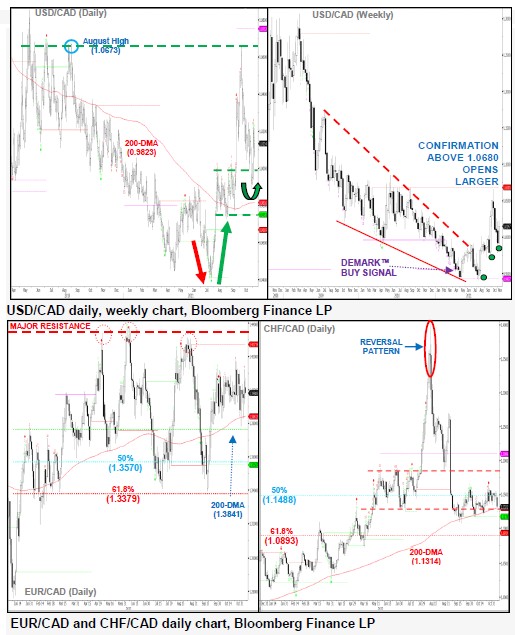

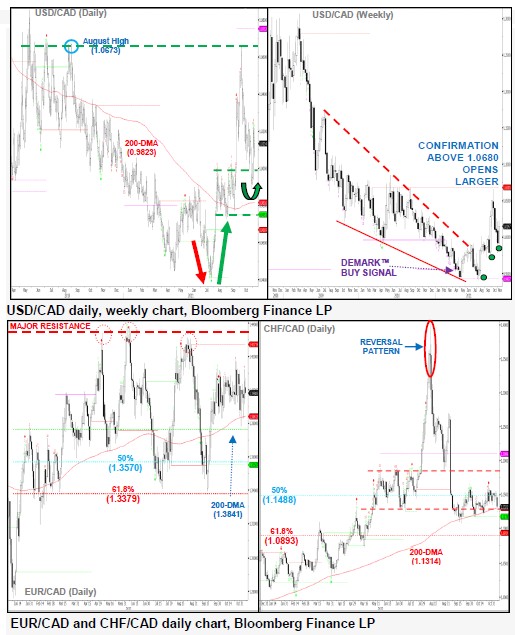

USD/CAD

Bulls hold gains above psychological 1.0000 level.

USD/CAD’s short-term price activity remains positive, following the sharp bullish reversal from the psychological 1.0000 level (prior trading range). Positive momentum needs to push above 1.0264 and 1.0400 to rebuild the potential major upside reversal higher above the old resistance level at 1.0673 (August high & Congestion zone).

A strong directional confirmation above here will open a much larger recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott Wave cycle.

Only a sustained close beneath parity will unlock bearish setbacks into the long-term 200-day MA at 0.9823 and 0.9726 (31st Aug low).

EUR/CAD is extending above its 200-day MA, within a large multi-month trading range. Key resistance continues to hold at 1.4379 (June swing high), which has for some time marked a strong distribution pattern.

CHF/CAD is retesting its support nearby the 200-day MA at 1.1314, following the dramatic price slide lower (triggered by the SNB intervention). The cross-rate has now retraced more than half of its 2011 gains.

