The past week, which was a day short of trading as Independence Day was observed on Jul 4, saw United Continental Holdings (NYSE:UAL) , the parent company of United Airlines, revealing encouraging news on the labor front

Shares of the carrier gained following the news that the leadership of the union representing its 25,000+ flight attendants has accepted the tentative deal pertaining to pay and other financial details. To become operational, the agreement will now have to be ratified. United Continental was also in the news owing to its decision to initiate flights to Auckland.

Apart from the above update, the past week saw the Atlanta, GA-based Delta Air Lines (NYSE:DAL) announcing the traffic numbers for June. Similar to May, load factor (% of seats filled with passengers) declined in June too as traffic growth was outpaced by capacity expansion. The carrier also unveiled a bearish guidance for the second quarter.

European low-cost carrier Ryanair Holdings plc (NASDAQ:RYAAY) also grabbed headlines by virtue of its impressive traffic numbers for June, despite the multiple challenges. The past week also saw updates from Alaska Air Group (NYSE:ALK) and JetBlue Airways (NASDAQ:JBLU) .

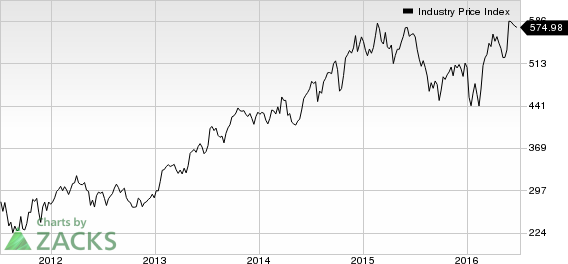

On the price front, the NYSE ARCA Airline index gained 2.63% to $82.91 over the past week as stocks recovered from the lows following the Brexit vote.

Read the last Airline Stock Roundup for June 29, 2016.

Recap of the Past Week’s Most Important Stories

1. United Continental inked a tentative pay-related deal with the labor union (Association of Flight Attendants or AFA), representing its flight attendants. The agreement aims to bring the carrier’s flight attendants under a single work group. Apparently, this is the first contract pertaining to the cabin crew members since 2010 when United Airlines and Continental Airlines merged resulting in the formation of United Continental Holdings (read more: United Continental Gains on Tentative Labor Deal with AFA).

On a separate note, United Continental, in a customer friendly move, launched non-stop flights connecting its premier Pacific gateway at San Francisco International Airport and Auckland. By launching its first service to Auckland, the Chicago-based carrier as officially started its joint venture revenue sharing agreement with Air New Zealand.

2. Delta announced a 3.1% increase in revenue passenger miles (RPMs: a measure of traffic) and 3.5% rise in average seat miles (ASMs: a measure of capacity) for the month of June. Load factor decreased 40 basis points to 87.7% in the month.

The company witnessed a 5% drop in PRASM in the month mainly due to volatile foreign currency exchange rates and soft passenger yields from domestic markets. The metric is expected to decline approximately 5% in the second quarter (the previous guidance had called for a decline of around 4.5%).

Delta expects operating margin to be around 17% in the second quarter (the previous guidance had projected the metric around 21%). Average fuel price per gallon is expected in the band of $1.95 to $2.00. System capacity is projected to increase approximately 3%.

3. Alaska Airlines, a wholly owned subsidiary of Alaska Air Group, announced that it intends to introduce flights between Seattle and San Luis Obispo, CA from Apr 13, 2017. The daily and non-stop flight between these destinations aims to meet the surge in traffic on this popular route (read more: Alaska Airlines to Fly Between Seattle and San Luis Obispo).

On a separate note, Alaska Air Group reported a 10.9% increase in June traffic. Capacity too increased 11.7% while load factor declined 70 basis points to 86%. At the end of the first six months of 2016, Alaska Air generated RPMs of 18 billion (up 11.1% year over year) and ASMs of 21.5 billion (up 12%). Load factor declined 70 basis points to 83.5%.

4. Ireland-based Ryanair Holdings reported solid traffic data for the month of June on the back of its customer friendly “Always Getting Better” scheme. The carrier’s traffic climbed 11% to 10.6 million in the month. Load factor (percentage of seats filled by passengers) rose to 94% from 93% a year ago.

5. In a customer-friendly move, low-cost carrier JetBlue Airways announced that it would cover Transportation Security Administration (TSA) Pre enrollment cost for its Mosaic TrueBlue members, the carrier’s most frequent fliers. The airline has introduced this limited time offer to cut down TSA screening checkpoint wait times. Frequent fliers who attained Mosaic status before Jun 30, 2016 are eligible for this offer. The offer comes at an appropriate time as the ongoing summer has been predicted by the Airlines for America to be the busiest one for US carriers.

Performance

The following table shows the price movement of the major airline players over the past week and during the last 6 months.

Company | Past Week | Last 6 months |

HA | 1.91% | 16.61% |

UAL | 2.0% | -25.61% |

GOL | 1.2% | 82.59% |

DAL | 1.46% | -24.43% |

JBLU | 1.40% | -23.95% |

AAL | 5.88% | -28.31% |

SAVE | 4.46% | 17.56% |

LUV | 1.82% | -5.62% |

VA | 0.55% | 62.51% |

ALK | 1.82% | -25.08% |

The table shows that all airline stocks traded in the green over the past week, as stocks recovered from the Brexit tremors. Shares of American Airlines Group (NASDAQ:AAL) appreciated the most (5.88%).

Over the past six months, the majority of the airline stocks lost value, leading to a 0.91% decline in the NYSE ARCA Airline index. American Airlines was the primary laggard with shares depreciating 28.31% over the same period.

What's Next in the Airline Space?

We expect airline heavyweights like Southwest Airlines Co. (NYSE:LUV) and American Airlines Group to report their June traffic numbers in the coming days.

SOUTHWEST AIR (LUV): Free Stock Analysis Report

RYANAIR HLDGS (RYAAY): Free Stock Analysis Report

JETBLUE AIRWAYS (JBLU): Free Stock Analysis Report

DELTA AIR LINES (DAL): Free Stock Analysis Report

ALASKA AIR GRP (ALK): Free Stock Analysis Report

UNITED CONT HLD (UAL): Free Stock Analysis Report

AMER AIRLINES (AAL): Free Stock Analysis Report

Original post

Zacks Investment Research