In the past week, several airline companies like American Airlines Group (NASDAQ:AAL) , Southwest Airlines (NYSE:LUV) , Alaska Air Group (NYSE:ALK) , JetBlue Airways (NASDAQ:JBLU) and Hawaiian Holdings (NASDAQ:HA) released their respective fourth-quarter 2018 financial numbers.

With oil prices declining almost 40% in the October-December timeframe (the fourth quarter period), it was not surprising that most carriers registered better-than-expected earnings and witnessed bottom-line growth year over year.

Meanwhile, the top line was driven by upbeat passenger revenues with demand for air travel remaining strong. Robust traffic during the Thanksgiving holiday period contributed to the uptick in passenger revenues. Following the impressive quarterly performance, Southwest Airlines, American Airlines and JetBlue Airways saw an improvement in share price.

Alaska Air Group was also in the news for raising its quarterly dividend by 9% to 35 cents per share. Meanwhile, many carriers had to cancel flights due to the bitter cold conditions in the Midwest.

(Read the last Airline Stock Roundup for Jan 23, 2019)

Recap of the Past Week’s Most Important Stories

1. Alaska Air Group’s fourth-quarter 2018 earnings (excluding 56 cents from non-recurring items) of 75 cents per share surpassed the Zacks Consensus Estimate of 73 cents. Revenues came in at $2,064 million, which outshined the Zacks Consensus Estimate of $2057.3 million and also improved year over year. Passenger revenues, accounting for a bulk (92.4%) of the top line, were rose 6% on a year-over-year basis. Additionally, the company hiked its quarterly dividend from 32 cents to 35 cents per share. The amount is payable Mar 7, 2019 to its shareholders of record as of Feb 19. Notably, this marks the company’s sixth dividend hike since its initiation of quarterly dividends in 2013. (Read more: Alaska Air Group's Q4 Earnings & Revenues Top Estimates).

2. American Airlines’ fourth-quarter 2018 earnings (excluding 35 cents from non-recurring items) of $1.04 per share surpassed the Zacks Consensus Estimate of $1.02. The bottom line also increased on a year-over-year basis. Revenues totaled $10,938 million, which fell short of the Zacks Consensus Estimate of $11,006.7 million. However, the top line improved on a year-over-year basis. Strong demand for air travel led to this year-over-year improvement in the top line. (Read more: American Airlines Q4 Earnings Beat, Revenues Miss).

American Airlines carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3. Southwest Airlines’ fourth-quarter 2018 earnings of $1.17 per share surpassed the Zacks Consensus Estimate by 11 cents. Results were aided by stronger revenues, higher yields and better cost management.

Operating revenues came in at $5,704 million, which exceeded the Zacks Consensus Estimate of $5,676.6 million. The top line also rose year over year. Passenger revenues accounting for bulk (93.2%) of the top line improved 8.6% year over year.In the first quarter of 2019, the company anticipates revenue per available seat mile (RASM) to rise 4-5% year over year. This bullish forecast is despite a $10-$15 million adversity from the impact of government shutdown so far in January as well as an estimated $40 million revenue shortfall due to the shift in timing of Easter to the second quarter.(Read more: Southwest Airlines Q4 Earnings Top, Q1 RASM View Upbeat).

4. JetBlue’s fourth-quarter 2018 earnings (excluding 5 cents from non-recurring items) of 50 cents per share surpassed the Zacks Consensus Estimate by 8 cents and increased 56.3% year over year. The bottom line was driven by the company’s prudent non-fuel cost management.

Total revenues came in at $1,968 million, which edged past the Zacks Consensus Estimate of $1,965.4 million and increased 12% year over year. Passenger revenues, which accounted for bulk of the top line (96.1%), improved 12.1% in the quarter under review. Other revenues were up 8.8 %. (Read more: JetBlue Stock Up 5% on Q4 Earnings and Revenue Beat).

5. Hawaiian Holdings’ fourth-quarter earnings (excluding 36 cents from non-recurring items) of $1 per share outpaced the Zacks Consensus Estimate by 2 cents. Moreover, quarterly revenues of $697.5 million edged past the Zacks Consensus Estimate of $696.3 million. While earnings per share decreased, revenues increased on a year-over-year basis.

Meanwhile, operating revenue per available seat mile in the quarter declined 3.3% year over year. In the first quarter of 2019, the metric is projected to decline between 3% and 6% on a year-over-year basis. Fuel cost per gallon (economic) is anticipated to be in the band of $1.95-$2.05in the first quarter. Non-fuel unit costs are projected to increase in the 1-4% range.

Capacity is projected to grow between 1.5% and 3% for the first quarter. The metric is expected to increase in the band of 1.5-4.5% for 2019. Non-fuel unit costs are envisioned to be flat or increase up to 3% in the same year.

Price Performance

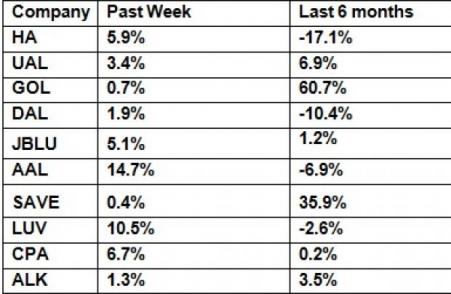

The following table shows the price movement of the major airline players over the past week and during the last six months.

The table above shows that all airline stocks traded in the green over the past week buoyed by solid results in Q4. As a result, the NYSE ARCA Airline Index gained 4% during the period. Shares of American Airlines gained the most (14.7%). Over the course of six months, the sector tracker declined 2.6% despite impressive gains at the likes of GOL Linhas and Spirit Airlines (NYSE:SAVE) .

What's Next in the Airline Space?

Fourth-quarter earnings report of SkyWest (NASDAQ:SKYW) is scheduled to be released on Jan 31.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

See Stocks Today >>

Alaska Air Group, Inc. (ALK): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA): Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

JetBlue Airways Corporation (JBLU): Get Free Report

Southwest Airlines Co. (LUV): Get Free Report

American Airlines Group Inc. (AAL): Free Stock Analysis Report

Original post

Zacks Investment Research