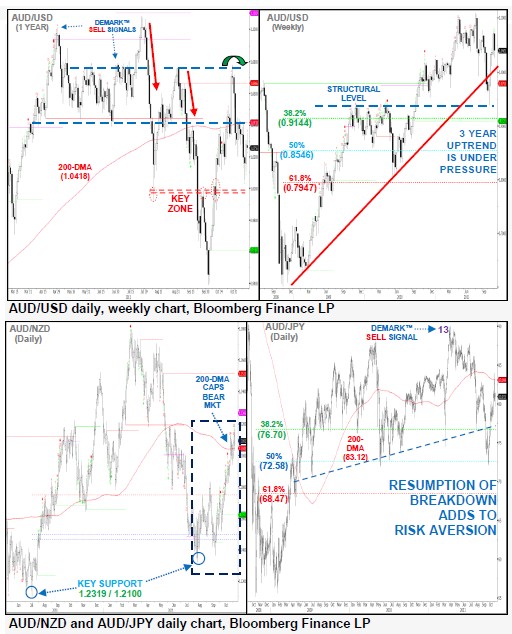

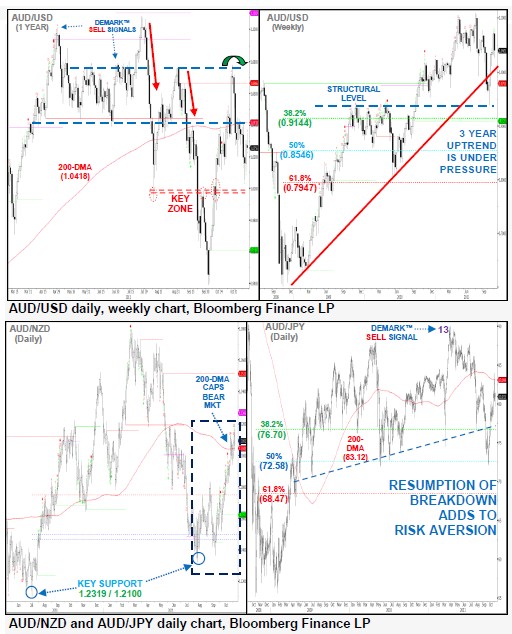

AUD/USD

Sharp setbacks weigh.

AUD/USD’s sharp setbacks continue to weigh. The move was triggered from key resistance at 1.0765 (01st Sept high) and is now holding beneath the 200-day MA (1.0418).

A sustained move below here is likely to mount downside pressure on the rate’s multi-year uptrend.

Elsewhere, the Aussie dollar remains stable against the New Zealand dollar. The pair is still locked within its new bear cycle structure while it holds beneath its 200-day MA. Key support can be found at 1.2320 and 1.2100.

The Aussie dollar has reversed gains against the Japanese yen and is now trading back below the long-term 200-day MA which is currently at 83.11. Near-term support continues to hold at 77.63 (18th Oct low). A break here will resume downside scope into 76.70 and signal further unwinding of risk appetite.

GBP/JPY

Continues to trade close to an area of potential support.

GBP/JPY continues to trade close to the 122.38/65 platform. This now potentially completes the corrective structure that has been witnessed since 127.32, with support anticipated.

Now that the surge higher from the end of October has been unwound, there is scope for a higher low to form, for a fresh swing to the upside. It is this unwinding that we have been expecting ahead of any potential fresh strength.

Bigger picture a rise towards 129.00/130.00 is possible, given the daily structure present since 116.84. A push back under 121.39 is needed to negate this positive structure.

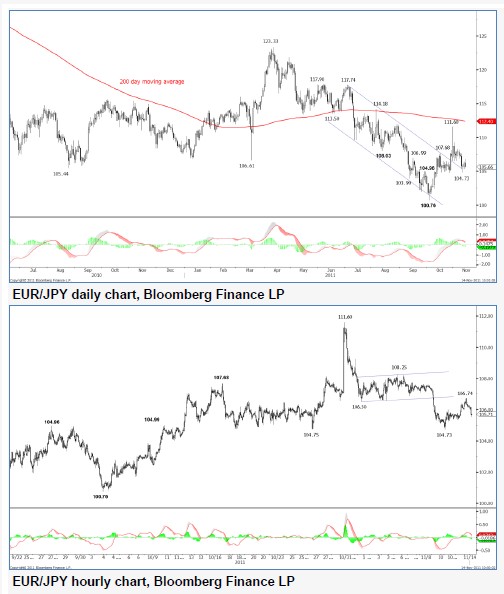

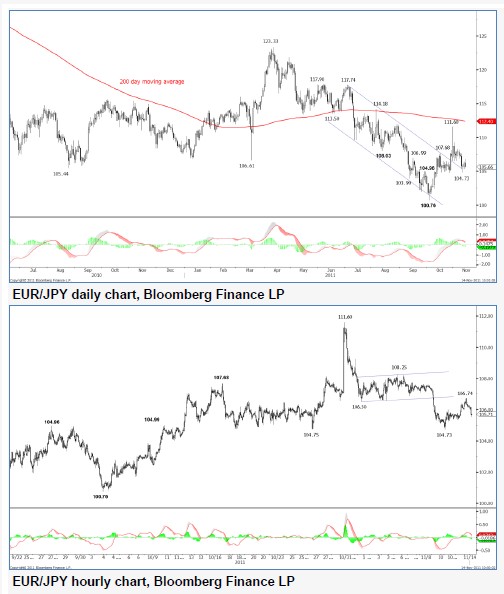

EUR/JPY

Return to 104.73 favoured.

Remainder of short position stopped at entry.

EUR/JPY has returned to test the old hourly channel as resistance, after peaking at formed a corrective structure in the hourly timeframe and has subsequently broken under 106.50. This now triggers the bearish flag that we had seen in the daily timeframe, warning of further losses towards 104.00 and possibly lower.

