Caloma Two and DZP recoveries increase value

Alkane Resources Ltd, (ALK) has managed to improve metallurgical recoveries at the DZP (with no additional operating or capital cost envisaged), and has released an initial resource for the Caloma Two deposit at the TGP. Together, they increase our fully diluted valuation by 11% from A$1.32 to A$1.47 (using a 10% discount rate and valuation assumptions as detailed later in this report). We believe that Alkane’s progress developing the TGP (currently >85% complete) and commissioning in early CY14 should provide a positive catalyst for the shares as it moves from developer to producer.

The TGP in production in Q314

Alkane will move from developer to producer for the first time since it closed the Peak Hill mine in 2005. The Tomingley Gold Project (TGP) mine plan comprises mining three deposits (Wyoming One, Wyoming Three and Caloma). However, Alkane’s release of an initial resource for Caloma Two should extend (by one year under our assumptions) the TGP’s mine life beyond the current official 7.5 years.

Financing the DZP

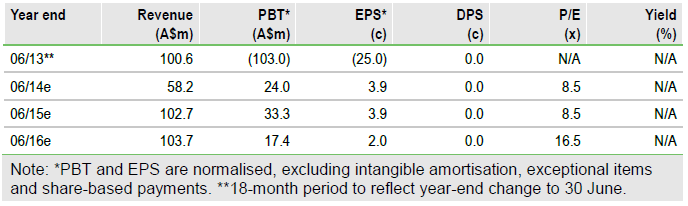

With the TGP fully funded and in production in H214 (note Alkane’s new June year end), or January to June of 2014, the focus for Alkane is to secure the A$996.4m required to develop the Dubbo Zirconia Project (DZP). Credit Suisse and Sumitomo Mitsui Banking Corporation have been mandated to progress financing for the DZP (please refer to page 6 for details).

Valuation: Adjusted for year end and Caloma Two

We upgrade our old valuation of A$1.32, comprising A$1.17 for TGP and DZP, plus A$0.15 per share for its Regis Resources shareholding, to A$1.47. Our adjustments are for Alkane’s change of financial year end from 31 December to 30 June, improvements to DZP rare earth element recoveries, and our gold price forecasts (see page 5). We also extend the TGP’s mine life from 7.5 years to 8.5 years to reflect Alkane’s release of an initial mineral resource estimate for the Caloma Two deposit. Our base case valuation is now A$1.47, which comprises A$0.14 for the TGP, A$1.30 for the DZP and A$0.02 for the value of Alkane’s remaining Regis Resources shareholding (errors may occur due to rounding). We expect that commissioning of the TGP in early CY14 will be positive to Alkane’s share price as it moves from development to production. Once in production, the TGP should also provide significant confidence in management’s ability to negotiate the NSW regulatory framework on the permitting and development of mining projects, which should carry over into the eventual development of the DZP in CY15.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Alkane Resources: Adjusted For Year End And Caloma Two

Published 12/10/2013, 02:57 AM

Updated 07/09/2023, 06:31 AM

Alkane Resources: Adjusted For Year End And Caloma Two

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.