The energy sector was generally stronger as the danger of geopolitical-led price spikes surfaced once again. The hostage crisis in Algeria received some attention as it raised concerns about the security of energy infrastructure in the country which produces around 1.4 million barrels per day.

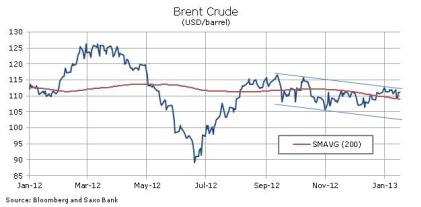

Brent crude oil moved back towards the higher end of its current range but did not find enough ammunition to challenge resistance, which is currently the January high at 113.30 USD/barrel while support can be found at the 200-day moving average currently at 109.

Mixed signals from major oil players

Both OPEC and the International Energy Agency (IEA) released their monthly reports this week. The IEA’s report warned about tightening oil markets due to increased Chinese demand and reduced Saudi Arabian supply. The western countries’ oil watchdog said it expected demand growth to rise by 930,000 barrels per day (bpd) in 2013, up from a previous estimate of 865,000 bpd. OPEC, meanwhile, struck a more cautious note when saying that increased competition from non-OPEC suppliers due to new production techniques could trigger reduced demand for the cartel’s oil.

BP seems to have gone along with this assumption as its latest long-term energy outlook saw OPEC’s spare capacity reaching six million bpd by 2015, the highest since the late 1980s. Increased spare capacity is one the most important factors when looking for price stability and following Saudi Arabia are cut in December its spare capacity (defined as volume of production that can be brought on within 30-days and sustained for at least 90 days) has risen to the highest level since January 2011.

WTI crude in demand as spread to Brent crude shrinks

The outperformance of WTI crude oil prices over Brent crude which we have seen during the last month continues with the spread contracting before finding support at USD 15 /barrel. This is the lowest level since last July and it comes after an October high of USD 24/barrel. The contraction was triggered by the continued improved outlook for the US economy combined with the long awaited expansion of the Seaway pipeline from Cushing, the delivery hub for NYMEX WTI crude, to refineries along the Mexican Gulf.

The increased flow of crude oil to the Gulf will help reduce supply pressure on Cushing and at the same time make moreof the oil that was previously landlocked available to the international market where prices are currently determined by that of Brent crude.

As the chart below shows, the spread has now reached support at USD 15/barrel and a break below would signal additional WTI crude outperformance as it moves closer to international levels. Forward prices on the two crude oils currently indicate that it will take another two years for the spread to halve from here.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Algeria Hostage Crisis Supports Oil Markets

Published 01/21/2013, 02:57 AM

Updated 05/14/2017, 06:45 AM

Algeria Hostage Crisis Supports Oil Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.