Air Products (NYSE:APD) announced that it is investing in six industrial gas plants along with a pipeline network for the supply of nitrogen, oxygen and other bulk gases in China to support the country’s growing electronics manufacturing industry. The company has secured multiple long-term supply awards from semiconductor and flat panel display manufacturers in China.

These facilities will support customers in major electronics clusters and industrial parks in China's key economic regions, including the Yangtze River Delta in Eastern China, Pearl River Delta in Southern China, and Beijing-Tianjin-Hebei region in Northern China.

For the past 12 months, the supply contracts received by Air Products include some landmark projects in China's electronics industry. Notable contracts include a new memory fab in the Fujian (Jinjiang) Integrated Circuit Industrial Park in Fujian Province, Southern China and a new foundry in the Pukou Economic Development Zone (PKEDZ) in Eastern China. PKEDZ is a state-level high-tech park which will be home to advanced manufacturing and is only 35 km away from the Nanjing Chemical Industry Park (NCIP). Air Products has already been serving customers in the NCIP and across Nanjing through pipelines and various supply modes.

Air Products continues to leverage its strong and reliable supply network across China. The company has been serving many world-leading and domestic manufacturers in the development of next generation electronics devices. Additionally, the company is supplying the country's highest-generation, most advanced and most efficient TFT-LCD (thin-film transistor liquid crystal display) fab located in the Banan Jieshi IT Industrial Park in Chongqing City, Western China.

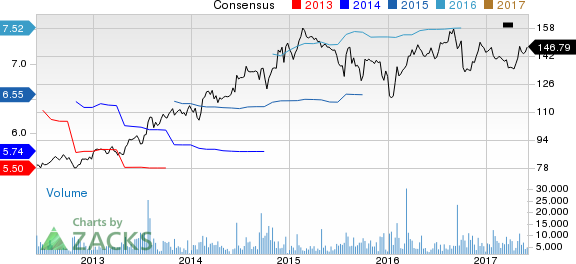

Air Products has outperformed the Zacks categorized Chemicals-Diversified industry over the past three months. The company’s shares have gained around 5.4% over this period, compared with roughly 2% gain recorded by the industry.

Air Products is well placed to leverage the cyclical recovery in core industrial end-markets. The company has built a strong project backlog. These projects are expected to be accretive to earnings and cash flow over the next few years. Acquisitions and new business wins are expected to continue to drive results in the near term. The company is also progressing well with its $600 million cost-cutting program.

Air Products also has significant amount of cash to invest in its core industrial gases business. The company expects to have roughly $8 billion to deploy in strategic, high-return opportunities to create shareholders value over the next three years.

However, the company’s industrial gases business in the EMEA region is seeing pressure from a weak operating environment. The company is also seeing lower volumes in Latin America due to weak demand. Moreover, volumes in packaged gases continue to be weak while LNG sales remain under pressure due to low project activity. The company is also exposed to currency headwinds.

Air Products and Chemicals, Inc. Price and Consensus

Air Products currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the chemical space include BASF SE (OTC:BASFY) , The Chemours Company (NYSE:CC) and Kronos Worldwide Inc (NYSE:KRO) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BASF has expected long-term growth of 8.9%.

Chemours has expected long-term growth of 15.5%.

Kronos has expected long-term growth of 5%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

BASF SE (BASFY): Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research