Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Alibaba (NYSE:BABA)

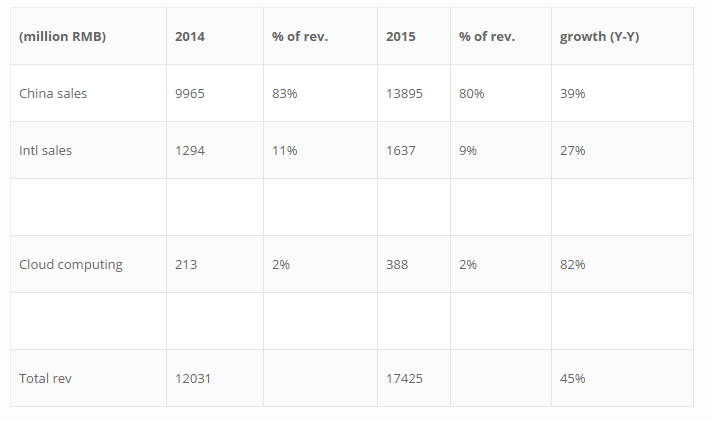

- Alibaba’s revenue increased by 45% as compared to same quarter last year.

- China sales growth was 39% but accounted for only 80% of its total revenues – a decrease from its last quarter

- Revenues from cloud computing grew at 82% but still accounted for being only 2% of its total revenue.

- Stock compensation for product development jumped by 704% same quarter last year, wherein cost of revenue went up by 91% compared to same quarter last year

- Alibaba has a cash and cash equivalent chest of $17,453 million a growth of 227% from the same quarter last year

Amazon (NASDAQ:AMZN)

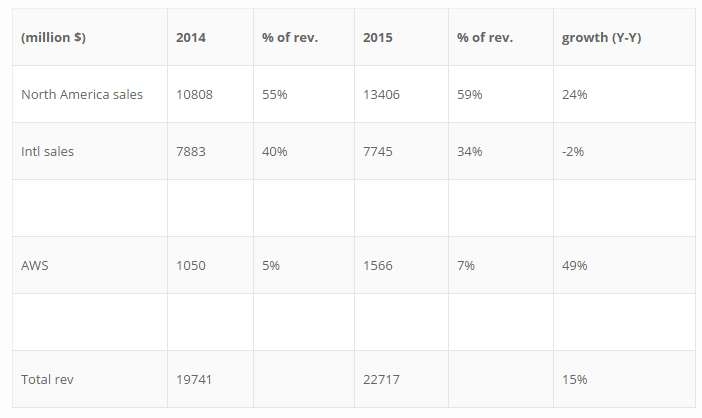

- Amazon’s revenue increased by 15% as compared to same quarter last year

- North American sales growth was 24% and it accounted for 59% of its revenue a growth of 4% from the same quarter last year

- AWS revenues grew by 49% from the same quarter last year and now accounted for 7% of total revenues

- Amazon as a cash and cash equivalent chest of $10,237 million, a growth of 101% from the same quarter last year

Amazon and Alibaba are in the same business but follow different paths.

Alibaba is trying to gather more GMV and increase its product portfolio. This has been validated by its purchase of a 9% stake in Zulily. Zulily sells clothing predominantly in North America for plus sized women.

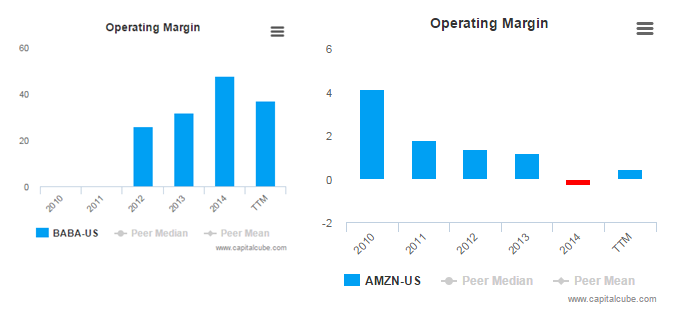

Amazon on the other hand is trying to create IP in its online retail business and is depending on many users converting to Prime shipping to cover its loss in retail. Alibaba by comparison is a more evolved retailer as can be seen by its Operating margins: