Air Products and Chemicals, Inc. (NYSE:APD) announced that it has inked an agreement with Dhahran Techno Valley Company for building and developing a world-class technology center that will cater the Kingdom of Saudi Arabia and Middle East region.

According to Air Products, the center will serve as the cornerstone for industrial gas technology and project development in Saudi Arabia. Once complete, it will provide technological expertise and lend support to new opportunities for industrial gases in the region. The center will provide the latest technologies from Air Products, focusing on improving energy efficiency, safety, reliability and operational excellence.

The new technology center will serve as a primary base for technology support in Saudi Arabia and will eventually become a base for collaboration with regional universities and for lending support to all of the company's technical activities in the region. It is expected to be fully operational by 2019.

Air Products has been working in Saudi Arabia since 1970s and it has made long-term investments in the country through joint ventures. Air Products and ACWA are presently developing the world's largest industrial gas complex, which will supply 75,000 metric tons per day of nitrogen and oxygen to Saudi Aramco's refinery and power station in Jazan.

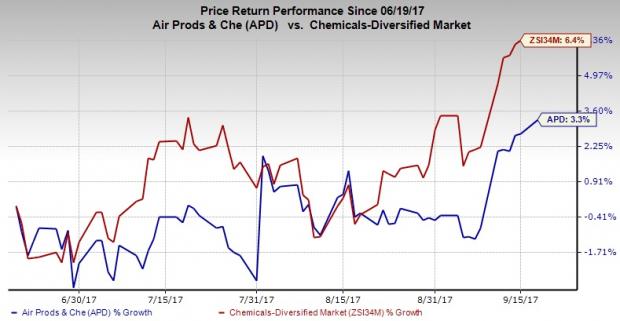

Air Products’ shares have moved up 3.3% in the last three months, underperforming the industry’s 6.4% gain.

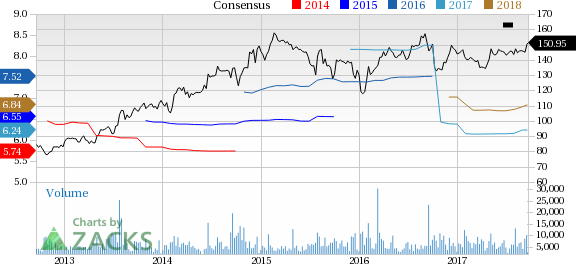

Air Products, in third-quarter fiscal 2017 (ended Jun 30, 2017) earnings call, increased its adjusted earnings per share guidance for the fiscal full year. For fiscal 2017, Air Products expects adjusted earnings per share of $6.20-$6.25 (up from $6.00-$6.25 expected earlier), which at midpoint, represents a 10% increase over the last year. For fourth-quarter fiscal 2017, the company anticipates adjusted earnings per share from continuing operations of $1.65-$1.70 per share, which at midpoint, represents a 12% increase over the last year.

Air Products is well placed to leverage the cyclical recovery in core industrial end-markets. The company has built a strong project backlog. These projects are expected to be accretive to earnings and cash flow over the next few years. Acquisitions and new business wins are expected to continue to drive results. The company is also progressing well with its $600 million cost-cutting program.

Air Products also has significant amount of cash to invest in its core industrial gases business. The company expects to deploy roughly $8 billion in strategic, high-return opportunities to create shareholders value over the next three years.

Air Products currently carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Some other top-ranked stocks in the basic materials space are Sociedad Quimica y Minera de Chile S.A. (NYSE:SQM) , Koppers Holdings Inc. (NYSE:KOP) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sociedad Quimica has an expected long-term earnings growth rate of 32.5%.

Koppers Holdings has an expected long-term earnings growth rate of 18%.

Kronos Worldwide has an expected long-term earnings growth rate of 5%.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Koppers Holdings Inc. (KOP): Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM): Free Stock Analysis Report

Original post

Zacks Investment Research