Yesterday saw support close to the 61.8% retrace of the 100.76 – 111.60 rise, after meeting 104.73. From there a test of the region close to the 38.2% retrace of the 108.25 – 104.73 fall has already taken place. Failure to hold under this 38.2% retrace will warn of a minimum return to the 106.50 region.

Structure present since 108.25 also suggests scope for a further leg lower back towards 100.76 if a sustained break under 104.75/3 can be achieved. A sustained hold over the 200 day moving average will turn the outlook bullish.

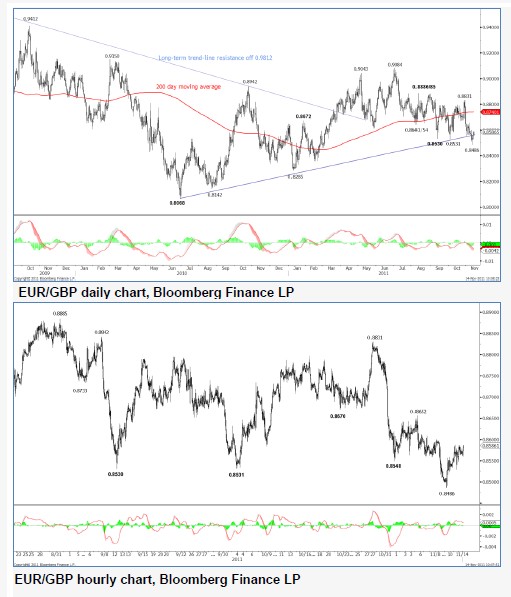

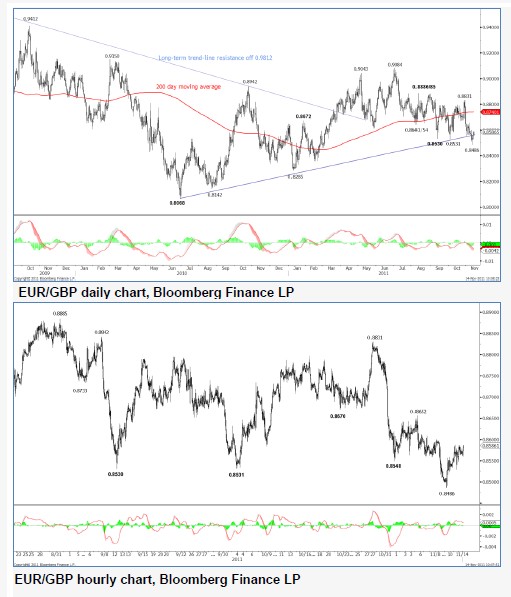

EUR/GBP

Lower high sought for fresh weakness.

EUR/GBP has managed to find a footing back over daily trend line support that was broken last week. We wait to see if this push back higher can be maintained on a closing basis. Of stronger significance is the push out of the three month range seen last week, following the fall under 0.8530/31.

This now warns of a larger breakout to the downside to target 0.8285/0.8068. Such a move will be assisted by the perception of Sterling as a safe haven, assuming the yields of Italian government bonds can stay above 6.00%.

In the near-term, a break back over 0.8652 is required to neutralise the outlook once again. In the meantime, a lower high is sought for a further extension lower.

Failure to hold under the old double bottom and trend-line will warn of a false break lower, with a danger that trade returns back into the old range. Scope is seen for a near-term return to 0.8486.

