While low oil prices have been a boon for transportation stocks, the last six years have been tough for airline ETFs.

Rough market conditions and a lack of investor interest sent the last two airline-centric funds (from Direxion and Guggenheim) down in flames in 2011 and 2013.

Then on Thursday, U.S. Global Investors launched the US Global Investors Inc (JETS).

Based on this week’s chart, it was a smart move.

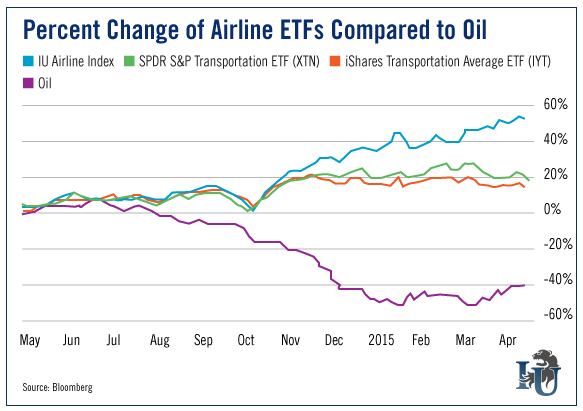

Our chart this week compares the percent gains of two broad transportation ETFs with the percent loss of oil... as well as the performance of our unique Investment U Airline Index.

Because the Jets ETF is too new to chart, we based our index on some of the ETF’s holdings and back-tested it over the last year. As you can see, the sector is taking off while oil prices remain grounded.

Our Chief Investment Strategist, Alexander Green, is certainly bullish about the sector. Writing about it in yesterday’s issue of Investment U Daily, he said, “due to industry consolidation, restructurings, lower fuel costs, diversified revenue streams, increasing air traffic and rising profits, airline stocks are ready to rise.

“And the Jets ETF is just the ticket.”