AKM Industrial Co., Ltd moves from UNDERVALUED to NEUTRAL

It has a Fundamental Analysis Score of 75 and a Capital Cube Implied Price of 1.63 HKD

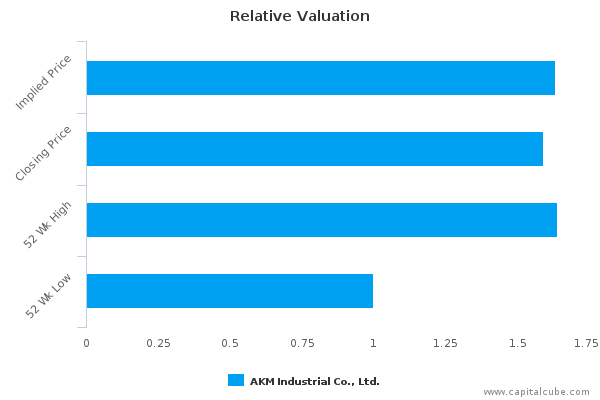

Relative Valuation

AKM Industrial Co., Ltd. is currently neutrally valued, as its previous close of HKD 1.59 lies within the CapitalCube estimate range of HKD 1.52 to HKD 1.75. Over the last 52 week period, AKM Industrial Co., Ltd. has fluctuated between HKD 1 and HKD 1.64.

Company Overview

- Relative underperformance over the last year is in contrast with the more recent outperformance.

- AKM Industrial Co., Ltd. currently trades at a higher Price/Book ratio (3.15) than its peer median (2.62).

- We classify 1639-HK as Harvesting because of the market's relatively low growth expectations despite its relatively high returns.

- 1639-HK's relatively high profit margins are burdened by relative asset inefficiency.

- Compared with its chosen peers, changes in the company's annual earnings are better than the changes in its revenue, implying better than median cost control and/or some economies of scale.

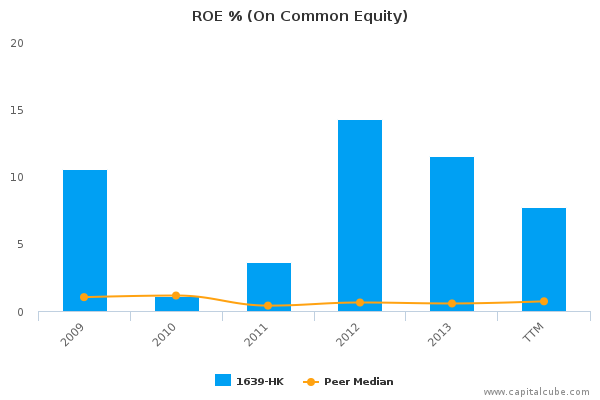

- 1639-HK's return on assets currently and over the past five years suggest that its relatively high operating returns are sustainable.

- The company's relatively high pre-tax margin suggests tight control on operating costs versus peers.

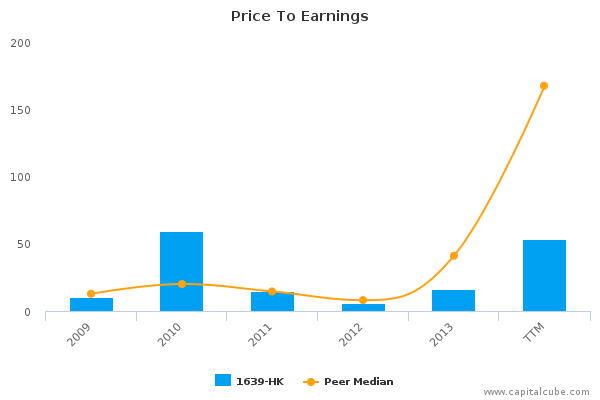

- While 1639-HK's revenue growth in recent years has been above the peer median, the stock's PE ratio is less than the peer median suggesting that the company's earnings may be peaking and the market expects a decline in its growth expectations.

- The company's level of capital investment seems appropriate to support the company's growth.

- 1639-HK has the financial and operating capacity to borrow quickly.

