On Oct 31, we issued an updated research report on Align Technology, Inc. (NASDAQ:ALGN) . The stock currently sports a Zacks Rank #1 (Strong Buy).

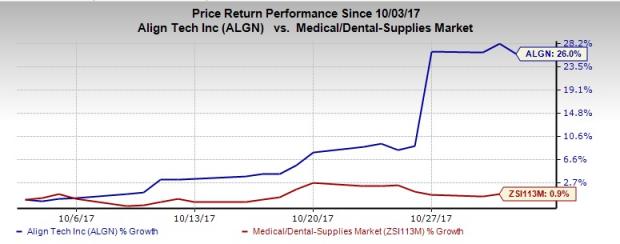

Align Technology, which manufactures and markets a system of clear aligner therapy, intra-oral scanners and CAD/CAM (computer-aided design and manufacturing) digital services used in dentistry, orthodontics and dental records storage, has been trading above its industry over the past month. The stock has gained 26% in this period as compared to 0.9% growth of the industry. The company delivered an encouraging third quarter of 2017, posting better-than-expected earnings and revenues.

We are encouraged by the company’s solid InvisAlign Technology prospects and growth in North America and internationally. The company’s receipt of two U.S. patents for SmartTrack Aligner material also buoys optimism.

Moreover, Align Technology has been seeing strong international sales, especially in the EMEA and APAC regions. The third quarter marked another milestone for the company where China became the second largest market globally with United States topping the numbers.

Align Technology witnessed balanced sales growth across all its channels in the recent past, primarily driven by high InvisAlign Technology case volumes. Solid performance in the summer drove Invisalign growth in the global teen market.

In an encouraging development, the company recently signed a distribution agreement with Patterson Dental. Per the non-exclusive agreement, effective September 2017, Align Technology’s iTero Element intraoral scanning system will be available as part of Patterson Dental’s CAD/CAM portfolio in the United States and Canada.

On the flipside, adverse foreign exchange translation continues to raise concerns for Align Technology’s international operations. Also, escalating costs and expenses are weighing on margins. Moreover, a tough competitive landscape and other macroeconomic headwinds pose a threat.

Other Key Picks

Other top-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Luminex Corporation (NASDAQ:LMNX) and Intuitive Surgical, Inc. (NASDAQ:ISRG) . Notably, PetMed and Luminex sport a Zacks Rank #1, while Intuitive Surgical carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed has a long-term expected earnings growth rate of 10%. The stock has rallied roughly 87.6% over the last year.

Luminexhas a long-term expected earnings growth rate of 16.3%. The stock has gained 18% in the last year.

Intuitive Surgicalhas a long-term expected earnings growth rate of 9.1%. The stock has gained 67.6% last year.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research