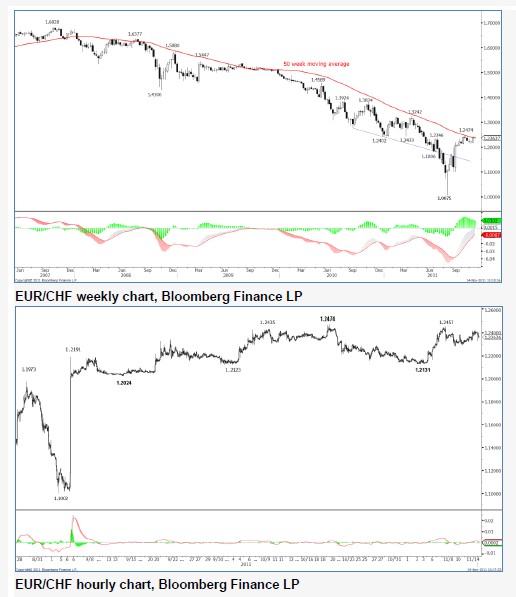

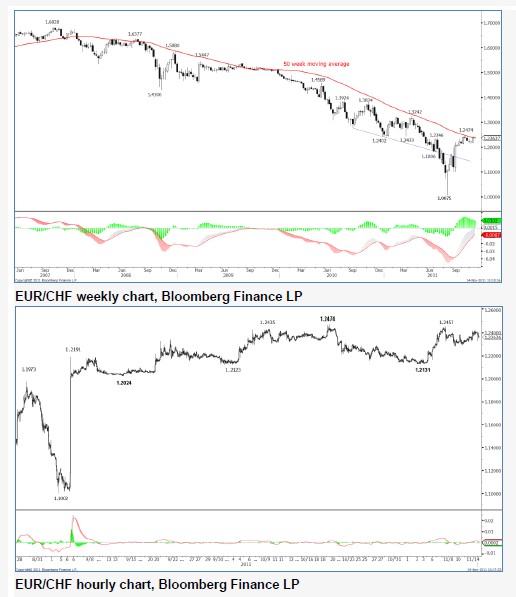

EUR/CHF

Continued resistance expected close to 1.2500.

EUR/CHF has remained strong, particularly in light of the movement in Italian government bond markets, where 10 year yields are maintaining a foothold over 6.00%. Over time, this may lead to a renewed desire for a safe haven, with downside pressure returning to EUR/CHF.

Should a re-test of the 1.2000 region take place with a fall under 1.1973 also following, this would warn of the end of the recovery seen since 1.0075, increasing the probability of a return to this level.

In any case, strong resistance is anticipated should this rate reach the 1.2500 zone. The recent failure to maintain trade above the 50 week moving average is also noted.

It remains to be seen if the SNB will be able to hold back the possible flow of funds into Swiss Francs, that may occur, if further stresses lead to yet higher yields in Italian government bonds.

Resuming sharp reversal into 1.3140.

EUR/USD is resuming its sharp reversal from key overhead resistance (primarily an important 2 year trend-line).

The bearish move is now being further anchored down by heightened European soverign debt risk after Italian Govt. yields launched above 7%. The recent break under 1.3653 (18th Oct low) unlocks further downside scope into 1.3146 (Oct swing low) and psychological level at 1.3000. Further pressure is also weighing from broad risk-related proxies. The euro currently shares a high correlation of 0.85% with the S&P500 which is now falling sharply from its recent multi-week highs.

Inversely, USD Index has turned back higher above its long-term 200-day MA. The bulls are likely to recapture the recent 9-month highs near 80. Speculative (net long) liquidity flows are holding steady around their recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

GBP/USD

Support near 1.5853 suggests a return to 1.6200.

Long strategy raised to 1.6000, with all three objectives at 1.6200. This was communicated to clients via e-mail and through the MT4 platform.

GBP/USD has potentially completed a corrective phase off the recent 1.6167 high, with scope now for a return to 1.6167 ahead of a test of 1.6200, where a lower high may form. However, should the 1.6200 region be met, a degree of resistance may be encountered, for a further pullback.

This year has seen a generally range bound environment, with a return to the highs of the annual range possible, near 1.6618/1.6747. Our bias remains positive due to the near-term bullish structure that is in place.

While above 1.5632 further strength is favoured. However, if this region fails to contain the current corrective phase, then the bias will turn negative again.

Sterling is expected to stay stronger then most, should the US Dollar enter into a strengthening phase.

USD/JPY

Probability now favours retracement to pre-intervention levels.

USD/JPY is continuing to edge lower, with the growing probability of another price retracement back to pre-intervention levels (PIR) and potentially even a new post world war record low beneath 75.35 (PINL).

Furthermore, sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone in the market continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40 year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

Keep in mind that such a scenario would help reactivate the longer-term technical bias, including prior monthly DeMark™ exhaustion signals, within the ending diagonal pattern, launhcing a powerful recovery into 91.00.

USD/CHF

Under 0.8960 will warn of the end to the corrective phase.

Sell strategy at 0.9100 removed.

USD/CHF may have completed a symmetrical correction from the low at 0.8568, after reaching 0.9151 in recent trade. We now wait to see if the 0.9151 high can contain price on the upside.

In particular we look to see if a break under 0.8923 can be realised as this would increase the probability of a return to weakness.

While below 0.9316, medium-term structure is suggestive of a re-test of the zone close to 0.8242, ahead of a possible return to 0.9316. However, we are mindful of the effect a return to 1.2000 in EUR/CHF may have in USD/CHF. Back under 0.7712 is required to change the medium-term bullish bias.

As Italian government bond yields have eased away from the highs, this takes the pressure off the Swiss Franc as a safe haven, for now.

USD/CAD

Bulls hold gains above psychological 1.0000 level.