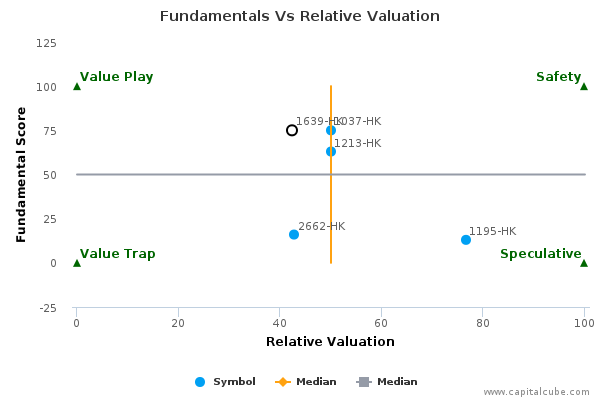

Investment Outlook

AKM Industrial Co., Ltd. has a fundamental score of 75 and has a relative valuation of NEUTRAL.

AKM Industrial Co., Ltd.'s price is very close to its implied price, thus not allowing for a specific classification into the Value – Price Matrix.

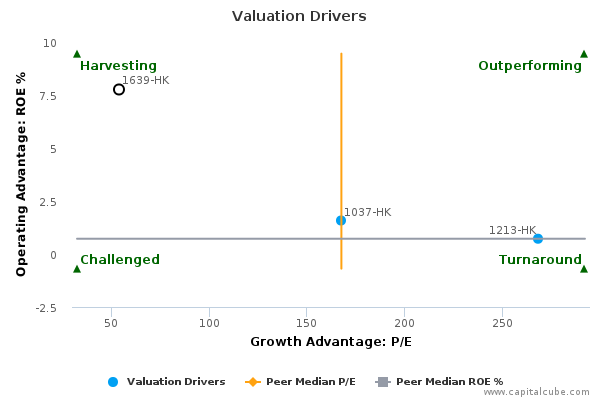

Drivers of Valuation

1639-HK has a Harvesting profile relative to its peers.

We classify 1639-HK as Harvesting because of the market's low expectations of growth (PE of 53.67 compared to peer median of 167.47) despite its relatively high returns (ROE of 7.76% compared to the peer median ROE of 0.72%).

The company currently trades at a higher Price/Book ratio of 3.15 compared to its peer median of 2.62.

1639-HK has maintained its Harvesting profile from the recent year-end.

Peer Analysis

A complete list of valuation metrics is available on the company page.

Company Profile

AKM Industrial Co., Ltd. manufactures semiconductors and components. The company operates through three business segments: Flexible Printed Circuits Business, Sourcing & Sale of Electronic Components, and Flexible Packaging Substrates. The Flexible Printed Circuits Business segment engages in manufacture and sale of Flexible Printed Circuits. The Sourcing & Sale of Electronic Components segment involves in the sourcing and sale of electronic components for surface mount technology and electronic modules. The Flexible Packaging Substrates segment manufactures and sells flexible packaging substrates. The company was founded on December 9, 1993 and is headquartered in Guangzhou, China.

Disclaimer

The information presented in this report has been obtained from sources deemed to be reliable, but AnalytixInsight does not make any representation about the accuracy, completeness, or timeliness of this information. This report was produced by AnalytixInsight for informational purposes only and nothing contained herein should be construed as an offer to buy or sell or as a solicitation of an offer to buy or sell any security or derivative instrument. This report is current only as of the date that it was published and the opinions, estimates, ratings and other information may change without notice or publication. Past performance is no guarantee of future results. Prior to making an investment or other financial decision, please consult with your financial, legal and tax advisors. AnalytixInsight shall not be liable for any party's use of this report.

AnalytixInsight is not a broker-dealer and does not buy, sell, maintain a position, or make a market in any security referred to herein. One of the principal tenets for us at AnalytixInsight is that the best person to handle your finances is you. By your use of our services or by reading any our reports, you're agreeing that you bear responsibility for your own investment research and investment decisions. You also agree that AnalytixInsight, its directors, its employees, and its agents will not be liable for any investment decision made or action taken by you and others based on news, information, opinion, or any other material generated by us and/or published through our services. For a complete copy of our disclaimer, please visit our website www.analytixinsight.com.