About a month has gone by since the last earnings report for Alexandria Real Estate Equities, Inc. (NYSE:ARE) . Shares have lost about 2.1% in the time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Alexandria Real Estate Equities Reports In-Line Q2 FFO

Alexandria reported second-quarter 2017 adjusted FFO of $1.50 per share. The figure came in line with the Zacks Consensus Estimate. Moreover, adjusted FFO per share compares favorably with the prior-year quarter tally of $1.36.

Results reflect robust growth in rental rate and strong leasing metrics, driven by higher internal and external growth.

Total revenue for the quarter jumped 20.8% year over year to $273 million. In addition, the figure handily surpassed the Zacks Consensus Estimate of $253 million.

Behind the Headline Numbers

Alexandria’s total leasing activity aggregated around 1.1 million RSF during the quarter. The company carried out lease renewals and re-leasing of space at a rental rate increase of 23.2% and 9.4% (cash basis) in the reported quarter. Moreover, key leases executed in the quarter included 163,648 RSF leased to Takeda Pharmaceutical Company Ltd., and 109,780 RSF lease renewed with Laboratory Corporation of America (NYSE:LH).

On a year-over-year basis, same-property net operating income (NOI) inched up 1.8%. It climbed 7% on a cash basis. As of second quarter 2017, occupancy for operating properties in North America was 95.7%.

As of second quarter 2017, investment-grade tenants accounted for 51% of annual rental revenue in effect. Furthermore, 79% of the annual rental revenue is from Class A properties in AAA locations.

Liquidity

Alexandria exited second-quarter 2017 with cash and cash equivalents of $124.9 million, down from $151.2 million recorded at the end of the prior quarter. The company ended the reported quarter with $1.8 billion of liquidity.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There have been two revisions higher for the current quarter compared to one lower.

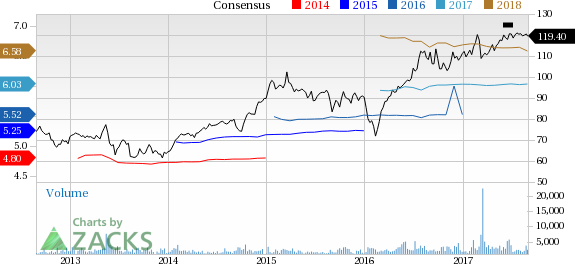

Alexandria Real Estate Equities, Inc. Price and Consensus

VGM Scores

At this time, Alexandria Real Estate's stock has a subpar Growth Score of D. However, its Momentum is doing a lot better with an A. The stock was allocated a grade of F on the value side, putting it in the bottom 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for momentum investors based on our style scores.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Alexandria Real Estate Equities, Inc. (ARE): Free Stock Analysis Report

Original post

Zacks Investment Research