USD/CAD’s short-term price activity remains positive, following the sharp bullish reversal from the psychological 1.0000 level (prior trading range). Positive momentum needs to push above 1.0264 and 1.0400 to rebuild the potential major upside reversal higher above the old resistance level at 1.0673 (August high & Congestion zone).

A strong directional confirmation above here will open a much larger recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott Wave cycle.

Only a sustained close beneath parity will unlock bearish setbacks into the long-term 200-day MA at 0.9823 and 0.9726 (31st Aug low).

EUR/CAD is extending above its 200-day MA, within a large multi-month trading range. Key resistance continues to hold at 1.4379 (June swing high), which has for some time marked a strong distribution pattern.

CHF/CAD is retesting its support nearby the 200-day MA at 1.1314, following the dramatic price slide lower (triggered by the SNB intervention). The cross-rate has now retraced more than half of its 2011 gains.

AUD/USD

Sharp setbacks weigh.

AUD/USD’s sharp setbacks continue to weigh. The move was triggered from key resistance at 1.0765 (01st Sept high) and is now holding beneath the 200-day MA (1.0418).

A sustained move below here is likely to mount downside pressure on the rate’s multi-year uptrend.

Elsewhere, the Aussie dollar remains stable against the New Zealand dollar. The pair is still locked within its new bear cycle structure while it holds beneath its 200-day MA. Key support can be found at 1.2320 and 1.2100.

The Aussie dollar has reversed gains against the Japanese yen and is now trading back below the long-term 200-day MA which is currently at 83.11. Near-term support continues to hold at 77.63 (18th Oct low). A break here will resume downside scope into 76.70 and signal further unwinding of risk appetite.

GBP/JPY

Continues to trade close to an area of potential support.

GBP/JPY continues to trade close to the 122.38/65 platform. This now potentially completes the corrective structure that has been witnessed since 127.32, with support anticipated.

Now that the surge higher from the end of October has been unwound, there is scope for a higher low to form, for a fresh swing to the upside. It is this unwinding that we have been expecting ahead of any potential fresh strength.

Bigger picture a rise towards 129.00/130.00 is possible, given the daily structure present since 116.84. A push back under 121.39 is needed to negate this positive structure.

EUR/JPY

Return to 104.73 favoured.

Remainder of short position stopped at entry.

EUR/JPY has returned to test the old hourly channel as resistance, after peaking at formed a corrective structure in the hourly timeframe and has subsequently broken under 106.50. This now triggers the bearish flag that we had seen in the daily timeframe, warning of further losses towards 104.00 and possibly lower.

Yesterday saw support close to the 61.8% retrace of the 100.76 – 111.60 rise, after meeting 104.73. From there a test of the region close to the 38.2% retrace of the 108.25 – 104.73 fall has already taken place. Failure to hold under this 38.2% retrace will warn of a minimum return to the 106.50 region.

Structure present since 108.25 also suggests scope for a further leg lower back towards 100.76 if a sustained break under 104.75/3 can be achieved. A sustained hold over the 200 day moving average will turn the outlook bullish.

EUR/GBP

Lower high sought for fresh weakness.

EUR/GBP has managed to find a footing back over daily trend line support that was broken last week. We wait to see if this push back higher can be maintained on a closing basis. Of stronger significance is the push out of the three month range seen last week, following the fall under 0.8530/31.

This now warns of a larger breakout to the downside to target 0.8285/0.8068. Such a move will be assisted by the perception of Sterling as a safe haven, assuming the yields of Italian government bonds can stay above 6.00%.

In the near-term, a break back over 0.8652 is required to neutralise the outlook once again. In the meantime, a lower high is sought for a further extension lower.

Failure to hold under the old double bottom and trend-line will warn of a false break lower, with a danger that trade returns back into the old range. Scope is seen for a near-term return to 0.8486.

EUR/CHF

Continued resistance expected close to 1.2500.

EUR/CHF has remained strong, particularly in light of the movement in Italian government bond markets, where 10 year yields are maintaining a foothold over 6.00%. Over time, this may lead to a renewed desire for a safe haven, with downside pressure returning to EUR/CHF.

Should a re-test of the 1.2000 region take place with a fall under 1.1973 also following, this would warn of the end of the recovery seen since 1.0075, increasing the probability of a return to this level.

In any case, strong resistance is anticipated should this rate reach the 1.2500 zone. The recent failure to maintain trade above the 50 week moving average is also noted.

It remains to be seen if the SNB will be able to hold back the possible flow of funds into Swiss Francs, that may occur, if further stresses lead to yet higher yields in Italian government bonds.