AK Steel (NYSE:AKS) topped earnings and sales estimates in second-quarter 2017. The steel maker reported net income of $61.2 million or 19 cents per share, up 253.7% from net income of $17.3 million or 8 cents recorded in the prior-year quarter. Earnings for the quarter surpassed the Zacks Consensus Estimate of 13 cents.

Total operating costs in the reported quarter rose around 1.3% year over year to roughly $1,447.7 million.

The company recorded net sales of $1,557.2 million for the quarter, up 4.3% from the year-ago quarter. Sales surpassed the Zacks Consensus Estimate of $1,530 million.

Pricing and Shipments

Shipments for the quarter were down around 6% year over year to 1,465,200 tons, mainly due to decrease in automotive demand. Average selling price per ton rose 11% year over year to $1,058 in the quarter mainly due to higher surcharges on specialty steel products and increased average selling prices on both spot and contract market sales.

Financials

AK Steel exited the quarter with cash and cash equivalents of $136 million and $1.3 billion available under its revolving credit facility. During the second quarter, the company reduced long-term debt by $129.8 million. Cash flows from operating activities were $203.2 million for the first half of 2017.

Outlook & Key Developments

AK Steel recently inked an agreement to acquire Precision Partners Holding Company for $360 million in cash. The company has received clearance from the U.S. antitrust for the transaction, which is subject to customary closing and regulatory approvals and is expected to complete in third-quarter 2017. The company expects to initially fund the transaction with borrowings under revolving credit facility and cash in hand.

According to AK Steel, the second-quarter performance reflects continued benefits obtained through strategic initiatives implemented over the past one-and-a-half year. The planned acquisition of Precision Partners will help to strengthen its position as a value-added design and materials solutions provider.

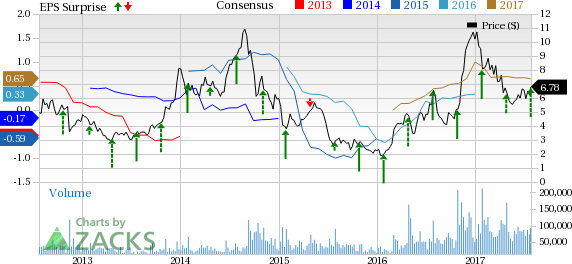

Price Performance

Shares of AK Steel have gained 5.1% in the last three months, underperforming the industry’s 8.8% rally.

Zacks Rank & Key Picks

AK Steel currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are The Sherwin-Williams Company (NYSE:SHW) , Ternium S.A. (NYSE:TX) and Hitachi Chemical Company, Ltd. HCHMY. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Ternium has expected long-term earnings growth rate of 18.4%.

Hitachi Chemical has expected long-term earnings growth rate of 5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

AK Steel Holding Corporation (AKS): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post