The aviation industry is witnessing a rapid recovery with packed planes and strong profits in the fourth quarter. American Airlines (NASDAQ:AAL) has posted impressive earnings results and provided an upbeat outlook for the year ahead.

American Airlines is Flying High

American Airlines (AAL) not only met but comfortably exceeded its Q4 estimates, showcasing strong financial performance. This encouraging result is attributed to a strong rebound in air travel demand after pandemic-induced lows. High passenger volumes, particularly during the Thanksgiving and Christmas holidays, have been key contributors to this growth. The American Airlines stocks jumped 10.76% for the week. The industry has also gained momentum due to a notable decrease in fuel expenses. A 10% decline in oil prices during the October-December period proved to be a significant tailwind for the airline industry. In addition to this, the rebound in international travel demand has added another facet to encouraging outlooks.

With American Airlines already making significant strides in paying down its debt, its stocks offer a promising prospect if the U.S. economy remains stable. The robust Q4 results, coupled with favorable market conditions, imply that the company has potential room to grow.

Investing in Airlines ETFs

Investors can buy shares in an ETF dedicated to either the airline industry or the broader transportation sector. These ETFs could offer exposure to companies like American Airlines and others in the sector, promoting diversification and potentially lowering investment risk.

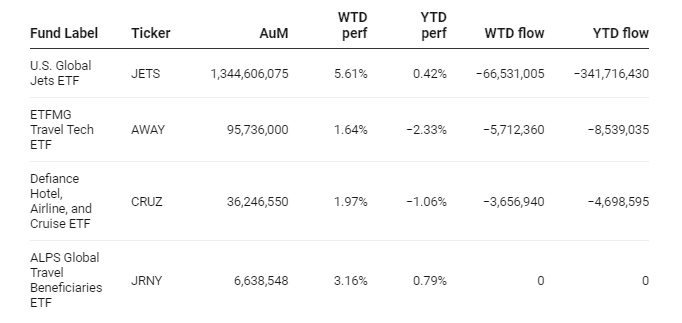

Looking at Airlines ETF performance this week shows U.S. Global Jets ETF (JETS) gained over 5.6%. As of the 26th of January, this year, JETS has an 11.32% exposure to American Airlines Group Inc. (AAL).

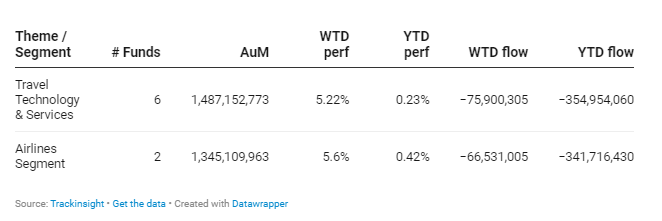

Group Data

Funds Specific Data