First TGP revenues imminent

Alkane’s Q214 quarterly activities report highlights the Tomingley Gold Project (TGP) as having commenced mining operations with ore being fed to the processing plant and an inaugural gold pour anticipated by end February. Initial gold production to 30 June 2014 (ie the end of Alkane’s FY14) is forecast at between 22koz and 27koz (vs our estimate of 33koz). Accounting for this and its quarterly cash flow report, we revise our total valuation from A$1.47 per share, to A$1.55 per share (using a 10% discount factor and gold price forecasts as per our gold sector report Gold – US$2,070 by 2020).

DZP progressing steadily

Alkane has received 70 responses to its environmental impact study and has advanced the Dubbo Zirconia Project (DZP) planning approval process to the Planning Assessment Commission, a department of the NSW state government. Furthermore, five major engineering companies have been invited to tender for the project’s front-end engineering and design. Also Alkane’s DZP financing teams continue to hold advanced discussions with international government agencies over sourcing potentially considerable amounts of export credit agency funding for DZP’s estimated capex of A$996.4m.

Valuation: Slight reduction in FY14 estimated gold production

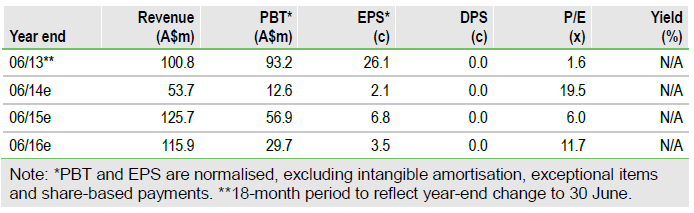

We revise our valuation for Alkane’s Q214 quarterly activities and cash flow reports (announced on 30 January). Specifically, we revise our 33koz TGP production target to 30 June downwards to 25koz (mid-range of Alkane’s stated forecast of 22-27koz) and note Alkane is forecasting A$20.1m (as per the quarterly cash flow report) in production costs for Q314 (vs our estimate of A$17m for H214, we now estimate total FY14 production costs of c A$25m). We do not consider the revision to TGP’s FY14 gold production forecast as negative – it simply reflects a conservative estimate of likely production at the critical early stages of commissioning a new mine. We revise our A$/US$ exchange rate from 0.96 to 0.87. Our gold price forecasts and other base case assumptions remain unchanged from our last update note published on 9 December 2013. Based on the aforementioned adjustments, our total valuation becomes A$1.55 per share versus A$1.47 in the above mentioned update note. Our A$1.55 valuation comprises A$0.23 for TGP, A$1.29 for DZP and A$0.02 for the value of Alkane’s remaining Regis Resources shareholding (including rounding difference).

To Read the Entire Report Please Click on the pdf File Below