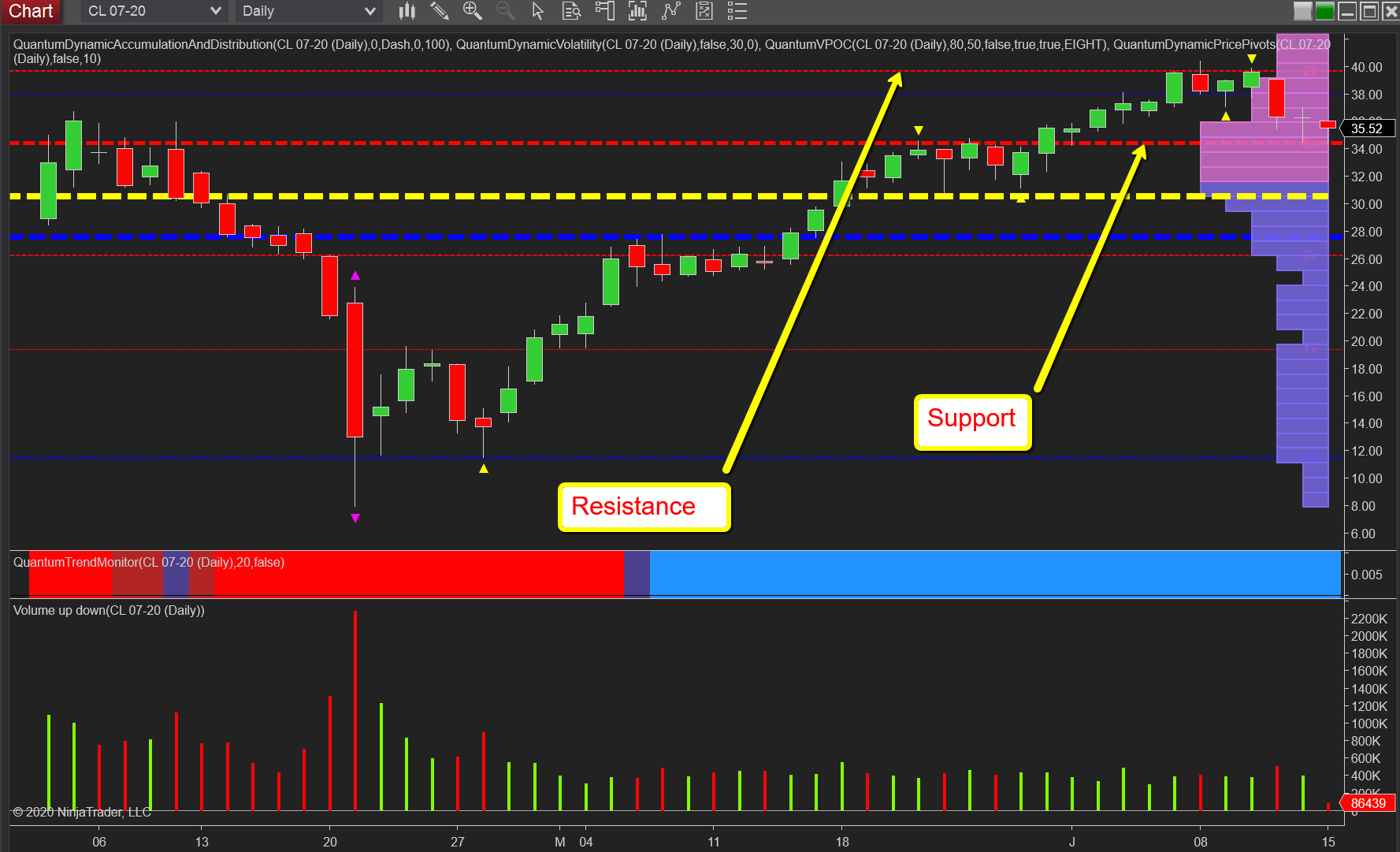

Levels are now in play on the daily chart for WTI futures with two in particular helping to define and shape the technical picture as the outlook for oil in the longer term remains bullish despite the weight of bearish pressure from the demand side of the equation.

If we take resistance first, the level here is that just below $40 per barrel and one which is taking on an increased significance and denoted with the red dashed line of the accumulation and distribution indicator. As can be seen, it is a level which held firm last week as oil threatened the $40 per barrel level, but failed to breach this psychological region. Below, we now have a stronger area of support building above the $34 per barrel region and denoted with the thick red dashed line. This is an area which acted as strong resistance in the past, but which is now offering an equally strong platform of potential support, and one which was tested on Friday and again in early trading today. In addition, volume congestion increases from this area down to the volume point of control above $30 per barrel, so both price and volume combining to provide platforms of support.

In summary, in the short term, expect to see further congestion between these two regions, and for any continuation of the longer-term bullish trend, the resistance level at $40 per barrel needs to be breached on rising volume.