Air Products and Chemicals Inc. (NYSE:APD) has secured new long-term supply deals from Samsung (KS:005930) Display. Per the contracts, the company will supply gaseous nitrogen and oxygen, and liquid argon to Samsung's Organic Light Emitting Diode (OLED) manufacturing complex in Tangjeong, South Korea.

BASF SE (BASFY): Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Original post

The company also supplies at Samsung Display's Tangjeong production line and many of Samsung's operations worldwide.Air Products has been operating five nitrogen plants, a pipeline network and related infrastructure to support the Tangjeong production line since 2004. Recently, it announced further investment to supply Samsung's semiconductor fab in Pyeongtaek, South Korea.

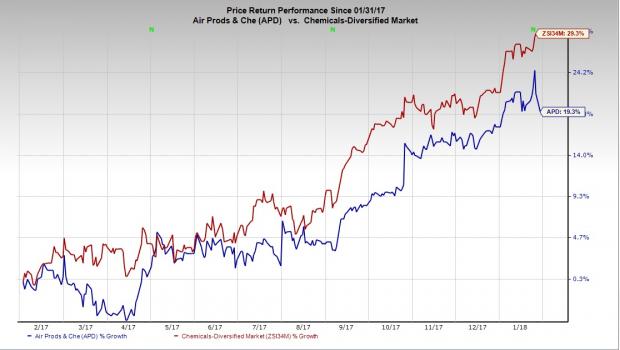

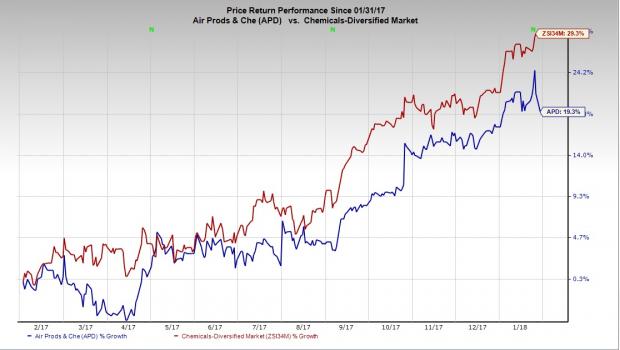

Air Products’ shares have moved up 19.3% over a year, underperforming the industry’s 29.3% gain.

In first-quarter fiscal 2018, the company reported adjusted earnings of $1.79 per share, up 22% from the year-ago quarter. The bottom line surpassed the Zacks Consensus Estimate of $1.66. Revenues in the same quarter were $2,216.6 million, up around 18% year over year. It also outpaced the Zacks Consensus Estimate of $2,159.2 million.

For fiscal 2018, the company anticipates adjusted earnings in the range of $7.15-$7.35 per share, up 13-16% from the prior year. The guidance includes an expected benefit of 20-25 cents per share from the U.S. Tax Cuts and Jobs Act. For the fiscal second quarter, it expects the same in the band of $1.65-$1.70 per share. Also, Air Products projects capital expenditure of $1.2-$1.4 billion for the current year.

Moreover, Air Products has built a strong project backlog. These projects are anticipated to be accretive to earnings and cash flow over the next few years. In addition, strategic investments in high-return projects, new business deals and acquisitions are expected to drive results in fiscal 2018.The company alsoremains on track with delivering on cost-reduction programs, which is likely to support margins as well.

Air Products and Chemicals, Inc. Price and Consensus

BASF SE (BASFY): Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Original post